SAP C_THR86_2311 SAP Certified Application Associate - SAP SuccessFactors Compensation 2H/2023 Exam Practice Test

SAP Certified Application Associate - SAP SuccessFactors Compensation 2H/2023 Questions and Answers

How can the compRating field be used to enhance the compensation worksheet?Note There are 2 correct answers to this question.

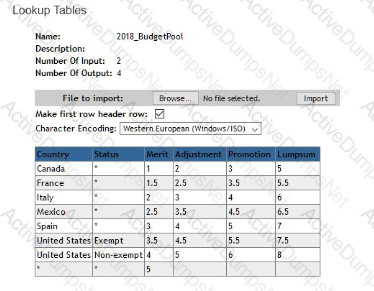

Your customer uses a look-up table to calculate custom budgets, as shown in the screenshot.

The budget is based on an employee s country and status In the template the country is defined with field ID customCountry and the status Is defined with field ID customStatus.What is the correct syntax to calculate the adjustment budget?

Your customer wants to include information on the planning form that is visible and read-only to planners, but may be edited by the Reward Team. How can you achieve this?

Your customer would Ike the Reward team to be able to override the final salary of the employee by directly entering in the final amount in Executive Review.However, they want to make sure that this is only posstole during the last week of the planning cycle.How can you achieve this?

You create a test user data tile

A customer would like percentage fields to only show decimal places if they are available. For example 40 00% should display as 40%,but if the percentage calculation is 40.54%. they want to display the decimal places.What number format should you use?

While validating the current cycles compensation statements you want to prevent them from being visible on employee profile while still allowing access to past compensation statements How can you accomplish this?

What can be configured under Define Standard Validation Rules?Note There are 2 correct answers to this question.

What happens to compensation forms when the currency conversion table is updated during the planning period?

A customer's performance process has a Final Review step at the end of the route map during which the reward team reviews the recommendations that have been made to ensure budget spend meets limits.The merit guideline is based upon performance rating, compa ratio, and two custom fields. Country and Job Family The customer wishes that the merit increase is reset to the default when the Country changes for an employee, but NOT when the Job Family changes.How can this requirement be met?

Your customer has implemented SAP SuccessFactors Employee Central (EC) and now wishes to implement a single global compensation template However, only part of the organization is in Employee Central, some countries are still using SAP ERP. but there are plans to move to SAP SuccessFactors Employee Central over the next two years The customer wants to use the Compensation module to plan for all employees regardless of where their employee data sits.What is the recommended approach to this scenario?

Which report can aggregate compensation details from multiple plans?Note There are 2 correct answers to this question

You have configured a worksheet for a client that uses the following formula in a custom column of type Money (curSalary ' lookupCbudgettable" customCountry 1))/100. The lookup table ‘budget_table' is configured with one input and one output There are three rows in the table•USA =5•GBR = 3•’ = 2 When the worksheet loads the column displays correctly but when a merit value is changed il switches to NfA for the employee What could be done to fix this behavior?

Your customer is based in the UK and has a functional currency of GBP. However, they also have offices in the US (USD). France (EUR), and Germany (EUR) They would like the budget displayed in local currency for alt planners for example. German planners see the budget in EUR. not GBP.How can you best accomplish this?Note There are 2 correct answers to this question

Which information is included in the rollup report?Note There are 2 correct answers to this question

Which of the following requires the use of custom validations?Note There are 2 correct answers to this question

In an EC-integrated compensation worksheet what are some ol the reasons you might include a lookup table in your configuration.Note There are 3 correct answers to this question.

Your client, who uses SAP SuccessFactors Employee Central wants to make sure that only employees who have been with the company more than 2 years are eligible for a Lump Sum. How do you build the eligibility rule to make this happen?

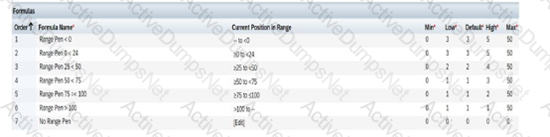

You configured merit guidelines as shown in the screenshot.

If an employee has a range penetration of 24% what would be the low to high guideline that would appear in the merit guideline column in the compensation worksheet?

Your non-EC customer v/ants only users in Pay Grade 1 and 2 to be ineligible for Lump Sum. Pay Grades 3 through 9 are eligible.What can you do to fulfill this requirement?Note. There are 3 correct answers to this question.

What types of custom fields can you use as formula criteria within the guidelines.Note There are 2 correct answers to this question.

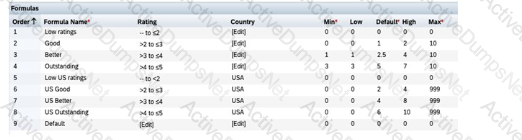

You set up a merit guideline rule based on the performance rating and country. You configure guideline formulas as shown in the screenshot. See image below.

An employee in the USA has a rating of 4. What would be their default merit increase?

Your EC-integtated client wishes to plan on monthly salaries (or employees in the UK. but on annual salaries for employee in the US All employees have their salaries stored in EC with a single pay component with a frequency of monthly' because of payroll integration constraints.Which of the following options is a solution for this requirement?

Your client has a salary template with a performance form attached The Completed Only option is set to No for this template. For this client the Performance forms are assigned in January to all employees for a goal setting process and then remain open for the entire year before getting their final rating in December The Salary forms are launched at the end of December and are open until the following end of January After the salary forms are launched, the Reward team realized that some employees who joined after January 1 do not have performance forms and launches them One of these new hires is rated Good in the performance form. How will this rating appear on the Salary worksheet?