Pegasystems PEGACPDC25V1 Certified Pega Decisioning Consultant 25 Exam Practice Test

Certified Pega Decisioning Consultant 25 Questions and Answers

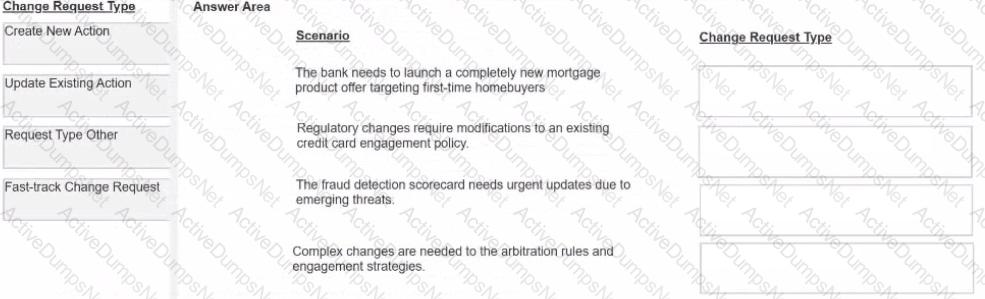

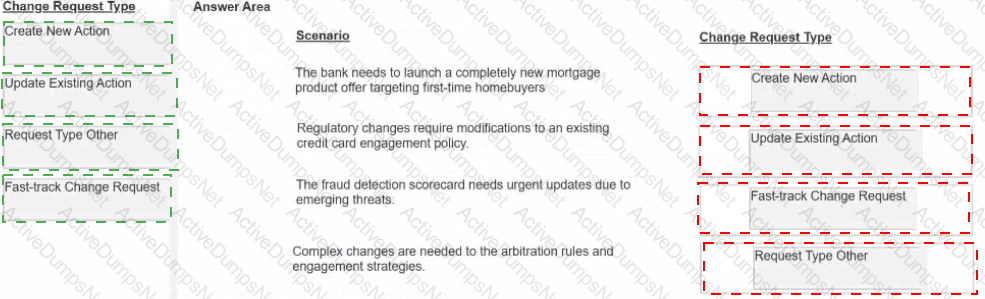

U+ BankT a retail bank, uses Pega Customer Decision Hub™ to manage various business changes throughout their operations The bank's team members need to understand which change request type to use tor different business scenarios they encounter

Select each change request type on the left, and drag it to the matching scenario descriptions on the right:

MyCo, a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFone 14 Pro offer is prioritized over other offers?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

U+ Bank implemented a customer journey for Its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the Journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

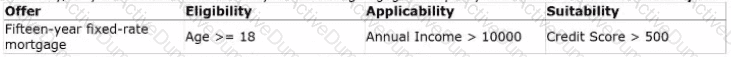

U+- Bank, a retail bank, has recently Implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

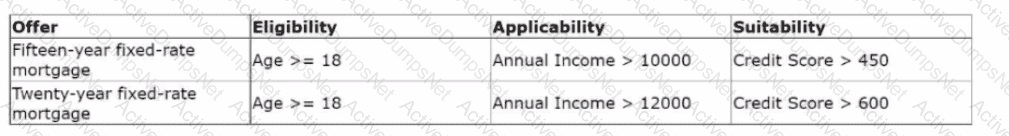

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer, Twenty-year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the business operations environment?

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

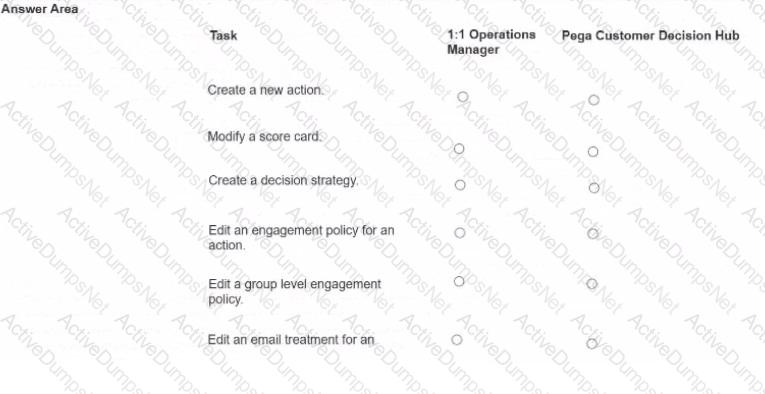

A financial institution's NBA team discovers that they need to modify their risk assessment strategy and edit a scorecard used for loan approvals. The team lead reviews the available options in 1:1 Operations Manager to determine the most appropriate approach to implementing these changes.

Which approach should the team lead use to implement these strategy and scorecard modifications?

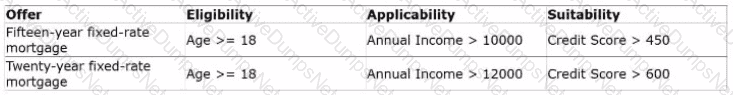

U+ Bank, a retail bank, has recently implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer , Twenty-year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the Business Operations Environment?

A customer qualifies for Standard card (priority 60), Rewards card {priority 40), and Premium card {priority 30). Standard card volume is exhausted. Rewards card has remaining volume, and Premium card has remaining volume. The system uses "Return any action that does not exceed constraint" mode.

Which actions does the customer receive in this scenario?

U+ Bank presents various credit card offers to its customers on its website. The bank uses AI to prioritize the offers according to customer behavior. With the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

In a decision strategy, you can use aggregation components to____________.

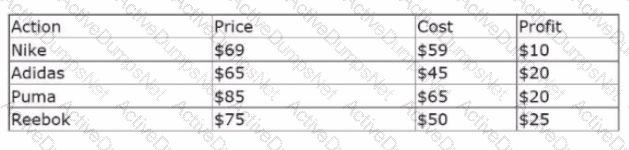

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Prices of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

The details of the shoes are provided in the following table:

To output the most profitable shoe, which component do you add in the blank space that is highlighted in red?

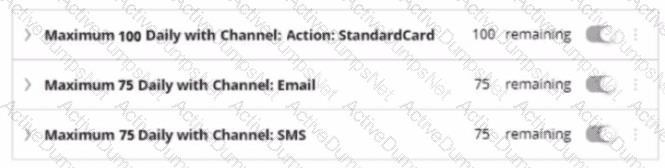

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?

What significant role can a Switch component play in a decision strategy?

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days.

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days. Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

Which of the following reasons explains why a customer might receive an action that they already accepted?

U+ Bank has recently implemented Pega Customer Decision Hub™. As a first step, the bank went live with the contact center to improve customer engagement. Now, U+ Bank wants to extend its customer engagement through the web channel. As a decisioning architect, you have created the new set of actions, the corresponding treatments, and defined a new trigger in the Next-Best-Action Designer for the new web channel.

What else do you configure for the new treatments to be present in the next-best-action recommendations?

In a decision strategy, to use a customer property in an expression, you

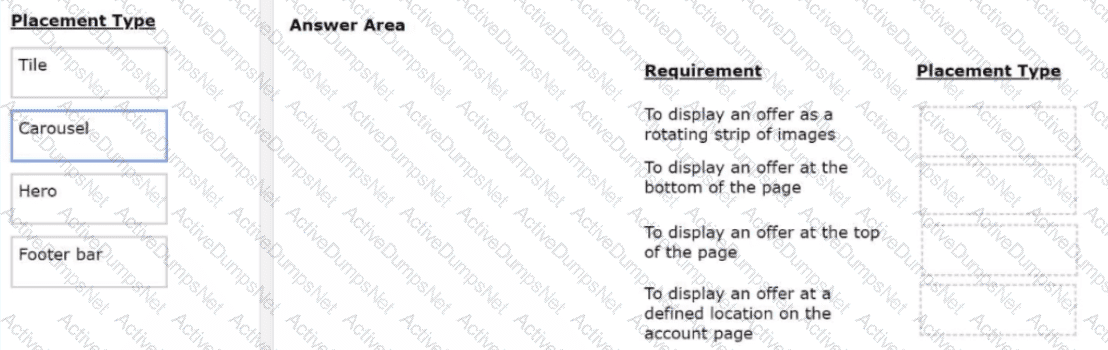

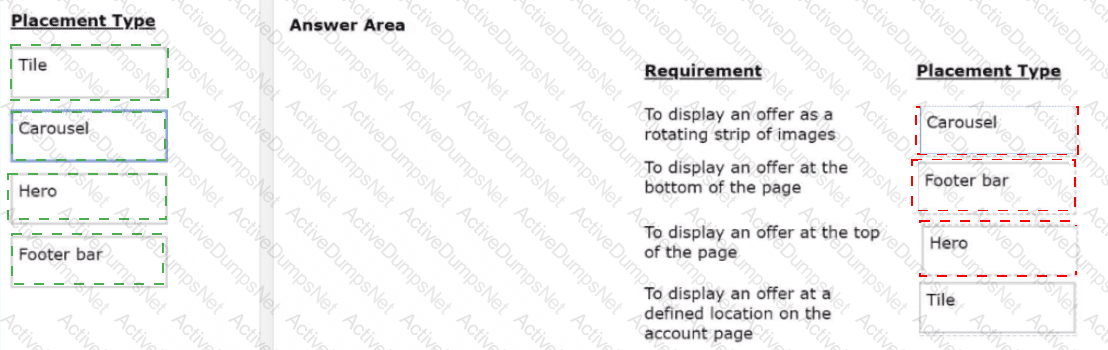

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

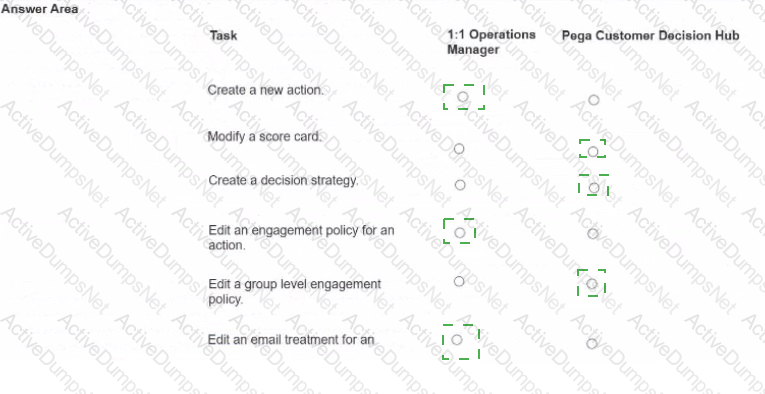

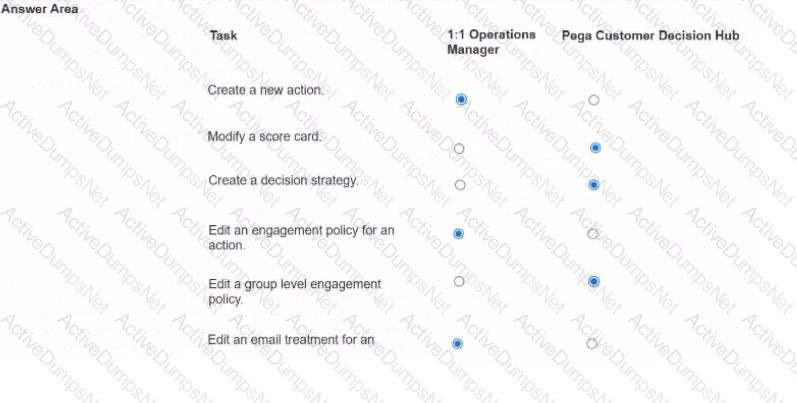

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 Operations Manager portal.

For each task, select the correct portal in which you perform the build tasks based on best practices.

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of Pega Customer Decision Hub™. The bank wants to present the credit card offers through inbound and outbound channels based on the following criteria:

1. Customers must be above the age of 18 to qualify for credit card offers.

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for credit cards.

3. The Platinum Card, one of the credit card offers, is suitable for customers with debt-to-income ratio < 45.

As a decisioning architect, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

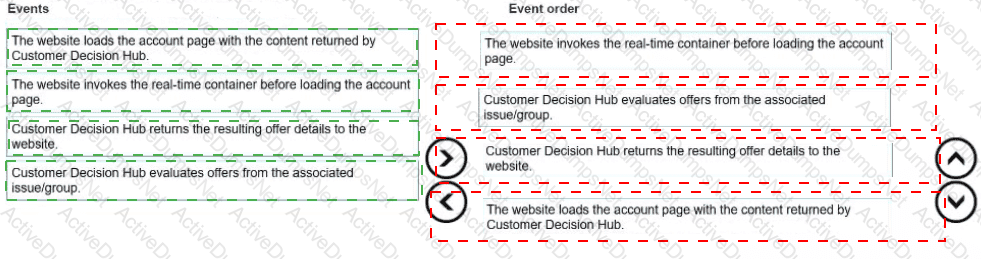

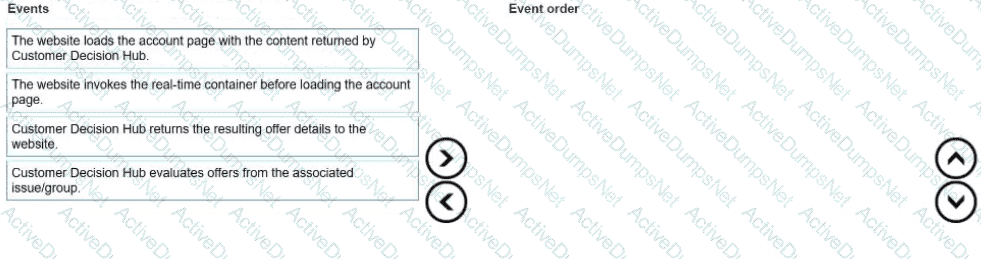

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

Place the events in the sequential order.

A telecommunications company is promoting IPhone upgrades with unlimited data plans. The marketing team notices that a customer explicitly stated in a recent survey that they are not interested in iPhone products. The company wants to apply appropriate engagement policy conditions to respect customer preferences.

Which engagement policy condition type should you use to prevent iPhone offers for customers who express disinterest?

MyCo, a telecom company, notices that when customers call to check on bill status, 80% of the time, they received the wrong offer promotion, leading to customer dissatisfaction. The company decides to boost customers' needs in the prioritization formula, to Improve sales in the current quarter.

Which arbitration factor do you configure to implement the requirement?

What is the name of the property that the system computes automatically when you use an Adaptive Model decision component?

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on Its website to promote new offers to each customer.

Place the events in the sequential order.

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning architect, how do you implement the business requirement?

GlobalRetail operates in a fast-changing digital marketplace where customer preferences and competitor offers change weekly. Their marketing team struggles with lengthy approval processes that prevent quick responses to market trends, often causing them to miss critical engagement opportunities.

What does agility represent in the context of customer engagement projects?

You are the decisioning architect on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

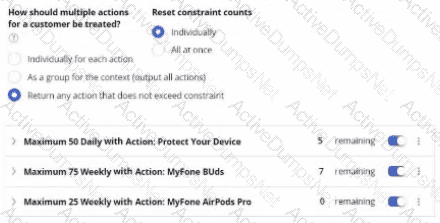

In the following figure, a volume constraint uses the Return any action that does not exceed constraint mode with the three following action type constraints that have remaining limits:

1.Maximum 50 Daily with Action: Protect Your Device, 5 remaining

2.Maximum 75 Daily with Action: MyFone Buds, 7 remaining

3.Maximum 25 Daily with Action: MyFone AirPods Pro, 0 remaining

A customer, CUST-01, qualifies for all the three actions. Given this scenario, how many actions does the system select for CUST-01 in the outbound run?

MyCo,a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFonel4 Pro offer is prioritized over other offers7

C:\Users\Waqas Shahid\Desktop\Mudassir\Untitled.jpg

C:\Users\Waqas Shahid\Desktop\Mudassir\Untitled.jpg