PRMIA 8008 PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition Exam Practice Test

PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition Questions and Answers

Which of the following statements are true:

I. Credit VaR often assumes a one year time horizon, as opposed to a shorter time horizon for market risk as credit activities generally span a longer time period.

II. Credit losses in the banking book should be assessed on the basis of mark-to-market mode as opposed to the default-only mode.

III. The confidence level used in the calculation of credit capital is high when the objective is to maintain a high credit rating for the institution.

IV. Credit capital calculations for securities with liquid markets and held for proprietary positions should be based on marking positions to market.

Which of the following statements are true?

I. Retail Risk Based Pricing involves using borrower specific data to arrive at both credit adjudication and pricing decisions

II. An integrated 'Risk Information Management Environment' includes two elements - people and processes

III. A Logical Data Model (LDM) lays down the relationships between data elements that an organization stores

IV. Reference Data and Metadata refer to the same thing

If μ and σ are the expected rate of return and volatility of an asset whose prices are log-normally distributed, and Ψ a random drawing from a standard normal distribution, we can simulate the asset's returns using the expressions:

Concentration risk in a credit portfolio arises due to:

A loan portfolio's full notional value is $100, and its value in a worst case scenario at the 99% level of confidence is $65. Expected losses on the portfolio are estimated at 10%. What is the level of economic capital required to cushion unexpected losses?

In estimating credit exposure for a line of credit, it is usual to consider:

Which of the following statements are true:

I. Stress tests should consider simultaneous pressures in funding and asset markets, and the impact of a reduction in liquidity

II. Judging the effectiveness of risk mitigation techniques is not a part of stress testing

III. A reverse stress test is useful for discovering hidden vulnerabilities and inconsistencies in hedging strategies

IV. Reputational risk, which is explicitly excluded from the definition of operational risk under Basel II, should still be considered as part of stress tests.

If the default hazard rate for a company is 10%, and the spread on its bonds over the risk free rate is 800 bps, what is the expected recovery rate?

Which of the following are valid methods for selecting an appropriate model from the model space for severity estimation:

I. Cross-validation method

II. Bootstrap method

III. Complexity penalty method

IV. Maximum likelihood estimation method

As part of designing a reverse stress test, at what point should a bank's business plan be considered unviable (ie the point where it can be considered to have failed)?

For a corporate issuer, which of the following can be used to calculate market implied default probabilities?

I. CDS spreads

II. Bond prices

III. Credit rating issued by S&P

IV. Altman's scoring model

Credit exposure for derivatives is measured using

Which of the following statements are true:

I. Capital adequacy implies the ability of a firm to remain a going concern

II. Regulatory capital and economic capital are identical as they target the same objectives

III. The role of economic capital is to provide a buffer against expected losses

IV. Conservative estimates of economic capital are based upon a confidence level of 100%

The VaR of a portfolio at the 99% confidence level is $250,000 when mean return is assumed to be zero. If the assumption of zero returns is changed to an assumption of returns of $10,000, what is the revised VaR?

Which of the following are valid approaches for extreme value analysis given a dataset:

I. The Block Maxima approach

II. Least squares approach

III. Maximum likelihood approach

IV. Peak-over-thresholds approach

Loss provisioning is intended to cover:

Which of the following is a cause of model risk in risk management?

Which of the following statements is true in relation to the Supervisory Capital Assessment Program (SCAP):

I. The SCAP is an annual exercise conducted by the Treasury Department to determine the health of key financial institutions in the US economy

II. The SCAP was essentially a stress test where the stress scenarios were specified by the regulators

III. Capital buffers calculated under the SCAP represented the amount of capital that the institutions covered by SCAP held in excess of Basel II requirements

IV. The SCAP focused on both total Tier 1 capital as well as Tier 1 common capital

An assumption regarding the absence of ratings momentum is referred to as:

Which of the following statements are correct?

I. A reliance upon conditional probabilities and a-priori views of probabilities is called the 'frequentist' view

II. Knightian uncertainty refers to things that might happen but for which probabilities cannot be evaluated

III. Risk mitigation and risk elimination are approaches to reacting to identified risks

IV. Confidence accounting is a reference to the accounting frauds that were seen in the past decade as a reflection of failed governance processes

Which of the following is a most complete measure of the liquidity gap facing a firm?

long bond position is hedged using a short position in the futures market. If the hedge performs as expected, then which of the following statements is most accurate:

Which of the following correctly describes a reverse stress test:

When compared to a low severity high frequency risk, the operational risk capital requirement for a medium severity medium frequency risk is likely to be:

Which of the following should be included when calculating the Gross Income indicator used to calculate operational risk capital under the basic indicator and standardized approaches under Basel II?

A Monte Carlo simulation based VaR can be effectively used in which of the following cases:

Between two options positions with the same delta and based upon the same underlying, which would have a smaller VaR?

Under the CreditPortfolio View model of credit risk, the conditional probability of default will be:

An equity manager holds a portfolio valued at $10m which has a beta of 1.1. He believes the market may see a dip in the coming weeks and wishes to eliminate his market exposure temporarily. Market index futures are available and the current futures notional on these is $50,000 per contract. Which of the following represents the best strategy for the manager to hedge his risk according to his views?

Regulatory arbitrage refers to:

In the case of historical volatility weighted VaR, a higher current volatility when compared to historical volatility:

What would be the consequences of a model of economic risk capital calculation that weighs all loans equally regardless of the credit rating of the counterparty?

I. Create an incentive to lend to the riskiest borrowers

II. Create an incentive to lend to the safest borrowers

III. Overstate economic capital requirements

IV. Understate economic capital requirements

The estimate of historical VaR at 99% confidence based on a set of data with 100 observations will end up being:

When compared to a medium severity medium frequency risk, the operational risk capital requirement for a high severity very low frequency risk is likely to be:

Which loss event type is the failure to timely deliver collateral classified as under the Basel II framework?

Identify the correct sequence of events as it unfolded in the credit crisis beginning 2007:

I. Mortgage defaults increased

II. Collapse in prices of unrelated assets as banks tried to create liquidity

III. Banks refused to lend or transact with each other

IV. Asset prices for CDOs collapsed

An operational loss severity distribution is estimated using 4 data points from a scenario. The management institutes additional controls to reduce the severity of the loss if the risk is realized, and as a result the estimated losses from a 1-in-10-year losses are halved. The 1-in-100 loss estimate however remains the same. What would be the impact on the 99.9th percentile capital required for this risk as a result of the improvement in controls?

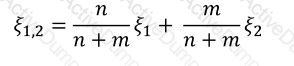

For a hypotherical UoM, the number of losses in two non-overlapping datasets is 24 and 32 respectively. The Pareto tail parameters for the two datasets calculated using the maximum likelihood estimation method are 2 and 3. What is an estimate of the tail parameter of the combined dataset?

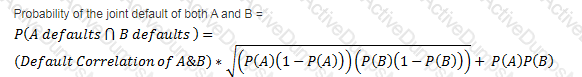

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon. If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

A portfolio's 1-day VaR at the 99% confidence level is $250m. What is the annual volatility of the portfolio? (assuming 250 days in the year)

A cumulative accuracy plot:

A risk analyst analyzing the positions for a proprietary trading desk determines that the combined annual variance of the desk's positions is 0.16. The value of the portfolio is $240m. What is the 10-day stand alone VaR in dollars for the desk at a confidence level of 95%? Assume 250 trading days in a year.

A key problem with return on equity as a measure of comparative performance is:

Which of the following statements are true:

I. The three pillars under Basel II are market risk, credit risk and operational risk.

II. Basel II is an improvement over Basel I by increasing the risk sensitivity of the minimum capital requirements.

III. Basel II encourages disclosure of capital levels and risks

Which of the following are true:

I. Monte Carlo estimates of VaR can be expected to be identical or very close to those obtained using analytical methods if both are based on the same parameters.

II. Non-normality of returns does not pose a problem if we use Monte Carlo simulations based upon parameters and a distribution assumed to be normal.

III. Historical VaR estimates do not require any distribution assumptions.

IV. Historical simulations by definition limit VaR estimation only to the range of possibilities that have already occurred.

The Basel framework does not permit which of the following Units of Measure (UoM) for operational risk modeling:

I. UoM based on legal entity

II. UoM based on event type

III. UoM based on geography

IV. UoM based on line of business

The cumulative probability of default for a security for 4 years is 11.47%. The marginal probability of default for the security for year 5 is 5% during year 5. What is the cumulative probability of default for the security for 5 years?

For identical mean and variance, which of the following distribution assumptions will provide a higher estimate of VaR at a high level of confidence?

Which of the following statements are true:

I. Pre-settlement risk is the risk that one of the parties to a contract might default prior to the maturity date or expiry of the contract.

II. Pre-settlement risk can be partly mitigated by providing for early settlement in the agreements between the counterparties.

III. The current exposure from an OTC derivatives contract is equivalent to its current replacement value.

IV. Loan equivalent exposures are calculated even for exposures that are not loans as a practical matter for calculating credit risk exposure.

Which of the following is not a measure of risk sensitivity of some kind?

For a back office function processing 15,000 transactions a day with an error rate of 10 basis points, what is the annual expected loss frequency (assume 250 days in a year)

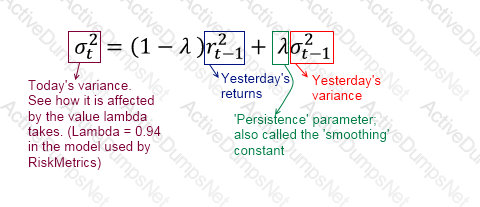

A stock's volatility under EWMA is estimated at 3.5% on a day its price is $10. The next day, the price moves to $11. What is the EWMA estimate of the volatility the next day? Assume the persistence parameter λ = 0.93.

If two bonds with identical credit ratings, coupon and maturity but from different issuers trade at different spreads to treasury rates, which of the following is a possible explanation:

I. The bonds differ in liquidity

II. Events have happened that have changed investor perceptions but these are not yet reflected in the ratings

III. The bonds carry different market risk

IV. The bonds differ in their convexity

Which of the following are valid techniques used when performing stress testing based on hypothetical test scenarios:

I. Modifying the covariance matrix by changing asset correlations

II. Specifying hypothetical shocks

III. Sensitivity analysis based on changes in selected risk factors

IV. Evaluating systemic liquidity risks