You are using the Create Budgets in a Spreadsheet option to load your budget balances into the General Ledger balances cube. Your FYXX Budget is not appearing in the Budget Name list of values.

What are two reasons for this?

You have been tasked with creating user-defined infolets to monitor key financial metrics. However, you cannot see the option to create infolets in the Infolet repository. What are the two requirements to be able to see the Create option?

A subsidiary company is about to configure their General Ledger in a highly regulated country where there is a legal requirement to produce fiscal reports under local GAAP. Subledgers transferring to General Ledger must use the local currency, and there is a requirement to report to the parent company (not local currency) using International Financial Reporting Standards (IFRS).

Which two ledger types should be configured to fulfill this reporting requirement?

You are creating values for thechart of account value setthat you are planning to use for theaccount segmentwithin yourChart of Accounts. You are not able to assign anAccount Type.

What is the reason for this?

Your customer uses Financials Cloud, Projects, Inventory, and SCM.

Which two statements are true regarding intercompany accounting for these products? (Choose two.)

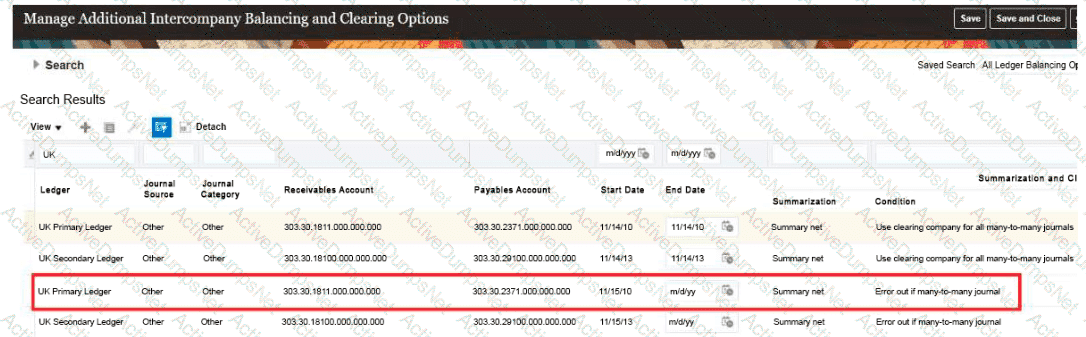

When will Intercompany processing balance a journal using the accounts identified here for the UK Ledger?

When creating your financial statements, you want a chart such as a bar graph to be included in the report output. Which two reporting tools allow you to achieve this?

Financial Reporting Web Studio is a powerful tool within the Oracle Fusion Cloud suite, designed to empower financial professionals with advanced reporting capabilities.

Which two are key capabilities of Financial Reporting Web Studio?

What are two uses of theColumn FlatteningandRow Flatteningfeatures?

You are using theCreate Budgets in a Spreadsheetoption toload your budget balancesinto theGL balances cube. YourFYXX Budgetis not appearing in theBudget Namelist of values.

Which two are the reasons for this?

You need to add new transactional attributes to the journal approval notification in an implementation project. Which two Business Intelligence catalog objects should you copy (or customize) and edit?

You are planning to create an Income Statement using Smart View.

Which Smart View tool should you use for this?

Users with the General Accountant job role have reported that they are unable to access the UK Ledger. They require read/write access to the full ledger. The accounting configuration completed successfully.

What should you do to allow access to the ledger?

You have three ledgers that use the same chart of accounts with one intercompany payable and one intercompany receivable account. The chart of accounts also has an intercompany segment. Each ledger has one legal entity assigned to it and each legal entity is associated with one balancing segment value.

At what level should you define the default intercompany balancing rule?

Which two statements are true about balances cubes in General Ledger?

Which two are predefined roles in General Ledger?

You already ran Translation, but a last-minute adjusting journal entry in your ledger currency was entered and posted after you consolidated your results.

What is Oracle's recommended practice when this occurs?

You have just been hired to add a new subsidiary to the corporate enterprise structure in the customer's Oracle Fusion Cloud.

The subsidiary will capture transaction information from subledgers in the local currency and under International Financial Reporting standards (IFRS) and local GAAP for corporate reporting requirements, which will report via the use of a secondary ledger.

The secondary ledger is used only at period end; there is no need to have real-time transaction or Journal details. It is noted that most of the accounting between IFRS and Corporate GAAP is similar.

Which conversion level would you recommend to keep a thin secondary ledger?

Challenge 2

Manage Shorthand Aliases

Scenario

Your client intends to utilize the Shorthand Alias feature and would like to see how the aliases will appear when entering transactions.

Task 2

Create a shorthand alias for the US Chart of Accounts to record Revenue Domestic for Supremo Fitness, Line of Business 2, and US Operations Cost Center.

Note:

. Prefix your alias name with 07, where 07 is

your exam ID.

. There is no Product or Intercompany

impact.

Task 3

Manage Chart of Accounts Mappings

Scenario

Your client needs to consolidate their UK Ledger to the Canadian parent ledger. Each Chart of Accounts

has the following segments:

Company-LoB-Account-Cost Center-Product-Intercompany

Know that the Company, LoB, Product, and Intercompany segments share the same value sets.

Create a Chart of Accounts mappings to map UK Chart of Accounts to CA Chart of Accounts that meets the following specifications:

Cost Center Mapping

. Balance Sheet (0 and 000) should be mapped to

Balance Sheet

. All other cost centers should be mapped to 610

Account Mapping

. Asset accounts (in the 1000 range) should be

mapped to account 11101

. Liability accounts (in the 2000 range) should be

mapped to account 22100

. Equity accounts (in the 3000 range) should be

mapped to account 34000

. Revenue accounts (in the 4000 range) should be

mapped to account 42000

. Expense accounts (from 5000 onwards) should be

mapped to account 51100

Note:

· Do not use conditions based on parents.

. Treat any account after the 5000 range as an expense.

· Ensure all maps are numeric only.

· When creating your mapping rules for each segment

please allow for existing and future segment values

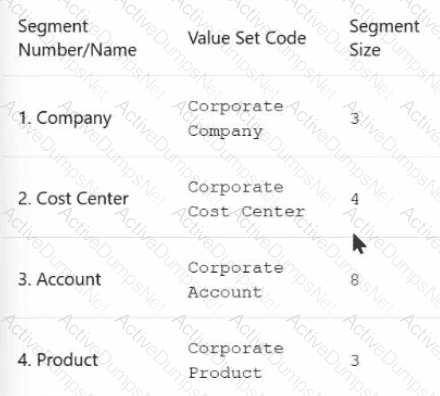

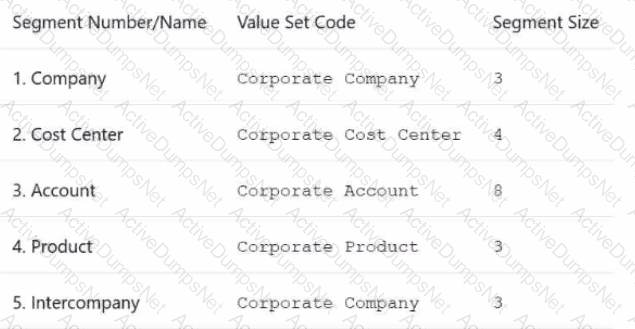

Manage Chart of Accounts Structure and Instance

Scenario

Your client is implementing Oracle Fusion Cloud Financials. The decision is to have a 5-segment Chart of Accounts: Company, Cost Center, Account, Product, and Intercompany. You are working in

the General Ledger team and will be responsible for creating the Chart of Accounts Structure and Instance for the Chart of Accounts.

Task 1

Create a Chart of Accounts Structure and Instance for the following Chart of Accounts:

Note:

· Prefix all your setups with 07, where 07 is your candidate ID

· There is one balancing segment.

· Choose the appropriate segment labels.

. For the purpose of this test there is no need to deploy the flexfield.

. Valid code combinations should be added to the Code Combination table automatically.

· Shorthand aliases will not be implemented.

. Accept the defaults for the instance segments.