Microsoft MB-310 Microsoft Dynamics 365 Finance Exam Practice Test

Microsoft Dynamics 365 Finance Questions and Answers

You need to configure expense management tor Humongous Insurance and its subsidiary. Which options should you use? To answer select the appropriate options in me answer area

NOTE: Each correct selection is worth one point.

You need to ensure the promotional gifts are posted to the correct account. What should you use?

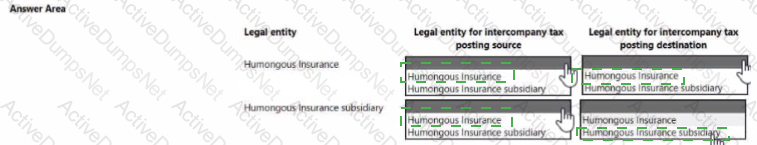

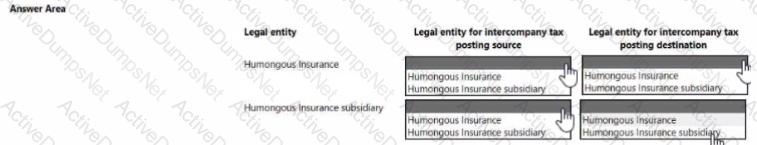

You need to reconfigure the taxing jurisdiction for Humongous insurance's subsidiary What should you do?

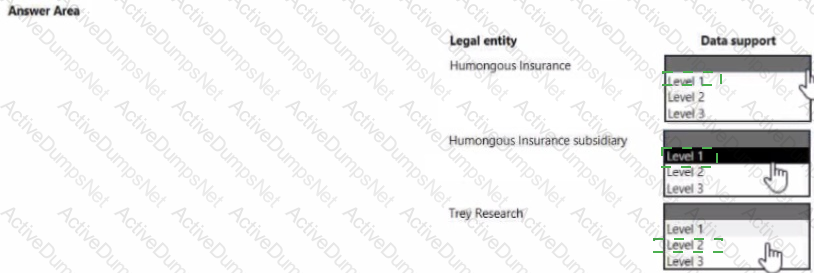

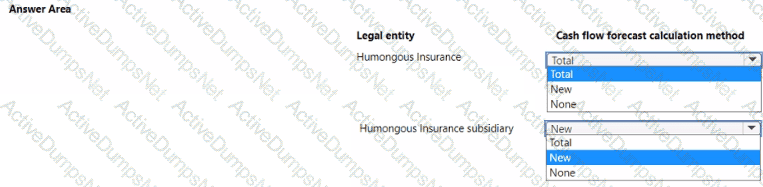

You need to configure the cash flow management reports.

How should you configure cash flow management? To answer, select the appropriate options m the answer area.

NOTE: Each correct selection is worth one point.

You need to configure credit card processing for all three companies.

Which option should you use? To answer, select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

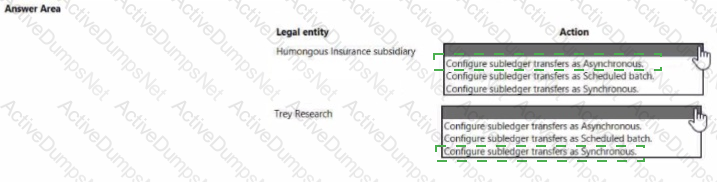

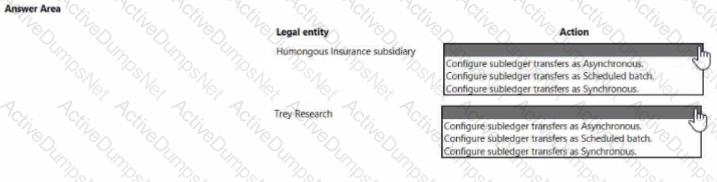

You need to ensure accounting entries are transferred from subledgers to general ledgers.

How should you configure the batch transfer rule? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to configure the posting groups for Humongous insurance s subsidiary. Which ledger posting group field should you use?

You need to ensure Trey Research meets the compliance requirement.

Which budget technology should you implement? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point

You need to configure credit card processing for all three companies

Which option should you use? To answer, select the appropriate options m the answer area

NOTE: Each correct selection is worth one point.

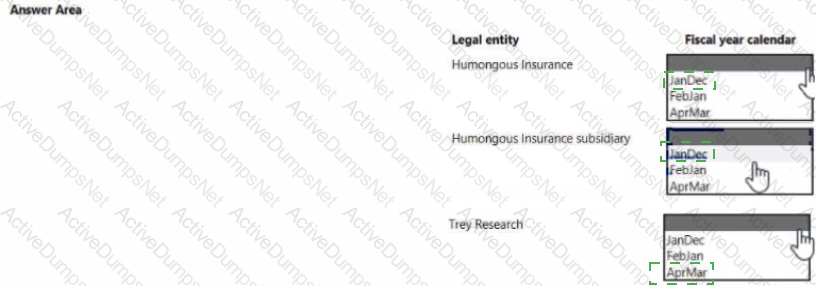

You need to configure the fiscal year calendars for each legal entity.

How should you configure the fiscal year calendars? To answer, select me appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

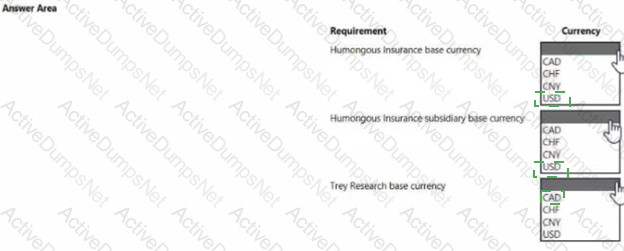

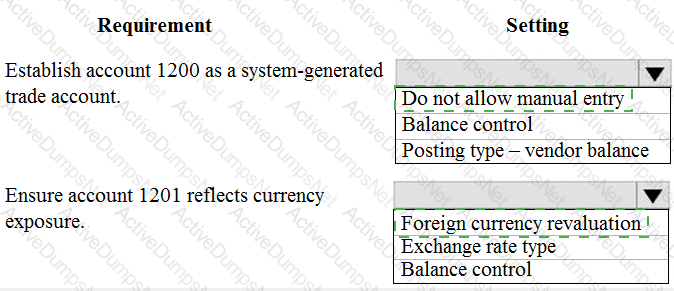

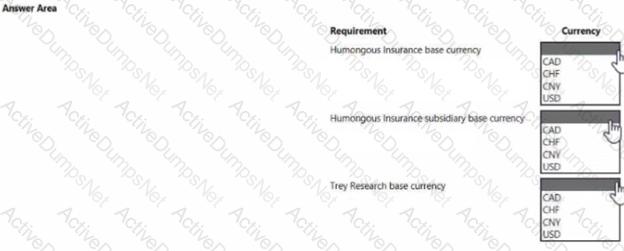

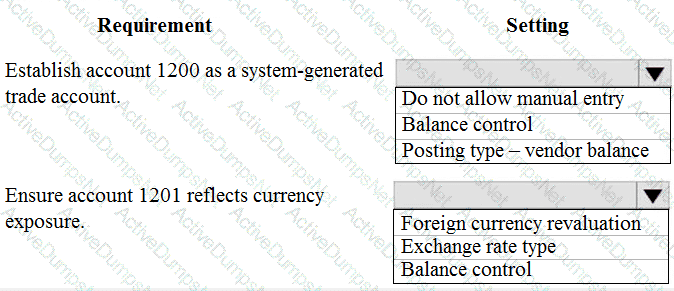

You need to configure currencies for the legal entities.

configure currencies? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

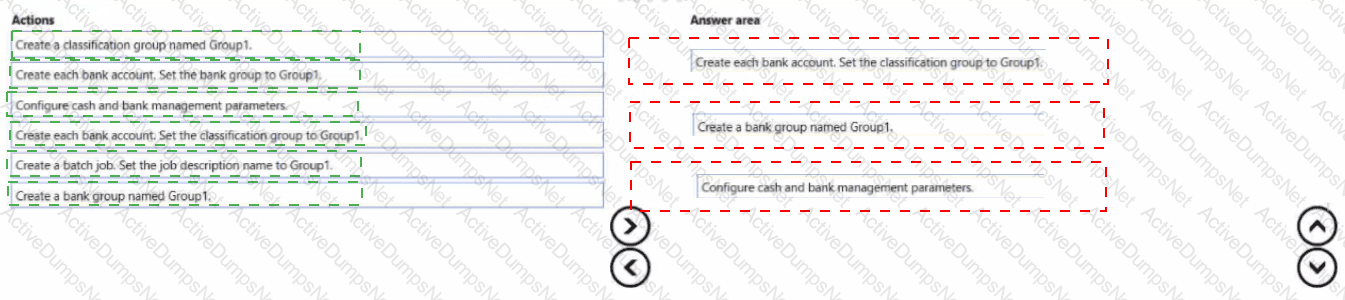

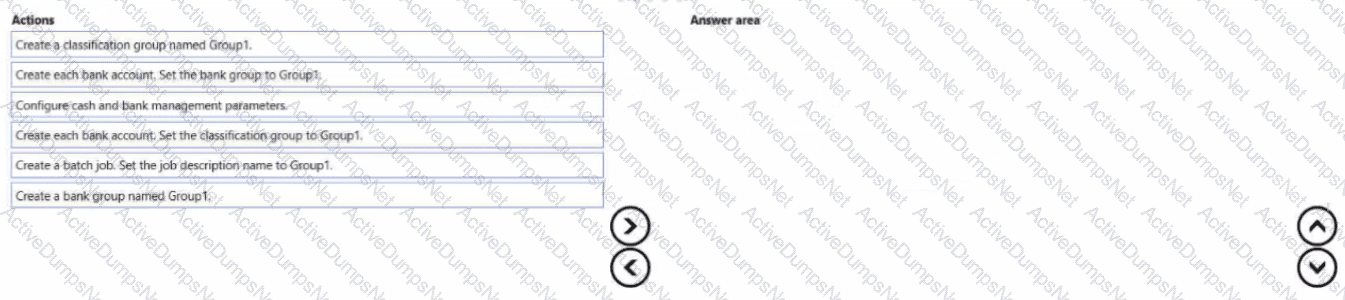

You need to create Trey Research s bank accounts.

Which three actions should you perform in sequence? To answer move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

An organization is upgrading to Dynamics 365 Finance.

One of the organization's legal entities needs to have different main accounts for a period of six months.

You need to configure the legal entity override dates.

Which two actions can you perform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

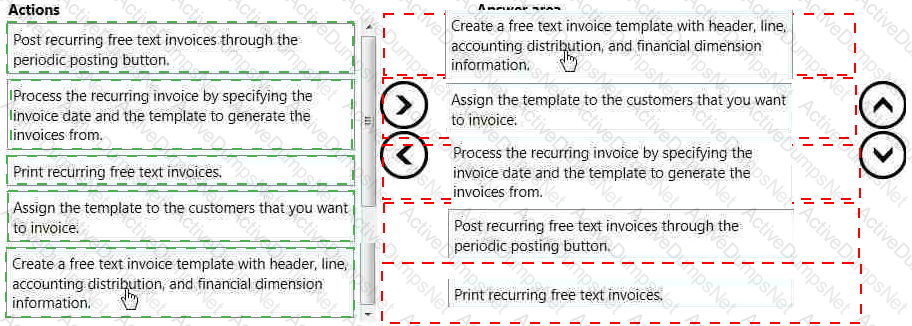

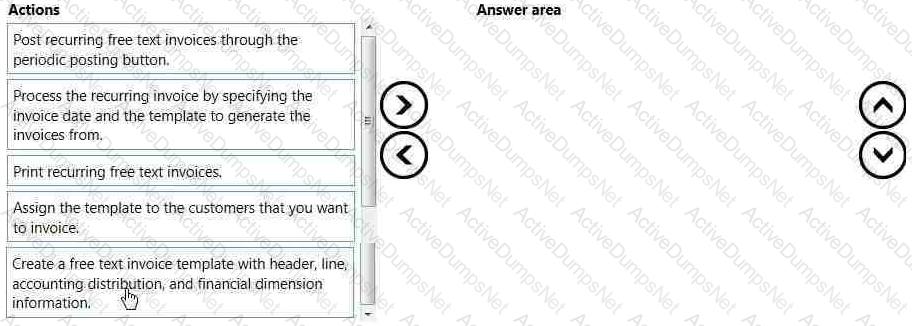

An organization sells monthly service subscriptions. The organization sends invoices to customers on the 15th of every month in the amount of $450.00.

You need to set up, configure, and process recurring free text invoices for the customers.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

You are the controller for an organization. The company purchased six service trucks. You observe that your accountant set up Fixed assets - vehicles in the wrong fixed asset group.

You need to achieve the following;

• Change the fixed asset group so that the existing fixed asset transactions for the original fixed asset are canceled and regenerated for the new fixed asset.

• Ensure that all value models for the existing fixed asset are created for the new fixed asset Any information that was set up for the original fixed asset is copied to the new fixed asset.

• Close the old fixed asset number in the old fixed assets group and create a new fixed asset number in the new fixed assets

group.

What should you do?

You need to set up financial reports to meet management requirements. What should you do? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

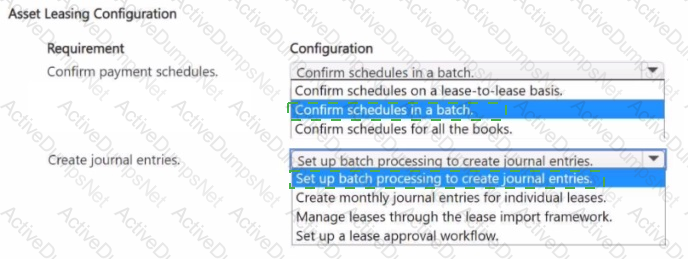

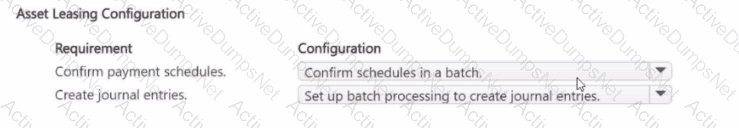

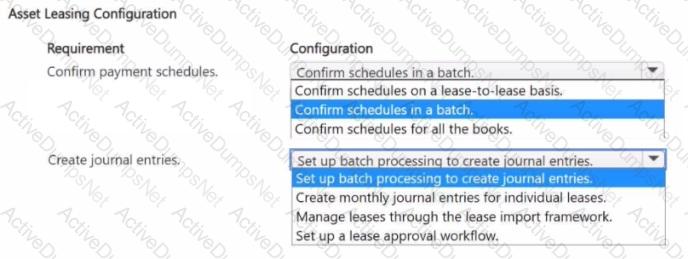

You need to resolve the issue related to monthly lease expenses.

How should you configure asset leasing? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to enforce financial budgets for management and resolve User As issue. What should you do?

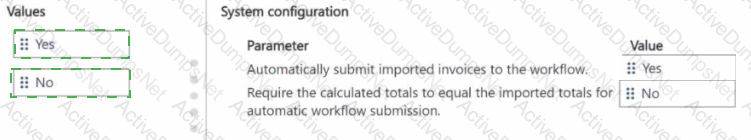

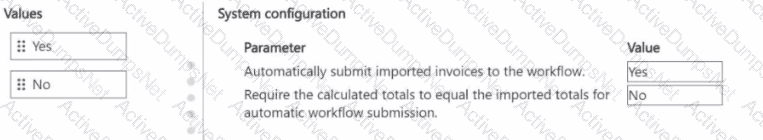

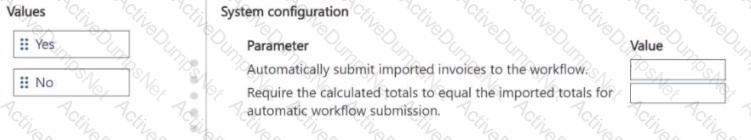

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to recommend a solution to prevent User3's issue from recurring.

What should you recommend?

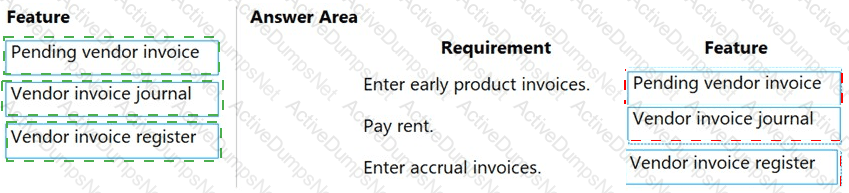

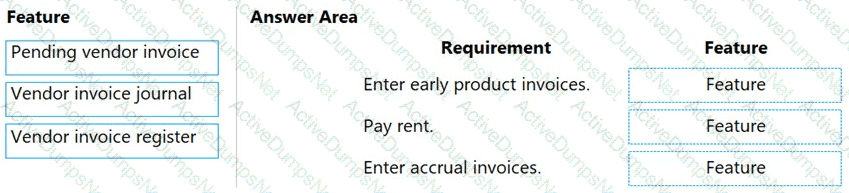

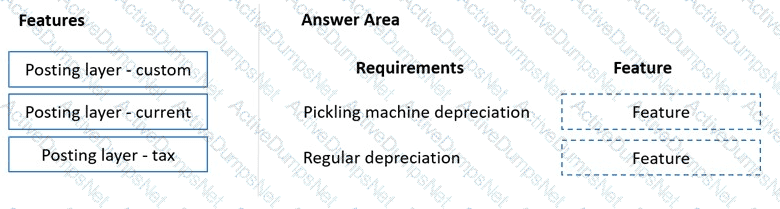

You need to configure the system to meet invoicing requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

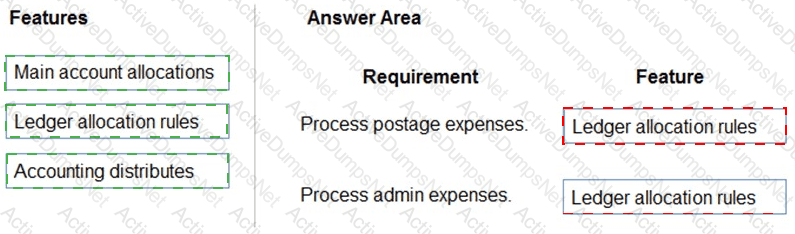

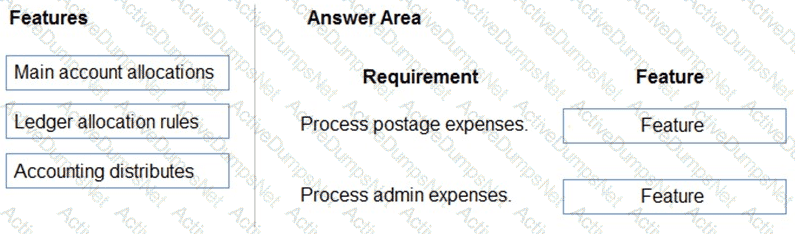

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or net at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

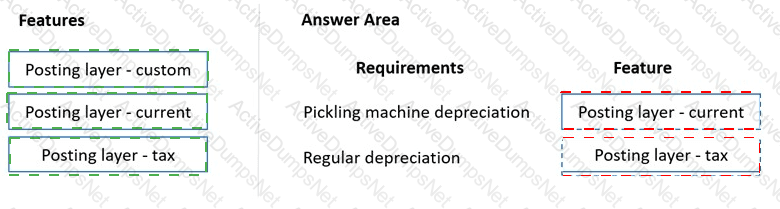

You need to configure system functionality for pickle type reporting.

What should you use?

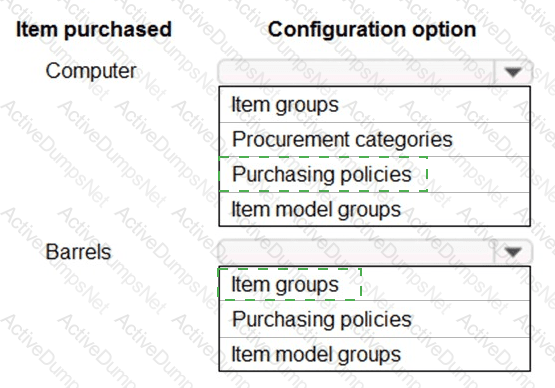

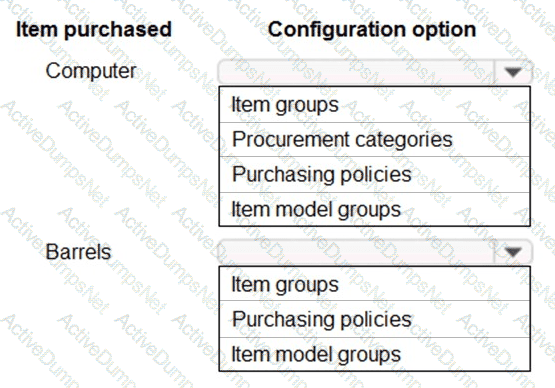

Which configuration makes it possible for User4 to make a purchase?

You need to configure Accounts Receivable to take pre-orders.

Which feature should you use?

You need to identify the root cause for the error that User5 is experiencing.

What should you check?

You need to select the functionality to meet the requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to determine the root cause for User1’s issue.

Which configuration options should you check? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

You need to resolve the issue that User4 reports.

What should you do?

You need to address the employees issue regarding expense report policy violations.

Which parameter should you use?

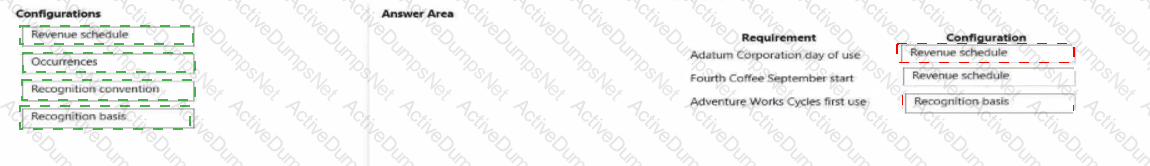

You need to configure revenue recognition to meet the requirements.

Which configuration should you use? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than not at all. You may need to drag the split bar between panes or scroll to view content

NOTE: Each correct selection is worth one point

You need to address the posting of sales orders to a closed period.

What should you do?

You need to identify the posting issue with sales order 1234.

What should you do?

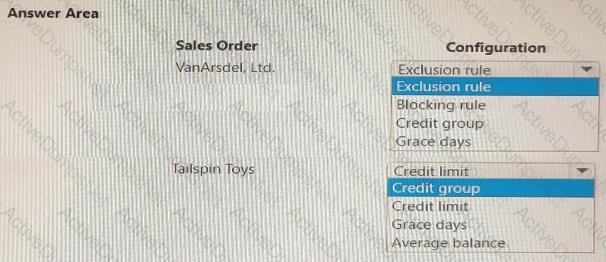

You need to identify why the sales orders where sent to customers.

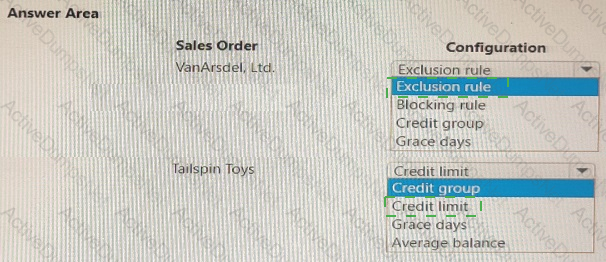

Which configuration allowed the sales orders to be sent? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct select is worth one point.

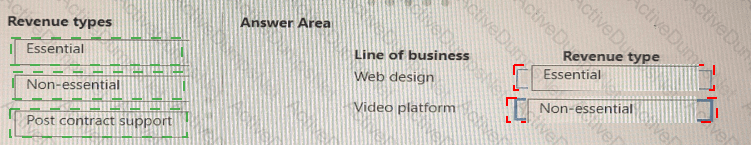

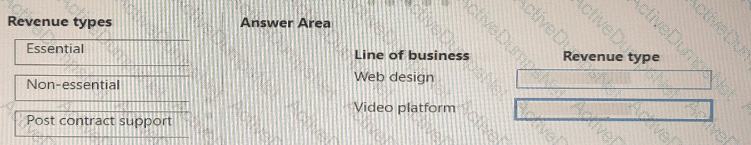

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

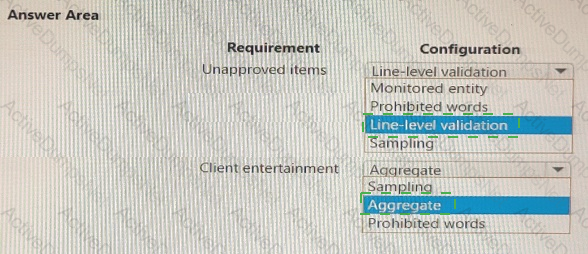

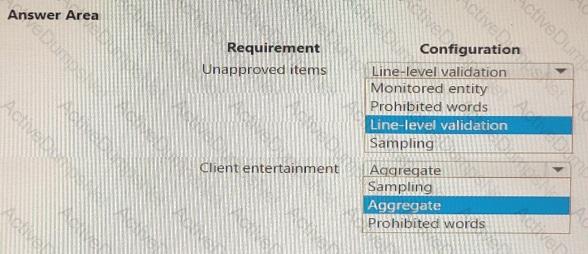

You need to prevent prohibited expenses from posting.

Which configurations should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

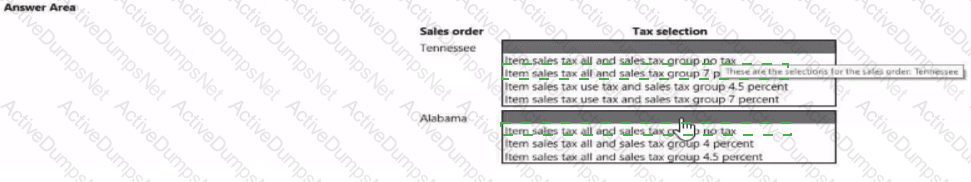

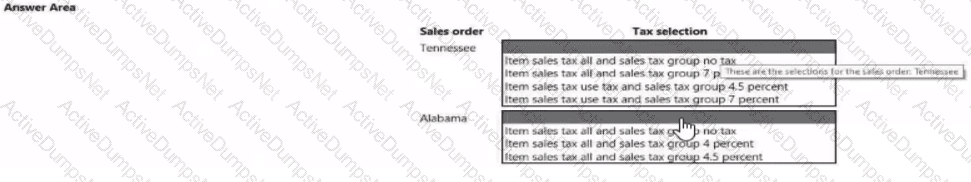

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

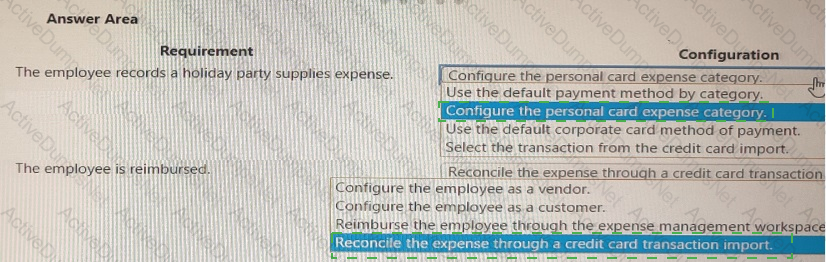

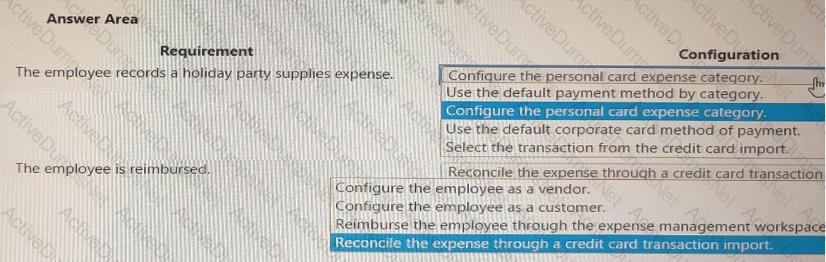

You need to configure the expense module for reimbursement.

How should you configure the expense module? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to configure the system to meet the fiscal year requirements. What should you do?

You need to ensure that User9's purchase is appropriately recorded.

Which three steps should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to correct the sales tax setup to resolve User5's issue.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to configure settings to resolve User1’s issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?