IIC C11 Principles and Practice of Insurance Exam Practice Test

Principles and Practice of Insurance Questions and Answers

[Regulatory Framework / Automobile Insurance]

What is the name of the pooling agreement where all high-risk drivers are underwritten in a common pool?

[Introduction to Risk and Insurance]

Jack is a first-time homeowner. How can he mitigate his risk?

[Insurance Documents and Processes]

What type of wording is written on a custom basis for a specific situation?

[Claims]

Antonio lights a firecracker and throws it to Brett. Brett tosses it to Sandra. Sandra catches it and throws it to Celina. It explodes in Celina’s hands, injuring her. Who is the immediate cause of the loss?

[Introduction to Risk and Insurance]

Why does the need for liability insurance arise?

[Sales and Distribution of Insurance]

What should the broker provide in the broker report?

[Insurance Documents and Processes]

What is a cover note?

[Introduction to Risk and Insurance]

Which action reduces a hazard?

[Insurance Companies]

Who has authority from a company to manage that company's business within their territory, to appoint other agents, and to settle claims?

[Claims]

How are staff adjusters and independent adjusters similar?

[Underwriting – Rates, Hazards, Perils]

What is the effect of perils and hazards on insurance rates for the underwriter?

[Insurance Companies]

Which statement reflects how an insurer invests their capital?

[Insurance Categories and Functions]

Which risk could be insured bychattel coverage?

[Underwriting and Rating: Setting Insurance Rates]

Which factor could explain poorer performance of renewal clients as opposed to new business clients?

[Insurance Companies]

Ace Brokerage Inc., a liability insurer, has been in business for three years. It is suffering financial difficulties despite writing a significant amount of new business. What is the most likely reason?

[Insurance as a Contract – Subject of Insurance]

What does the term "subject of insurance" refer to?

[Insurance Documents and Processes]

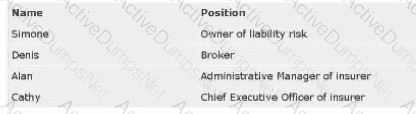

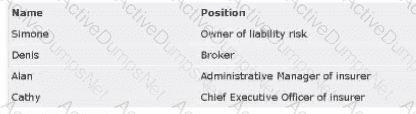

Whose signatures wouldusuallyappear on therisk’s policy?

A company suffers a $100,000 property loss at its commercial location. If Insurer X and Insurer Y have policies subject to the same terms and conditions, and there is no deductible, what will each insurer pay based on the information below?

Insurer X insured amount: $400,000

Insurer Y insured amount: $100,000

[Insurance as a Contract: The Insurance Policy]

George emails his cousin offering to buy her textbooks for $500. He states that unless she replies “no,” they have a deal. Which essential element of a binding contract is missing?

[Insurance Companies]

Which role is directly employed by the Canadian property and casualty insurance industry?

[Claims]

How are staff adjusters and independent adjusters similar?

[Claims]

Mark was involved in an at-fault accident one year ago. As there was minimal vehicle damage and no apparent injuries, Mark settled with the third party and did NOT report the accident to his insurer. Today, Mark has been served a statement of claim alleging long-term injuries. Which action will Mark's insurer MOST LIKELY take, and why?

A company suffers an $80,000 theft loss from its commercial property.

Insurer A covers the property for $300,000.

Insurer B covers the same property for $100,000.

Assuming both policies have identical terms, how is the $80,000 loss shared?

[Sales and Distribution of Insurance / Broker Responsibilities]

A commercial brokerage failed to advise the insurer of a client's modified risk. The insurer discovered this only at the time of a major loss and denied the claim due to material change. How will the client MOST LIKELY proceed?

[Regulatory Framework]

Which legal term describes the time in which a claim may be brought by the policyholder?

Which insurance industry impact is an example of a surety?

[Sales and Distribution of Insurance]

Orianna is an insurance professional who acts on behalf of the insurerandthe insured. She owns her client list and is paid commission once policies are arranged. What is her profession?

[Risk Management – Pre-Loss Objectives]

Which is a pre-loss objective of risk management for an organization?

Which financial outcome would be expected when engaging in a speculative risk?

[Underwriting and Rating: Setting Insurance Rates]

What is the annual premium for a building insured for$500,000at a rate of$0.80 per $100?