IIA IIA-CIA-Part2 Practice of Internal Auditing Exam Practice Test

Practice of Internal Auditing Questions and Answers

The chief audit executive (CAE) determined that the internal audit activity lacks the resources needed to complete the internal audit plan Which of the following would be the most appropriate action tor the CAE to take?

An internal auditor has discovered that duplicate payments were made to one vendor. Management has recouped the duplicate payments as a corrective action. Which of the following describes management’s action in this case?

According to IIA guidance, organizations have the most influence on which element of fraud?

An organization has a health and safety division that conducts audits to meet regulatory requirements. The chief health and safety officer reports directly to the CEO. Which of the following describes an appropriate role for the chief audit executive (CAE) with regard to the organization's health and safety program?

A chief audit executive (CAE) a developing a work program for an upcoming engagement that will review an organization’s small contracting services. When of the following would the CAT need to consider most when developing the work program?

An internal auditor completes a series of engagement steps and is ready to turn in the workpapers for the engagement supervisor’s review. The auditor has additional, separate notes about the engagement and is unsure what to do with them. The workpapers are complete and contain sufficient information to support the engagement work. What should the auditor do with the additional notes, according to IIA guidance?

The internal audit activity of an insurance company is reviewing six of the company’s 11 branches. During the review of the fourth branch that was selected, the internal audit team discovered control breaches that could result in regulatory sanctions if not addressed. How should the internal audit team proceed?

Senior management requested that the internal audit activity perform a consulting project to assist in making a decision on a new software system. Which of the following would be used to determine the engagement objectives?

An internal auditor reviewed the tender documents for the procurement of manufacturing equipment and observed the following:

Tender technical specifications were compliant with internal policies.

The sole assessment criterion of the tender was economic feasibility.

All bids were submitted to a designated software and could not be opened before the submission deadline.

The winner was approved by senior management.

The winner was selected based on which bidder offered the newest technology.

Which of the following is the most appropriate conclusion?

When forming an opinion on the adequacy of management's systems of internal control, which of the following findings would provide the most reliable assurance to the chief audit executive?

• During an audit of the hiring process in a law firm, it was discovered that potential employees' credentials were not always confirmed sufficiently. This process remained unchanged at the following audit.

• During an audit of the accounts payable department, auditors calculated that two percent of accounts were paid past due. This condition persisted at a follow up audit.

• During an audit of the vehicle fleet of a rental agency, it was determined that at any given time, eight percent of the vehicles were not operational. During the next audit, this figure had increased.

• During an audit of the cash handling process in a casino, internal audit discovered control deficiencies in the transfer process between the slot machines and the cash counting area. It was corrected immediately.

Which of the following is the primary weakness of internal control questionnaires (ICQs)?

Which of the following is the best approach for the internal audit function to communicate moderate and high risk observations to management?

According to IIA guidance, which of the following is least likely to be a key financial control in an organization's accounts payable process?

Which of the following performance measures is considered a lagging indicator to the largest degree?

An internal auditor discovered a control weakness that needs to be communicated to management. Which of the following is the best method for first communicating the weakness?

Which of the following structures would best suit a maintenance organization that needs to adapt quickly to rapidly changing technology?

According to IIA guidance, which of the following reflects a characteristic of sufficient and reliable information?

After the team member who specialized in fraud investigations left the internal audit team, the chief audit executive decided to outsource fraud investigations to a third party service provider on an as needed basis. Which of the following is most likely to be a disadvantage of this outsourcing decision?

A newly appointed chief audit executive (CAE) started analyzing the organization's policies in an attempt to customize them to address internal audit specifics. Which of the following organizationwide practices is most likely to be acceptable to the CAE?

According to the International Professional Practices Framework, which of the following is an appropriate reason for issuing an interim report?

To keep management informed of audit progress when audit engagements extend over a long period of time.

To provide an alternative to a final report for limited-scope audit engagements.

To communicate a change in engagement scope for the activity under review.

According to IIA guidance, which of the following is a limitation of a heat map?

A code of business conduct should include which of the following to increase its deterrent effect?

1. Appropriate descriptions of penalties for misconduct.

2. A notification that code of conduct violations may lead to criminal prosecution.

3. A description of violations that injure the interests of the employer.

4. A list of employees covered by the code of conduct.

Which of the following statements is true regarding engagement planning?

Which of the following best describes external benchmarking using trend analysis for a subsidiary of an international company?

A newly appointed chief audit executive (CAE) of a small organization is developing a resource management plan. Which of the following approaches would be most beneficial to help the CAE obtain details of the internal audit activity's collective knowledge, skills, and other competencies?

An internal auditor wants to examine the intensity of correlation between electricity price and wind speed. Which of the following analytical approaches would be most appropriate for this purpose?

Upon completing a follow-up audit engagement, the chief audit executive (CAE) noted that management has not implemented any mitigation measures to address the high

risks that were reported in the initial audit report. What initial step must the CAE take to address this situation?

Which of the following would be the most effective fraud prevention control?

According to IIA guidance, which of the following steps should precede the development of audit engagement objectives?

During a consulting engagement an internal auditor wants to determine whether all principal stakeholders are involved in a project. Which tool should the auditor use?

Management asks the chief audit executive (CAE) to allocate an internal auditor as a non-voting member of a steering committee. The committee will oversee the implementation of a significant and confidential acquisition. Which of the following should guide the CAE’s selection?

Upon the completion of an audit engagement an audit manager performs a review of a staff auditor's workpapers. Which of the following actions by the manager is the most appropriate this review''

Which of the following activities best demonstrates an internal auditor's commitment to developing professional competencies?

An organization obtains maintenance personnel from a third-party service provider. The third-party service provider submits monthly timetables of contracted maintenance personnel and bills the organization on an hourly basis. Which of the following will most likely help an internal auditor validate the number of hours billed by the third-party service provider?

An internal auditor observed that sales staff are able to modify or cancel an order in the system prior to shipping She wonders whether they can also modify orders after shipping. Which of the following types of controls should she examine?

An internal auditor wants to compare performance information from one quarter to another. Which analytics procedure would the auditor use?

The chief audit executive (CAE) for a manufacturing company included in this year s audit plan a review of the company's laboratory, using an experienced external service provider. The audit plan was approved by the audit committee without any changes At the time of engaging the external service provider, the CAE also secured the approval from the CEO. Who is responsible for ensuring that the conclusions reached for this exercise are adequately supported7

Which of the following statistical sampling approaches is the most appropriate for testing a population for fraud?

Which of the following is the most appropriate reason for a chief audit executive to conduct an external assessment more frequently than five years?

The board of directors expressed concerns about potential external risks that could impact the organization s ability to meet its annual objectives and goals The board requested consulting services from the internal audit activity to gain insight regarding the external risks Which of the following engagement objectives would be appropriate to fulfill this request?

Which of the following resources would be most effective for an organization that would like to improve how it informs stakeholders of its social responsibility performance?

The internal audit activity plans to assess the effectiveness of management's self-assessment activities regarding the risk management process. Which of the following procedures would be most appropriate to accomplish this objective?

Which of the following is a true statement regarding whistleblowing?

How do internal auditors generally determine the priority of the areas within the engagement scope?

While reviewing warehouse inventory records, an internal auditor noticed that the warehouse has a surprisingly high number of products in storage. Over the past three years, the auditor had visited this particular warehouse numerous times for previous engagements and remembered that the warehouse was rather small. The auditor then decided to compare the square footage of the warehouse to the recorded number of products in storage. The auditor’s action is an example of which of the following?

Management has taken immediate action to address an observation received during an audit of the organization's manufacturing process Which of the following is true regarding the validity of the observation closure?

Which of the following behaviors could represent a significant ethical risk if exhibited by an organization's board?

1. Intervening during an audit involving ethical wrongdoing.

2. Discussing periodic reports of ethical breaches.

3. Authorizing an investigation of an unsafe product.

4. Negotiating a settlement of an employee claim for personal damages.

An internal auditor reviewed bank reconciliations prepared by management of the area under review. The auditor noted that the bank statements attached did not have the

bank heading, logo, or address. Which of the following statements is true regarding this situation?

While conducting a review of the logistics department the internal audit team identified a crucial control weakness. The chief audit executive (CAE) decided to prepare an audit memorandum for management of the logistics department followed by an informal meeting What is the most likely reason the CAE decided to prepare the audit memorandum?

An internal auditor is preparing an internal control questionnaire for the procurement department as part of a preliminary survey. Which of the following would provide the best source of information for questions?

According to IIA guidance, which of the following statements regarding the internal audit charter is true?

Which of the following types of resources is the most important and challenging to identify and allocate in order to perform an audit engagement?

Which of the following conditions are necessary for successful change management?

1. Decisions and necessary actions are taken promptly.

2. The traditions of the organization are respected.

3. Changes result in improvement or reform.

4. Internal and external communications are controlled.

How should an internal auditor approach preparing a detailed risk assessment during engagement planning?

Which of the following is one of the five attributes that internal auditors include when documenting a deficiency?

Which of the following is most likely to be considered a control weakness?

Which of the following has the greatest effect on the efficiency of an audit?

Which of the following is an appropriate responsibility for the internal audit activity with regard to the organization's risk management program?

The final internal audit report should be distributed to which of the following individuals?

An internal auditor completed a consulting engagement covering a recent advertising campaign. The audit client asked the auditor to forward a copy of the report to one of the three advertising agencies used by the organization. According to IIA guidance, which of the following statements is true regarding this request?

Which of the following would be most useful for an internal auditor to obtain during the preliminary survey of an engagement on internal controls over user access management?

Which is the most appropriate evaluation criterion regarding the quality of audit engagement workpapers?

Management testimony of improper segregation of duties in the cash receipt process can be considered which of the following?

Which of the following statements is true regarding the audit objective for an assurance engagement?

A chief audit executive (CAE) reviews the supervision of an internal audit engagement Which of the following would most likely assure the CAE that the engagement had adequate supervision?

The chief audit executive (CAF) determined that the residual risk identified in an assurance engagement is acceptable. When should this be communicated to senior management?

An examination of the accounts payable function evidenced multiple findings with respect to segregation of duties. After management's response and action plan are received and documented in the final report, which of the following is most appropriate?

A chief audit executive (CAE) received a detailed internal report of senior management's internal control assessment. Which of the following subsequent actions by the CAE would provide the greatest assurance over management's assertions?

A chief audit executive (CAE) is trying to balance the internal audit activity's needs for technical audit skills budget efficiency and staff development opportunities. Which of the following would best assist the CAE in achieving this balance1?

When developing the scope of an audit engagement, which of the following would the internal auditor typically not need to consider?

Which of the following best describes the internal audit activity's responsibility within a risk and control framework?

Which of the following is an advantage of nonstatistical sampling over statistical sampling?

Which of the following is a justifiable reason for omitting advance client notice when planning an audit engagement?

When presenting an observation m writing which or the Mowing is usually true regarding the level of detail provided?

1. The description of the observation in the final audit report contains more detail then the description m the engagement workpapers

2. The description of the observation m the engagement workpapers contains more detail than the descriptor n a preliminary observation document

3. A preliminary observation document contains more detail than tie observation description in the final audit report

4. A preliminary observation document contains more detail than tie observation description in the engagement workpapers

When constructing a staffing schedule for the internal audit activity (IAA), which of the following criteria are most important for the chief audit executive to consider for the effective use of audit resources?

1. The competency and qualifications of the audit staff for specific assignments.

2. The effectiveness of IAA staff performance measures.

3. The number of training hours received by staff auditors compared to the budget.

4. The geographical dispersion of audit staff across the organization.

The internal audit activity has become aware of public complaints regarding the sales practices of telephone marketing personnel in a large organization. The internal auditors decide to review a sample of all complaints within the last three months to ensure they are reflective of current marketing practices. Which of the following best describes this sampling technique?

According to IIA guidance, which of the following individuals should receive the final audit report on a compliance engagement for the organization's cash disbursements process?

Which of the following statements best describes the difference between risk appetite and risk tolerance?

The external auditor has identified a number of production process control deficiencies involving several departments. As a result, senior management has asked the internal audit activity to complete internal control training for all related staff. According to IIA guidance, which of the following would be the most appropriate course of action for the chief audit executive to follow?

An organization owns vehicles that are kept off-site by employees to pick up and deliver orders. An internal auditor selects a specific vehicle from the fixed asset register for

testing. Which of the following would best provide sufficient, indirect evidence for the auditor to confirm the existence of the vehicle?

According to IIA guidance, which of the following typically serves as the basis for an engagement work program?

The internal audit manager has been delegated the task of preparing the annual internal audit plan for the forthcoming fiscal year All engagements should be appropriately categorized and presented to the chief audit executive for review Which of the following would most likely be classified as a consulting engagement?

A toy manufacturer receives certain components from an overseas supplier and uses them to assemble final products Recently quality reviews have identified numerous issues regarding the components' compliance with mandatory quality standards. Which type of engagement would be most appropriate to assess the root causes of the quality issues?

Which of the following is the primary purpose of implementing a program whereby employees are rotated from other parts of the organization into the internal audit activity?

Which of the following is an appropriate activity when supervising engagements?

Which of the following methodologies consists of the internal auditor holding individual meetings with different people, asking them the same questions, and aggregating the results?

Which of the following describes (he primary reason why a preliminary risk assessment is conducted during engagement planning?

The internal audit activity is currently working on several engagements, including a consulting engagement on the management process in the human resources department. Which of the following actions should the chief audit executive take to most efficiently and effectively ensure the quality of the engagement?

During the planning stage of an assurance engagement, an internal auditor has been assigned to prepare a risk matrix. Which of the following should the internal auditor consider when attempting to identify process-level risks?

Organizations that adopt just-in-time purchasing systems often experience which of the following?

Which of the following should be described in the recognition element of a typical internal audit repot?

When estimating the impact of an inherent risk, which of the following should internal auditors consider?

An internal audit activity has to confirm the validity of the activities reported by a grantee that received a charitable contribution from the organization. Which of the following methods would best help meet this objective?

Which of the following is not an outcome of control self-assessment?

A customer has supplied personal information to a bank to facilitate opening an account. The bank is part of a larger group of companies with core businesses including general insurance, life insurance, and investment products. Considering that the customer has closed his only account with the bank and the statutory data retention period has elapsed, which of the following actions by the bank is most likely to align with appropriate data privacy principles?

Senior management is challenging regulatory fines that were assessed to the organization due to questionable business practices. Their actions and the fines could have an adverse effect on the organization's ability to continue business. How would the chief audit executive respond?

In which of following scenarios is the internal auditor performing benchmarking?

Which of the following best describes the risk contained in an initial public offering for a new stock?

Which of the following steps should an internal auditor complete when conducting a review of an electronic data interchange application provided by a third-party service?

Ensure encryption keys meet ISO standards.

Determine whether an independent review of the service provider's operation has been conducted.

Verify that the service provider’s contracts include necessary clauses.

Verify that only public-switched data networks are used by the service provider.

Senior IT management requests the internal audit activity to perform an audit of a complex IT area. The chief audit executive (CAE) knows that the internal audit activity lacks the expertise to perform the engagement. Which of the following is the most appropriate action for the CAE to take?

Which of the following statements is true regarding internal controls?

An investor has acquired an organization that has a dominant position in a mature, slow-growth industry and consistently creates positive financial income Which of the following terms would the investor most likely label this investment in her portfolio?

The internal audit function is performing an assurance engagement on the organization’s environmental, social, and governance (ESG) program. The engagement objective is to determine whether the ESG program’s activities are meeting the program’s established goals. The internal audit function has completed a risk and control assessment of the ESG program's activities. What is the appropriate next step?

An internal auditor tested whether purchase orders were supported by appropriately approved purchase requisitions She sampled a population of purchase documents and identified instances where purchase requisitions were missing However, she did not notice that n some cases purchase requisitions were approved by an unauthorized person Which of the following risks most appropriately describes this situation?

An internal auditor s testing tor proper authorization of contracts and finds that the rate of deviations discovered in the sample is equal to the tolerable deviation rate. When of the following is the most appropriate conclusion for the internal auditor to make based on this result?

While reviewing the workpapers and draft report from an audit engagement, the chief audit executive (CAE) found that an Important compensating control had not been considered adequately by the audit team when it reported a major control weakness Therefore, the CAE returned the documentation to the auditor in charge for correction Based on this Information, which of the following sections of the workpapers most likely would require changes?

1.Effect of the control weakness.

2.Cause of the control weakness

3.Conclusion on the control weakness.

4.Recommendation for the control weakness.

Which of the following activities would an internal auditor perform as a consulting engagement for an organization?

A manufacturer is under contract to produce and deliver a number of aircraft to a major airline. As part of the contract, the manufacturer is also providing training to the airline's pilots. At the time of the audit, the delivery of the aircraft had fallen substantially behind schedule while the training had already been completed. If half of the aircraft under contract have been delivered, which of the following should the internal auditor expect to be accounted for in the general ledger?

When determining the level of staff and resources to be dedicated to an assurance engagement, which of the following would be the most relevant to the chief audit executive?

An internal auditor is conducting an assurance engagement in the procurement area. The auditor follows a checklist of tasks prepared for the engagement. During the process, the auditor notices some deviations from the procurement procedure requirements. However, these deviations are not directly linked to and do not prevent the auditor from completing the checklist tasks. So, the auditor does not investigate these deviations further. Which checklist drawback most likely applies to this situation?

Which of the following would most likely cause an internal auditor to consider adding fraud work steps to the audit program?

When auditing an organization's cash-handling activates which of the following is the most reliable form of testimonial evidence an internal auditor can obtain?

A team of internal auditors is assigned to audit the employee relations process in an organization, which includes employee conduct and disciplinary hearings. Which of the following audit approaches would provide the auditors with the best evidence to determine the degree to which disciplinary decisions are complying with documented policy?

Which of the following is true about surveys?

Which of the following is the primary reason for internal auditors to conduct interim communications with management of the area under review?

Which of the following statements is true regarding internal control questionnaires?

For an action plan to be effective, it should be designed primarily to address which of the following elements of an observation?

The human resources (HR) department was last reviewed three years ago and is due for an assurance engagement after undergoing recent process changes. Which of the following would the most effective option identify the HR department's risks and controls?

Senior IT management requests the internal audit activity to perform an audit of a complex IT area. The chief audit executive (CAE) knows that the internal audit activity lacks the expertise to perform the engagement. Which of the following is the most appropriate action for the CAE to take?

Which of the following reasonably represents best practices regarding what should be the level of internal audit resource investment in monitoring and following up on engagement outcomes?

An internal auditor notes that employees continue to violate segregation-of-duty controls in several areas of the finance department, despite previous audit recommendations. Which of the following recommendations is the most appropriate to address this concern?

According to IIA guidance, which of the following statements is true regarding engagement planning?

An internal auditor discovered that equipment used to monitor air quality was not maintained according to the established maintenance schedule. If the issue is not addressed, the equipment may not provide accurate information on pollutant levels, which could result in regulatory sanctions and reputational damage. The auditor discussed the issue with both the manager in charge and the CEO, who explained that they understand the risk, but it has become too expensive to maintain the equipment as scheduled. In this situation, what should the chief audit executive do?

An internal auditor observes a double payment transaction on a supplier invoice during an accounts payable engagement. Which of the following steps would be the most effective in helping the auditor determine whether fraud exists?

Which of the following statements is true regarding internal controls?

Which of the following methods is most closely associated to year over year trends?

What is the primary purpose of issuing a preliminary communication to management of the area under review?

An internal auditor using the five-attribute approach to document deficiencies in a warehouse shipping process. Which of the following attributes will be included in the workpapers?

An internal auditor is conducting a preliminary survey of the investments area, and sends an internal control questionnaire to the management of the function. (An extract of the survey is provided below).

1. Are there any restrictions for any company's investments?

2. Are there any written policies and procedures that document the flow of investment processing?

3. Are investment purchases recorded in the general ledger on the date traded?

4. Is the documentation easily accessible to an persons who need in to perform their job?

Which of the following is a drawback of testing methods like this?

In a health care organization the internal audit activity provides overall assurance on governance, risk and control The chief audit executive advises and influences senior management, and the audit strategy leverages the organization's management of risk According to HA guidance which of the following stages of internal audit maturity best describes this organization?

According to ISO 31000, which of the following statements is correct?

Which statement best describes the benefit of using workpapers from recent internal audit engagements of the area under review to plan new engagements?

Which of the following activities Is most likely to require a fraud specialist to supplement the knowledge and skills of the internal audit activity?

Which of the following should be included in a privacy audit engagement?

1. Assess the appropriateness of the information gathered.

2. Review the methods used to collect information.

3. Consider whether the information collected is in compliance with applicable laws.

4. Determine how the information is stored.

Following an IT systems audit, management agreed to implement a specific control in one of the IT systems. After a period, the internal auditor followed up and learned that management had not implemented the agreed management action due to the decision to move to another IT system that has built-in controls, which may address this risks highlighted by the Internal audit Which of the following Is the most appropriate action to address the outstanding audit recommendation?

While reviewing the workpapers and draft report from an audit engagement, the chief audit executive (CAE) found that an important compensating control had not been considered adequately by the audit team when it reported a major control weakness. Therefore, the CAE returned the documentation to the auditor in charge for correction. Based on this information, which of the following sections of the workpapers most likely would require changes?

Effect of the control weakness.

Cause of the control weakness.

Conclusion on the control weakness.

Recommendation for the control weakness.

An audit observation noted that annual inventory counts of biofuel was not being performed appropriately Fuel yards were not visited and physical amounts of biofuel were not reconciled with accounting data Management of the division understood the issue and promised to resolve the problem When should the internal auditor schedule a follow-up review?

Which of the following steps should an internal auditor complete when conducting a review of an electronic data interchange application provided by a third-party service?

1.Ensure encryption keys meet ISO standards.

2.Determine whether an independent review of the service provider's operation has been conducted.

3.Verify that the service provider's contracts include necessary clauses.

4.Verify that only public-switched data networks are used by the service provider

An internal auditor is asked to review a recently completed renovation to a retail outlet. Which of the following would provide the most reliable evidence that the completed work conformed to the plan?

When establishing a quality assurance and improvement program, the chief audit executive should ensure the program is designed to accomplish which of the following objectives?

1. Add value.

2. Improve operations.

3. Provide assurance that the internal audit activity conforms with the Standards.

4. Provide assurance that the internal audit activity conforms with the IIA Code of Ethics.

The audit manager asked the internal auditor to perform additional testing because several irregularities were found in the financial information. Which of the following would be the most appropriate analytical review for the auditor to perform?

The newly appointed chief audit executive (CAE) of a large multinational corporation, with seasoned internal audit departments located around the world, is reviewing responsibilities for engagement reports. According to IIA guidance, which of the following statements is true?

Applying ISO 31000; which of the following is part of the external context for risk management?

Which of the following is most likely to be judged as a significant residual risk that would exceed the organization's acceptable risk level?

According to the IIA Code of Ethics, which of the following is required with regard to communicating results?

According to IIA guidance, which of the following reflects a valid principle for the internal audit activity to rely on the work of internal or external assurance providers?

Which of the following is the most important determinant of the objectives and scope of assurance engagements?

The organizational chart, business objectives, and policies and procedures of the area to be reviewed

An internal auditor is assessing the organization's risk management framework. Which of the following formulas should he use to calculate the residual risk?

A)

B)

C)

D)

According to IIA guidance, when of the Mowing statements is true regarding an engagement supervisor's use of review notes?

According to IIA guidance which of the following statements is true regarding the annual audit plan?

Which of the following statements is true regarding the use of internal control questionnaires (ICOs)?

According to IIA guidance, which of the following corporate social responsibility (CSR) evaluation activities may be performed by the internal audit activity?

1.Consult on CSR program design and implementation

2.Serve as an advisor on CSR governance and risk management.

3.Review third parties for contractual compliance with CSR terms

4Identify and mitigate risks to help meet the CSR program objectives

According to IIA guidance, which of the following is true when the internal audit activity is asked to investigate potential ethics violations in a foreign subsidiary?

A company makes a product at a cost of $26 per unit, of which $10 is fixed cost. The product is usually sold for $30 per unit; however, the company has been approached by a new customer who would like to purchase 3,500 units for $18 each Further, the company would Incur additional cost to deliver the units to this customer If the company has the excess manufacturing capacity and all other factors are constant, what is the additional cost that the company would Incur in order to make a profit of $1.50 per unit for this order?

In order to obtain background information on an assigned audit of data center operations an internal auditor administers control questionnaires to select individuals who have primary responsibilities within the process. Which of the following is a drawback of this approach?

To effectively communicate the acceptance of risk in an organization a chief audit executive must first consider which of the following?

Which of the following offers the best explanation of why the auditor in charge would assign a junior auditor to complete a complex part of the audit engagement?

Which of the following is true regarding the monitoring of internal audit activities?

Which of the following is the most important determinant of the objectives and scope of assurance engagements?

An internal auditor wants to determine whether employees are complying with the information security policy, which prohibits leaving sensitive information on employee desks overnight. The auditor checked a sample of 90 desks and found eight that contained sensitive information. How should this observation be reported, if the organization tolerates 4 percent noncompliance?

Which of the following is critical to the success of an effective interview?

Which of the following actions would an internal auditor perform primarily during a consulting engagement of a debt collections process?

Which of the following is an example of a directive control?

Which of the following is applicable to both a job order cost system and a process cost system'?

The chief audit executive (CAE) has assigned an internal auditor to an upcoming engagement. Which of the following requirements would most likely indicate that the Internal auditor was assigned to an assurance engagement?

According to IIA guidance, which of the following activities are typically primary objectives of engagement supervision?

Which of the following audit steps would an internal auditor perform when reviewing cash disbursements to satisfy IIA guidance on due professional care?

Which of the following is the best option for the chief audit executive to consider for effective coordination of assurance coverage?

Which of the following is an example of internal benchmarking?

An internal auditor suspects that a program contains unauthorized code or errors. Which of the following would assist the internal auditor in this regard?

Which of the following best describes the manual audit procedure known as vouching?

Which of the following manual audit approaches describes testing the validity of a document by following it backward to a previously prepared record?

According to IIA guidance, which of the following describes the primary reason the chief audit executive (CAE) should actively network and build relationships with senior management and the board?

Senior management wants assurance that third-party contractors are following procedures as agreed with the organization. Which type of audit would be most appropriate

to achieve this objective?

An internal auditor wants to assess the completeness of sales invoices issued by the organization over a period of time Providing that at the necessary data and analytics software is which of the following types of analyse would be appropriate to satisfy the auditor's objective?

Which of the following would help the internal audit activity assess compliance with the organization's standard operating procedures for bank deposits during a preliminary survey?

Which of the following best describes the guideline for preparing audit engagement workpapers?

According to IIA guidance, which of the following is based on the results of a preliminary assessment of risks relevant to the area under review?

Which of the following processes does the board manage to ensure adequate governance?

When a significant finding is noted early during a review of the accounts payable function, which next course of action is best for communicating the issue?

If the skills and competencies are not present within the internal audit activity to complete an ad-hoc assurance engagement, which of the following is an acceptable resolution?

The chief audit executive (CAE) of a small internal audit activity (IAA) plans to test conformance with the Standards through a quality assurance review. According to the Standards, which of the following are acceptable practice for this review?

1. Use an external service provider.

2. Conduct a self-assessment with independent validation.

3. Arrange for a review by qualified employees outside of the IAA.

4. Arrange for reciprocal peer review with another CAE.

The internal audit activity (IAA) wants to measure its performance related to the quality of audit recommendations. Which of the following client survey questions would best help the IAA meet this objective?

New environmental regulations require the board to certify that the organization's reported pollutant emissions data is accurate. The chief audit executive (CAE) is planning an audit to provide assurance over the organization's compliance with the environmental regulations. Which of the following groups or individuals is most important for the CAE to consult to determine the scope of the audit?

Flowcharts are useful during audit planning because they contain information that may help internal auditors with which of the following?

An internal audit manager is planning a contract compliance audit Which of the following should be done prior to developing the audit work program?

Which of the following statements is true regarding risk assessments, including the evaluation and prioritization of risk and control factors?

An internal auditor wants to assess whether the organization's governing body was involved in strategic decisions for the use of social media. What could provide the most relevant evidence?

The internal audit activity plans to assess the effectiveness of management’s self-assessment activities regarding the risk management process. Which of the following procedures would be most appropriate to accomplish this objective?

An internal auditor is asked to perform an assurance engagement in the organization's newly acquired subsidiary When developing the objectives tor the engagement which ot the following statements describes the most important items that the auditor needs to consider?

In a small internal audit function, a single auditor is responsible for conducting the entire audit engagement. In this situation, what is the benefit of using a checklist as part of an engagement work program?

The chief audit executive of a medium-sized financial institution is evaluating the staffing model of the internal audit activity (IAA). According to IIA guidance, which of the following are the most appropriate strategies to maximize the value of the current IAA resources?

• The annual audit plan should include audits that are consistent with the skills of the IAA.

• Audits of high-risk areas of the organization should be conducted by internal audit staff.

• External resources may be hired to provide subject-matter expertise but should be supervised.

• Auditors should develop their skills by being assigned to complex audits for learning opportunities.

What is the primary reason that audit supervision includes approval of the engagement report?

According to IIA guidance, which of the following statements is true regarding audit workpapers?

An internal auditor performed a review that focused on the organization’s process for vetting vendors. The internal auditor’s testing identified that 120 out of 130 vendors had a business relationship with the organization’s procurement manager that violated conflict-of-interest policies. Which of the following conclusions could the internal auditor draw from these results?

Which of the following is the primary reason a chief audit executive should network with an organization’s executives?

During an audit, the chief audit executive reviews and approves changes to the audit program. Which of the following describes this activity?

When addressing the excessive overtime being paid lo employees in an organization's customer service call center, which of the following would be most relevant for the internal auditor to use?

1 Confirmation.

2. Trend analysis.

3 External benchmarking

4. Internal benchmarking

A technology firm's internal audit function is slated to perform a series of engagements assessing the security of its software development processes. To successfully perform these engagements, which competency should the internal audit function possess?

An internal auditor plans to conduct a walk-through to evaluate the control design of a process. Which of the following techniques is the auditor most likely to use?

According to IIA guidance,which of the following is true about the supervising internal auditor's review notes?

• They are discussed with management prior to finalizing the audit.

• They may be discarded after working papers are amended as appropriate.

• They are created by the auditor to support her fieldwork in case of questions.

• They are not required to support observations issued in the audit report.

Which of the following represents a ratio that measures short-term debt-paying ability?

When determining the level of staff and resources to be dedicated to an assurance engagement, which of the following would be the most relevant to the chief audit executive?

Which of the following factors would be the most critical in determining which engagements should be included in the annual internal audit plan?

An internal auditor finds inconsistencies in a risk area that needs immediate attention. Which of the following actions is most appropriate for the auditor?

Which of the following scenarios is an example of appropriate engagement supervision?

An internal auditor is planning an engagement at a financial institution. Toe engagement objective is to identify whether loans were granted in accordance with the organization's policies. When of the following approaches would provide the auditor with the best information?

During follow-up, the chief audit executive (CAE) is having a discussion with management about the internal audit team's recommendations related to a significant issue Management accepted the issue but took no remedial action What is the next step for the CAE?

An audit client responded to recommendations from a recent consulting engagement. The client indicated that several recommended process improvements would not be implemented. Which of the following actions should the internal audit activity take in response?

Which of the following is not a primary purpose for conducting a walk-through during the initial stages of an assurance engagement?

Which of the following is the most appropriate way to ensure that a newly formed internal audit activity remains free from undue influence by management?

Which of the following offers the best explanation of why the auditor in charge would assign a junior auditor to complete a complex part of the audit engagement?

An internal auditor develops an engagement observation related to an organization's accumulation of large travel advances. The auditor observes that the organization's procedures do not require justification for travel advances greater than a specific amount Which of the following best describes the organization's procedures?

In preparing the engagement work program, which of the following is generally true with respect to secondary controls?

Which of the following is more likely to be present in a highly centralized organization?

Which of the following types of policies best helps promote objectivity in the internal audit activity’s work?

A chief audit executive (CAE) following up on action plans from previously completed audits identifies that management has determined that certain action plans are no longer necessary If the CAE disagrees with management's decision, which of the following is the most appropriate next step for the CAE to take?

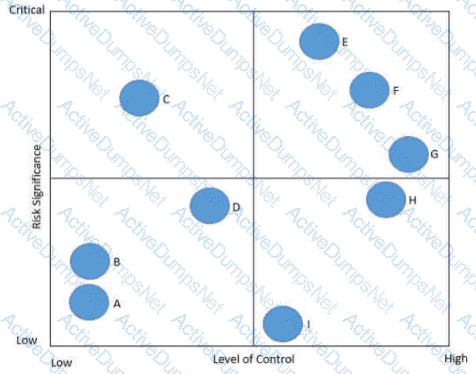

In the following risk control map risks have been categorized based on the level of significance and the associated level of control. Which of the following statements is true regarding Risk C?

Which type of assurance engagement is conducted to determine whether a process or area is performing as intended, accomplishing its objectives, and doing so in an efficient and economical way?

An internal auditor is planning a consuming engagement and the objective is to identify opportunities to improve the efficiency of the organization’s procurement process. The auditor is preparing to conduct a preliminary survey of the area. Which of the following approaches would be most useful to obtain relevant information to support the engagement objective?

Due to emerging new technologies that greatly affect the organization, the chief audit executive (CAE) wants to conduct frequent IT audit and is particularly focused on improving the quality of these engagements. Which of the following is the most viable solution for the CAE to ensure that IT audit quality is immediately enhanced and maintained long-term?

Which of the following is most appropriate for internal auditors to do during the internal audit recommendations monitoring process?