Guidewire ClaimCenter-Business-Analysts ClaimCenter Business Analyst - Mammoth Proctored Exam Exam Practice Test

Total 50 questions

ClaimCenter Business Analyst - Mammoth Proctored Exam Questions and Answers

To help manage new user setup, Succeed Insurance would like all manager-level employees to be able to add new users to ClaimCenter. Some managers are already assigned the Community Admin role, which has a set of permissions for the administration of the ClaimCenter community model that includes the permission to create new users.

Where are two places the Business Analyst (BA) can go to view the permissions assigned to manager-level users? (Choose two.)

Which two actions may the Business Analyst (BA) perform based on the roles and permissions functionality of ClaimCenter? (Choose two.)

Which two best practices should a Business Analyst (BA) follow to be prepared for a Requirements Workshop? (Choose two.)

A car accident in a rural area of Durango, Colorado is reported to Succeed Insurance. The driver of the damaged car reportedly hit the base of a windmill tower while driving at night. There was no other passenger in the car when the accident happened, and the driver has a valid auto policy on file.

While the driver is not physically injured, the entire passenger side of the car has been severely damaged. Although the windmill is still functioning, the base of the tower has sustained multiple broken parts.

Which two incidents need to be created for the claim based on the reported accident? (Choose two.)

Which set of three objects is required to create a liability exposure?

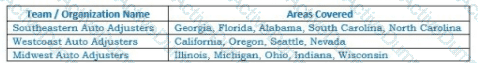

A claim for an auto accident in Tampa, Florida has been reported and recorded in ClaimCenter. The ClaimCenter base product Global Claim Assignment Rule is utilized for automatic assignment to Adjusters regardless of complexity of claims.

What is the likely path of assignment for this claim?

Which two components are necessary to create the check(s) using the wizard? (Choose two.)

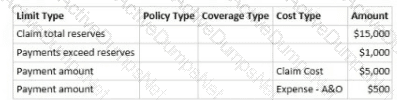

An Adjuster at Succeed Insurance is handling a homeowners claim with a dwelling exposure for damage to the insured's home. The Adjuster's Authority Limit Profile has the following limits:

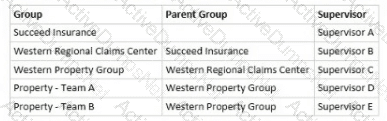

The table below is a view of the property claims organization within Succeed Insurance. The Adjuster is a member of the group Property - Team A.

The Adjuster creates a payment in the amount of $6,500 for repairs to the insured's home. How will it be processed assuming that the claim has sufficient reserves for the payment?

An Adjuster at Succeed Insurance is handling a personal auto claim for an insured who hit a tree after swerving to avoid a child who ran into the road.

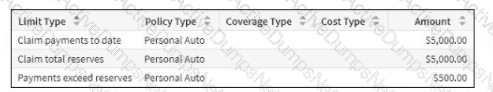

The Adjuster has this Authority Limit Profile:

The Adjuster creates a collision exposure and sets the initial reserves so that payments can be made to the insured for repairs to the damaged vehicle. No payments have been created yet.

The current financials for the claim are as follows:

Which two financial transactions will not require approval given that each option is the only transaction change rather than a cumulative change? (Choose two.)

Succeed Insurance requires that all vehicles involved in collisions be evaluated to determine if the vehicle is a total loss. A vehicle claim is deemed a total loss using a calculation based on points earned for selecting specific vehicle information.

What are two examples of acceptance criteria for this business requirement? (Choose two.)

What are two recommended best practices with user interface (UI) mock-ups in a ClaimCenter implementation project? (Choose two.)

Drivers for Rideshare companies need insurance that provides protection when they are driving the vehicle for personal reasons. This will be the Succeed Insurance standard Personal Auto Policy. However, they also need insurance to protect them from the increased risks associated with working as a Rideshare Driver. This would include when they are logged in to the Rideshare application waiting for a customer match, on their way to pick up a customer, but not when a customer has entered the vehicle.

When a driver is working as a Rideshare Driver, this new Rideshare coverage will protect them from the following types of risks, and there is a need to be able to collect the appropriate information about the losses:

. Injury to a first-party driver

. Damaged personal property of the third-party passengers

Which two exposures need to be configured? (Choose two.)

A Business Analyst (BA) noticed that one of the User Story Card files for the project indicated that it had recently been modified. The BA wanted to see who changed it, what was changed, and why it was changed.

Where on the Story Card can the BA go to determine the changes recently made to it?

When creating a new Personal Auto claim, Succeed Insurance would like to identify when Rideshare is the primary use for a vehicle. A Business Analyst (BA) thinks that Primary Use already exists as a typekey on the Vehicle Details screen.

What are two ways the BA can confirm whether this field is configured in ClaimCenter and, if it is, which values are available in the typelist? (Choose two.)

Succeed Insurance is implementing a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the standard user interface to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to improve efficiency and the expediency of claims processing in its region.

Under which ClaimCenter theme will the User Story Card be found for documenting these requirements?

Total 50 questions