CIMA P3 Risk Management Exam Practice Test

Risk Management Questions and Answers

A UK manufacturing company has simultaneously:

• purchased a put option to sell USD 1million at an exercise price of GBP1.00 = USD1.65

• sold a call option that grants the option holder the right to buy USD 1million at a price of GBP1.00 = USD1.61 (this option has the same maturity date as the put).

Which of the following is a valid explanation for entering into these option positions?

DFG is the largest bridge-building company in its home country, H. DFG works exclusively for the government of country H and the government awards DFG 80% of the contracts to build new bridges.

DFG's directors are considering using the big data approach to identify opportunities to increase sales revenues and profit.

Which of the following statements are true?

HIW manufactures motorcycles and has factories in several countries HIW produces several different types of motorcycle, with different models often being tailored to suit the needs of customers in specific countries HIW has identified a positive net present value project to build a new factory in Farland, which will make motorcycles for sale in Farland and for export to neighbouring countries HIW has not previously traded in Fartand or its neighbours Farland is regarded as politically and economically unstable and its currency is highly volatile against other leading currencies

HIWs Board wishes to consider the interests of different stakeholder groups who will be affected by the investment in Farland The Board recognises that there could be conflict between the goals of maximising profit and of maximising shareholder wealth

Which THREE of the following statements are correct?

SDF is a quoted company. Which of the following matters should normally be dealt with by SDF's audit committee?

B uses a balanced scorecard to monitor the performance of its divisions.

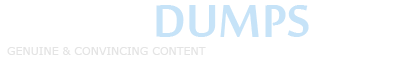

Classify each of the following decisions taken by a division's management team as either commercially sound or dysfunctional.

The managers of a company are agents for the shareholders tasked with increasing shareholders' wealth. Which of the following will usually increase shareholders' wealth?

Why do businesses take risks?

Select the TWO correct answers.

A UK manufacturing company has simultaneously:

• purchased a put option to sell USD 1million at an exercise price of GBP1.00 = USD1.65

• sold a call option that grants the option holder the right to buy USD 1million at a price of GBP1.00 = USD1.61 (this option has the same maturity date as the put).

Which of the following is a valid explanation for entering into these option positions?

TT is a jewellery manufacturer in country A It makes jewellery from precious metals and stones and sells it to shops in country A and also overseas It is the 3rd largest company in country A with a huge turnover

TT has found it very difficult to prevent staff committing fraud and last year the Board was sure that the year end inventory was lower than it should have been Gross profit was also slightly lower than expected

Which TWO of the following internal controls would be most effective in helping to reduce staff fraud within TT?

HJK is a retailer, with more than 40 shops around the country. The directors suspect that a serious fraud has occurred at one of the branches and a team of internal auditors has been sent to investigate.

An analytical review investigation shows that sales revenue is in line with budget, but overtime payments to shop staff exceed budget by 20%.

How should the internal audit team proceed?

D plc is a public relations company. Shares in D plc have recently been listed on the UK stock exchange.

D plc has an internal audit department that reports to the Chief Executive Officer (CEO). The CEO is considering outsourcing internal audit to an audit firm, which would not be the firm that conducts D plc's external audit.

Identify THREE advantages to D plc of outsourcing internal audit in this way.

TDC is a company which runs gas-fired power stations in western Europe. The Risk Committee has just received a report that a power station built to the same design and specification in a developing country has recently collapsed. The causes of the collapse are unclear but the consequences for TDC would be catastrophic if something similar were to happen in Europe

Which of the following actions being considered by the Risk Committee are ethical?

Select ALL that apply

MNB is a multinational IT company with headquarters in Asia and with operations in all continents.

MNB is attempting to expand its operations in Europe. This is seen as a major challenge as the European market is very well developed and highly competitive.

MNB develops and manufactures its own products. Parts and assemblies are sourced across Asia, America and Europe. These are sometimes purchased locally as a condition of a contract, but MNB aims to include as much of its own equipment as possible. Transfer prices between MNB's subsidiaries can be set in YEN, USD, EURO, GBP. Transfer prices are revised every month in line with production times as most goods are made on short order with sales cycles running at 3-4 months.

What types of risk are being presented here?

Which of the following actions would breach CIMA's Code of Ethics for Professional Accountants?

DFG's home currency is the D$.

DFG is heavily exposed to the exchange rate between the D$ and the L$, country L's currency. DFG's treasurer has noted the following:

• Inflation has been running at 5% in DFG's home country and 8% in country L

• Interest rates are 7% in DFG's home country and 11% in country L

• The spot rate is D$1.0000 = L$2.1000 and the three month forward rate is D$1.0 = L$2.1196

Which of the following statements is consistent with these figures?

CH makes a popular type of chocolate bar The bars are made on a production line and are scanned for size and shape as they move along the line Wrong sized and misshapen bars are rejected as being poor quality. The scanner detects 90% of poor quality bars. If CH wants to reduce the risk of poor quality bars being sold to the public it can add a further check by a person scanning the production line as well. this check would detect 80% of poor quality bars

If the further check was implemented what percentage of poor quality bars would still get through the checking process?

R plc is considering an investment of $1,100,000 in a new machine which is expected to have substantial cash inflows over the next five years.

The annual cash flows from this investment and their probability are shown below:

Annual cash flow ($) Probability

200,000 0.4

280,000 0.5

350,000 0.1

At the end of its five-year life, the asset is expected to sell for $100,000. The cost of capital is 5%.

What is the Expected Net Present Value?

Give your answer to the nearest whole $.

You have just been employed as a management accountant in a small business with an annual turnover of $0.5 million.

You have a wide range of duties because the business is small.

Which of the following is an ethical risk?

H has a floating rate loan that it wishes to replace with a fixed rate. The cost of the existing loan is LIBOR + 4%. H would have to pay a fixed rate of 8% on a fixed rate loan. H's bank has found a potential counterparty for a swap arrangement.

The counterparty wishes to raise a variable rate loan. It would pay LIBOR + 1% on a variable rate loan and 9% on a fixed rate.

The bank will require 10% of the savings from the swap and H and the counterparty will share the remaining saving equally.

Calculate H's effective rate of interest from this swap arrangement.

A publicly funded hospital has put various features in place in an attempt to improve strategic control and create an improved control environment.

Which TWO of the following features are most likely to meet this objective?

Company A's gross profit percentage has fallen from 70% to 61 % Which of the following possible explanations would most concern the internal auditors?

P Ltd, a service company, is seeking to recruit engineers to work in its maintenance division. Which TWO of the following suggestions will be most likely to help prevent fraud when recruiting the engineers?

Which THREE of the following form part of the role of Internal Audit?

M, a manufacturing company, has had some problems with defects in one of the main products it produces. This product has been made by the company for many years and is very profitable. Last month it had over 300 defects reported by customers which is more than 15% of products sold. This is a reputation risk for M and is also affecting profitability.

Which of the following controls could M introduce to reduce defects and also increase profitability?

A Firewall is an element of a company's Information Technology infrastructure.

Which THREE of the following are characteristics of a Firewall?

UIO sells mobile phones through a cham of 100 shops spread across the country Shop managers have considerable discretion over pncmg and the incentives offered to sales staff Shop managers are evaluated on the monthly contribution from completed sales. Those who exceed targets by more than 10% for three successive months are promoted Those who fail to achieve monthly targets in two successive months lose their jobs

Which of the following statements are true of the performance management of UIO's shop managers?

Select ALL that apply.

Internal audit should be both efficient and effective.

Which THREE of the following measure the efficiency of internal audit"?

B, a construction company, has a policy of carrying out a post completion audit on every construction project undertaken where the value exceeds $1 million.

What is the role of the post completion audit?

S Doc is an out-of-hours service provided by a country's government. The service allows members of the public to call and speak to a nurse who can advise on medical situations which are not obviously emergencies. Depending on the situation the caller can be referred to the full emergency services, or be advised to go to Accident and Emergency at the nearest hospital. Alternatively, a callout from a general practitioner (GP) can be organised; the caller can be advised of where GP services are available; advice can be given over the phone; or a decision can be taken that no further action is required at least until normal services resume on the next working day.

There has been a suggestion that the nurses who take these calls could be replaced by suitably trained operatives who have available to them a specially designed expert system.

Which of the following are advantages of using an expert system instead of nurses?

RFD, a listed company, is considering making an investment in a risky new venture. RFD has a substantial cash surplus that will be used to acquire the necessary resources. It is unlikely that RFD would have been able to raise finance for this investment because the company is already highly geared.

Which of the following statements about stakeholders' conflicting interests are true?

The safety guard on a piece of equipment was broken. The factory manager suspended an operator who refused to operate the equipment until it was repaired. The factory manager paid another operator a bonus for operating the damaged equipment until the safety guard could be repaired.

What does this incident say about the control environment within that factory?

P Ltd, a manufacturing company, is considering a new capital investment project to set up a new production line. The initial appraisal shows a healthy net present value of $6,465 million at a discount rate of 10% as shown in the table below:

However, management is unsure about the demand for the product which will be produced and has insisted that the future revenues should be reduced to certainity equivalents by taking 70%, 65% and 60% of the years 1,2, and 3 cash inflows respectively.

What should P do?

A large, publicly funded university is considering introducing a new information system in order to enhance its ability to store and retrieve academic records for past and current students, including the registration and deregistration of students.

In conducting an evaluation of the system, which THREE features would the management of the college be most likely to consider as essential prerequisites to implementation?

R is a manufacturer of biscuits. The market for biscuits is extremely competitive with many companies competing for contracts with large supermarkets. The intensity of the competition means that prices are kept low; and the buyers can demand higher levels of quality, and greater flexibility in supply arrangements.

Which of the following represent ways that the use of an Information System could help R to win and retain supermarket contracts in such a competitive market?

YGH has recently completed a post completion audit on a five year contract that has only recently come to a conclusion. The main finding was that the project delivered most of the expected benefits, but that it cost significantly more to implement than had been anticipated at the project appraisal stage. YGH would not have proceeded if the true cost had been known at that stage.

The project was the responsibility of the production department, which is presently managed by G.

When the project was proposed, the production department was managed by H. H is now YGH's Director of Operations.

How should the finding from this post completion audit be interpreted?

You have been assigned the role of lead internal auditor. Your task is to carry out the annual assessment of the production line maintenance department.

When planning for this audit, which of the following must be completed?

K Ltd is an on-line travel agency specialising in budget package holidays to a small number of popular locations. The holidays that it sells are made up of a "package" of flights, hotel accommodation and food. K Ltd's Finance Director is concerned that the company's scope of operation is too narrow and wishes to diversify.

Identify TWO actions that K Ltd should take immediately.

THG is a quoted company that manufactures expensive clothes that are sold to upmarket department stores THG's Board has commissioned a stress test to identify the impact of strategic risks The consultant who is conducting the test is currently investigating the impact that a 1 % increase in interest rates would have on THG.

Which TWO of the following are valid reasons for including an increase in interest rates in the stress test?

GHJ is a manufacturing company that insures against the financial costs associated with industrial injuries involving staff. The Health and Safety Office is part of GHJ's Operations Department. GHJ's insurers will automatically increase the insurance premium by 10% in the event of a claim against the policy.

Which TWO of the following are correct?

An electricity company owns and operates a nuclear power station located ten miles from a large city. A recent and very extensive engineering examination of the power station concludes with the estimate that the probability of a major nuclear disaster within the next 20 years is 0.2%.

Which of the following best explains the relevance of quantifying the risk in that way?

H is a senior production manager for P Ltd which is about to make a strategic decision on setting up a new production line requiring $3 million of new specialist equipment.

H's daughter is friends with and goes to school with the daughter of T, the sales manager in KK Ltd. KK Ltd is a potential supplier of the specialist equipment that P Ltd requires.

T owns a holiday home. H's daughter regularly accompanies T's daughter on family vacations at this holiday home, all at T's expense.

H is the only person working for P Ltd who is qualified to select the specialist equipment. KK Ltd will definitely bid for the sale.

What should H do?

C Ltd is a private, family-owned company which is hoping to become listed on a recognised Stock Exchange within the next two years. At the moment, the Board of Directors comprises five directors; four of whom are from the founding family and all of whom are involved in the day-to-day running of the business. The remaining director obtained a seat on the Board three years ago as a condition of an investment by a venture capital fund.

The Board meets in half-day sessions once a fortnight and the Board meetings are reasonably well run. All decisions are taken by the Board as a whole. There are no sub-committees.

Which of the following steps would it be appropriate for C Ltd to take in the light of the proposed listing?

University B has several departments. Each department at times obtains funding from different sources such as government grants and industry sponsorships. The central management of the university has decided to develop a module within its current Information System to track these funds centrally.

The central management of the University has decided to utilise in-house expertise in order to build this module.

Which THREE of the following represent advantages of developing this module and doing so using in-house expertise?

VBN's home currency is the V$. On 1 January, VBN must make a payment of C$2 million on 31 March of that same year.

On 1 January the spot exchange rate was V$1 = C$0.4.

On 1 January VBN paid $180,000 for a call option to buy C$2 million for V$5.5 million on 31 March. VBN's cost of borrowing was 8% per year.

On 31 March the spot rate was V$1 = C$0.45.

What was the total cost, including the cost of the option, of settling the payable?

JKL makes large export sales to customers in country X, whose currency fluctuates significantly against JKL's home currency JKL also makes large purchases from suppliers in countrrOC All of these transactions are in country X's currency

JKL's treasurer does not actively hedge currency risks because there is a natural hedge in place due to the company making both sales and purchases in the same currency

JKL's board has instructed the treasurer to put active hedging measures in place because the risk report would otherwise have to disclose the fact that JKL has a currency risk which is not actively hedged

Which of the following statements are correct? Select ALL that apply.

R plc is considering an investment of $1,100,000 in a new machine which is expected to have substantial cash inflows over the next five years.

The annual cash flows from this investment and their probability are shown below:

Annual cash flow ($) Probability

200,000 0.4

280,000 0.5

350,000 0.1

At the end of its five-year life, the asset is expected to sell for $100,000. The cost of capital is 5%.

What is the Expected Net Present Value?

Give your answer to the nearest whole $.

Which of the following statements concerning the role of a non-executive director (NED) is correct?

IOP manufactures aircraft engines. The company is presently engaged in a scenario planning exercise to consider the implications of a possible ban on the use of fossil fuels by the year 2040.

Which TWO of the following would be realistic responses to the scenario?

Which of the following scenarios might be relevant stress tests for a potential lender to conduct? Which TWO of the following answers are correct?

Laura is an accounts clerk. She is supposed to sign each invoice as evidence that she has conducted checks against supporting documents. Sometimes Laura signs invoices without making these checks.

Terry is a member of the internal audit team. Terry has been told to conduct compliance tests on whether Laura is checking the invoices properly.

Which of the following would give Terry a false sense of assurance that Laura's checks have been operating?