CIMA P1 Management Accounting Exam Practice Test

Management Accounting Questions and Answers

A company is preparing its annual budget and is estimating the number of units of Product A that it will sell in each quarter of year 2. Past experience has shown that the trend for sales of the product is represented by the following relationship:

y = a + bx where

y = number of sales units in the quarter a = 10,000 units b = 3,000 units x = the quarter number where 1 = quarter 1 of year 1

Actual sales of Product A in Year 1 were affected by seasonal variations and were as follows:

Quarter 1:14,000 units Quarter2: 18,000 units Quarter 3: 18,000 units Quarter 4: 20,000 units

Calculate the expected sales of Product A (in units) for each quarter of year 2, after adjusting for seasonal variations using the additive model.

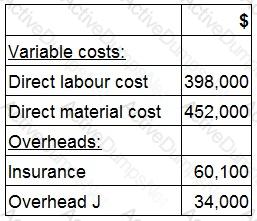

A company's product range includes Product N. The costs relating to Product N are shown below:

The direct labour costs relate to specialists employed to work wholly and exclusively with Product N.

If the company stopped making Product N, the insurance overhead cost would cease, but overhead cost J would be unaffected. Both overheads are absorbed in direct proportion to material costs.

Which of the following costs should be used in the decision whether to stop making Product N?

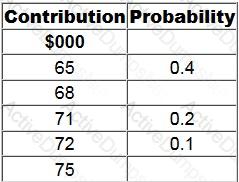

A project has five possible outcomes as follows:

The probability of a contribution of $68,000 is equal to the probability of a contribution of $75,000. Fixed costs are $70,000.

What is the probability of the project making a profit?

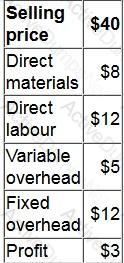

A company is considering whether to launch a new product. The selling price and costs for each unit of the product are shown in table below:

The fixed overhead cost is based on expected production of 2,000 units.

The company will only launch the product if it is expected to be profitable.

To which of the following is the decision to launch the product most sensitive?

MDS is facing a temporary shortage of Material H which is used to produce all three of its products.

In order to maximise its profitability, which product should be manufactured first?

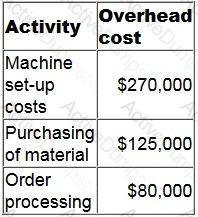

PQR has recently introduced an activity-based costing system.

It manufactures three products, details of which are given below.

The budgeted production overhead costs for the year are shown in table below:

What is budgeted machine set-up cost per unit of Product J?

Give your answer to the nearest cent.

A company's product has the following standard selling price, variable costs and contribution:

Budgeted sales and production was 20,000 units and actual was 19,500 units.

Due to a market downturn the production and sales budget should have been 10% lower.

What is the operational sales volume contribution variance?

A manufacturing company produces and sells a single product.

It is preparing its budget for the next period and expects to breakeven.

Budgeted fixed costs are the same as budgeted variable costs and the budgeted contribution to sales ratio is 50%.

If all budgeted costs decreased by 10%, which of the following statements is true?

A company makes two products, product X with a contribution per unit of $10 and product Y with a contribution per unit of $4.

These products are sold in the mix 3:2 by volume and fixed costs are $38,000 per period.

The breakeven point for product Y, based on the expected sales mix is:

Budgeted sales and production for Product X for this period are 12,000 units.

The standard cost and selling price for a single unit of the product are:

The fixed production overhead expenditure variance is:

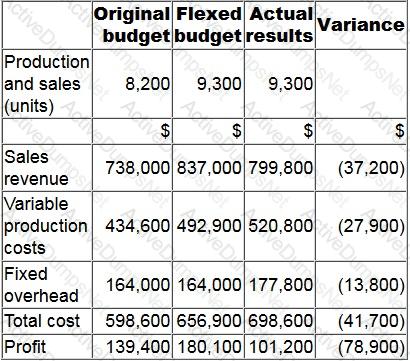

The budgetary control report of XYZ for the latest period is shown below. Variances in brackets are adverse.

What is the sales volume profit variance?

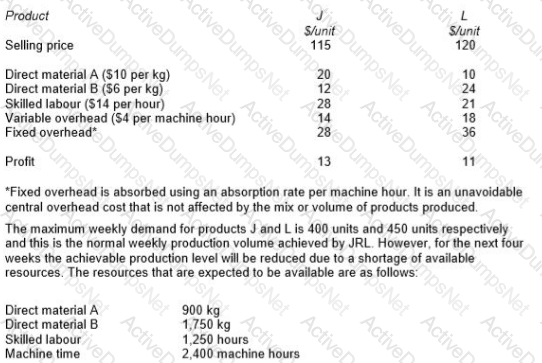

JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

Identify, using graphical linear programming, the weekly production schedule for products J and L that will maximize the profits of JRL during the next four weeks.

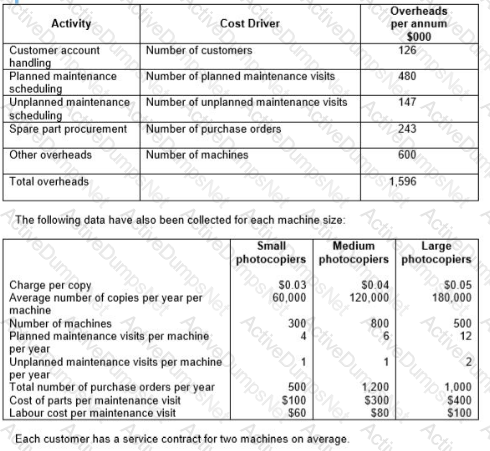

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company’s existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department’s support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company’s accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.

5c0e02ae-e691-41dd-b436-d41e2edaf83f: A company is using relevant costing to evaluate a make or buy decision.

The company already has a machine on an operating lease which can be used to make the product.

How would the lease rental cost be classified?

LM operates a parcel delivery service. Last year its employees delivered 15,120 parcels and travelled 120,960 kilometers. Total costs were $194,400.

LM has estimated that 70% of its total costs are variable with activity and that 60% of these costs vary with the number of parcels and the remainder vary with the distance travelled.

LM is preparing its budget for the forthcoming year using an incremental budgeting approach and has produced the following estimates:

• All costs will be 3% higher than the previous year due to inflation

• Efficiency will remain unchanged

• A total of 18,360 parcels will be delivered and 128,800 kilometers will be travelled.

Calculate the following costs to be included in the forthcoming year’s budget:

(i) the total variable costs related to the number of parcels delivered.

(ii) the total variable costs related to the distance travelled.

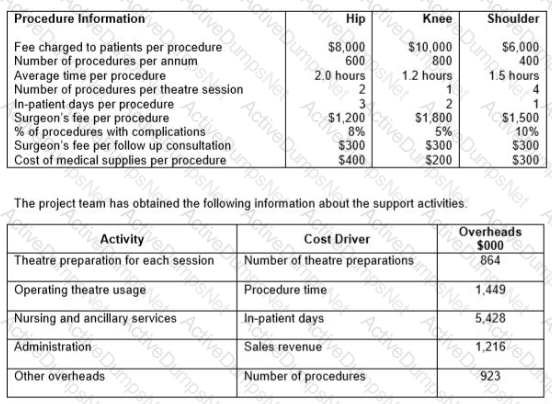

A healthcare company specializes in hip, knee and shoulder replacement operations, known as surgical procedures. As well as providing these surgical procedures the company offers pre operation and post operation in-patient care, in a fully equipped hospital, for those patients who will be undergoing the surgical procedures.

Surgeons are paid a fixed fee for each surgical procedure they perform and an additional amount for any follow-up consultations. Post procedure follow-up consultations are only undertaken if there are any complications in relation to the surgical procedure. There is no additional fee charged to patients for any follow up consultations. All other staff are paid annual salaries.

The company’s existing costing system uses a single overhead rate, based on revenue, to charge the costs of support activities to the procedures. Concern has been raised about the inaccuracy of procedure costs and the company’s accountant has initiated a project to implement an activity-based costing (ABC) system. The project team has collected the following data on each of the procedures.

Calculate the profit per procedure for each of the three procedures using activity-based costing.

What was the profit for the knee procedure, using ABC costing?

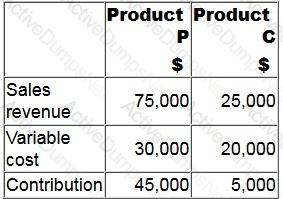

An entity manufactures two products.

The sales revenues of the products are in the constant mix of 3:1. Forecast data for next period are as follows:

The margin of safety for next period is $30,000 of sales revenue. Fixed costs are constant at all levels of output.

What is the forecast profit for next period?

Give your answer to the nearest whole number.

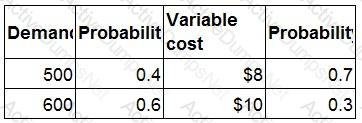

A company is launching a new product with a selling price of $20.

Demand and variable cost are both uncertain and possible demand levels and variable costs are given below:

Outcomes for demand and variable cost are independent.

What is the expected contribution from the product?

Give your answer as a whole number.

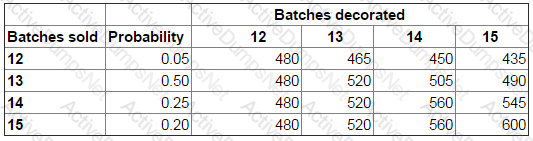

A bakery manager is deciding how many batches of birthday cakes to decorate each day.

Demand for the birthday cakes varies from 12 to 15 batches per day. Each batch decorated and sold earns a contribution of $40 but each batch unsold leads to loss of contribution of $15.

The payoff table below shows the total $ contribution from each of the possibilities:

Based on expected values, the number of batches of birthday cakes the bakery manager should decorate each day is:

The fixed production overhead volume variance is:

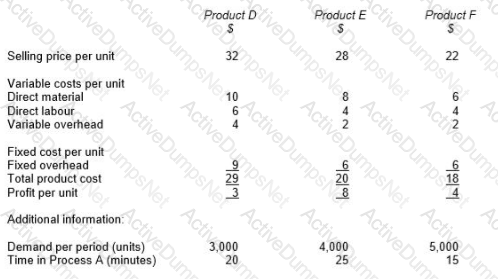

A company produces three products D, E and F. The statement below shows the selling price and product costs per unit for each product, based on a traditional absorption costing system.

Each of the products is produced using Process A which has a maximum capacity of 2,500 hours per period.

If a traditional contribution approach is used, the ranking of products, in order of priority, for the profit maximizing product mix will be:

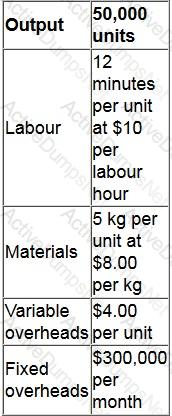

A company's budgeted data for the period are shown in the table below.

There is a stepped increase in fixed overheads of $10,000 when production exceeds 52,000 units.

Actual production for the period was 60,000 units.

What is the flexed budgeted cost for the period?

Give your answer as a whole number (in '000s).

CDF is a manufacturing company within the DF group. CDF has been asked to provide a quotation for a contract for a new customer and is aware that this could lead to further orders. As a consequence, CDF will produce the quotation by using relevant costing instead of its usual method of full cost plus pricing. The following information has been obtained in relation to the contract: Material D 40 tons of material D would be required. This material is in regular use by CDF and has a current purchase price of $38 per ton. Currently, there are 5 tons in inventory which cost $35 per ton. The resale value of the material in inventory is $24 per ton.

Components 4,000 components would be required. These could be bought externally for $15 each or alternatively they could be supplied by RDF, another company within the DF manufacturing group. The variable cost of the component if it were manufactured by RDF would be $8 per unit, and RDF adds 30% to its variable cost to contribute to its fixed costs plus a further 20% to this total cost in order to set its internal transfer price. RDF has sufficient capacity to produce 2,500 components without affecting its ability to satisfy its own external customers. However, in order to make the extra 1,500 components required by CDF, RDF would have to forgo other external sales of $50,000 which have a contribution to sales ratio of 40%.

Labour hours 850 direct labour hours would be required. All direct labour within CDF is paid on an hourly basis with no guaranteed wage agreement. The grade of labour required is currently paid $10 per hour, but department W is already working at 100% capacity. Possible ways of overcoming this problem are: • Use workers in department Z, because it has sufficient capacity. These workers are paid $15 per hour. • Arrange for sub-contract workers to undertake some of the other work that is performed in department W. The sub-contract workers would cost $13 per hour.

Specialist machine The contract would require a specialist machine. The machine could be hired for $15,000 or it could be bought for $50,000. At the end of the contract if the machine were bought, it could be sold for $30,000. Alternatively, it could be modified at a cost of $5,000 and then used on other contracts instead of buying another essential machine that would cost $45,000. The operating costs of the machine are payable by CDF whether it hires or buys the machine. These costs would total $12,000 in respect of the new contract.

Supervisor The contract would be supervised by an existing manager who is paid an annual salary of $50,000 and has sufficient capacity to carry out this supervision. The manager would receive a bonus of $500 for the additional work.

Development time 15 hours of development time at a cost of $3,000 have already been worked in determining the resource requirements of the contract.

Fixed overhead absorption rate CDF uses an absorption rate of $20 per direct labour hour to recover its general fixed overhead costs. This includes $5 per hour for depreciation.

Calculate the relevant cost of the contract to CDF. You must present your answer in a schedule that clearly shows the relevant cost value for each of the items identified above. You should also explain each relevant cost value you have included in your schedule and why any values you have excluded are not relevant.

Ignore taxation and the time value of money.

Select all the true statements.

RST is preparing a quotation, on a relevant cost basis, for a special order.

Which TWO of the following are relevant costs that should be included in the quotation?

For the past year a manufacturing company has recorded the number of units produced (x) each week and the total production cost (y) for that week. The company intends to use this data to predict future costs.

For the circumstance described above, linear regression is more useful and accurate than the high-low method because:

1. It uses all the sets of data observed to calculate the line of best fit.

2. The coefficient of variation can estimate what percentage of x is due to a change in y.

3. Forecasts remain valid for values for x outside of the observed range.

Which of the above statements are true?

The maximum availability of a material is 8,000 kg.

Product A requires 5 kg of this material and Product B requires 7 kg of this material which is in short supply.

The correct constraint to include for the material when formulating the linear programming problem is:

A company manufactures headphones.

70% of production costs are prime costs. Production overhead costs are driven by the number of headphones produced.

Which costing system would be most appropriate for product profitablilty analysis?

A pharmaceutical company manufactures pesticides which contain highly toxic chemicals.

In the context of environmental costing, which of the following would be classified as an external failure cost?

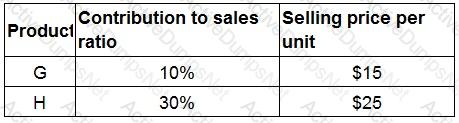

Information about a company's two products is as follows:

The products are currently sold in equal quantities.

Monthly fixed costs are $360,000.

What is the monthly breakeven sales revenue assuming a sales quantity mix of 50/50?

Give your answer to the nearest $.

Which costing method, used in just-in-time (JIT) production systems, attaches cost directly to output rather than following the flow of product through the production process?

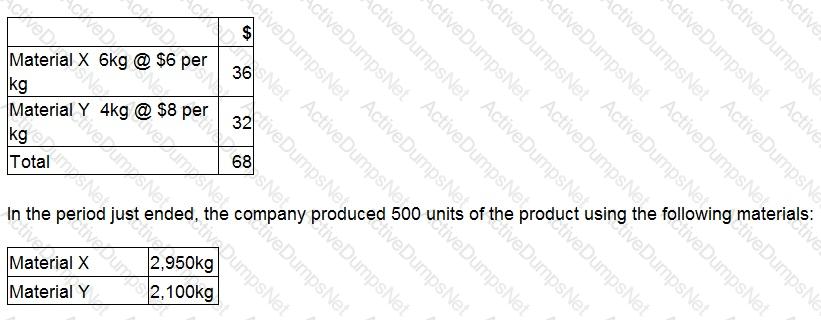

A company makes a product using two materials, X and Y.

The standard materials required for one unit of the product are:

What is the materials yield variance?

Give your answer as a whole number.

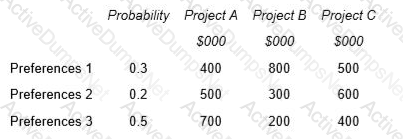

A company has to choose between three mutually exclusive projects. Market research has shown that customers could react to the projects in three different ways depending on their preferences. There is a 30% chance that customers will exhibit preferences 1, a 20% chance they will exhibit preferences 2 and a 50% chance they will exhibit preferences 3. The company uses expected value to make this type of decision.

The net present value of each of the possible outcomes is as follows:

A market research company believes it can provide perfect information about the preferences of customers in this market.

What is the maximum amount that should be paid for the information from the market research company?

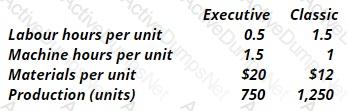

D3 makes 2 types of toilets - the Executive (Ex) and the Classic (CI). Direct labour costs $6 per hr and overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is $28 per machine hour. What is the traditional cost per unit for (Ex) and (CI)?

Christian the management accountant at a car manufacturer has been given a list of costs that have been incurred due to accidents and errors either occurring or being prevented.

Which of the following are examples of non-conformance costs? Select ALL that apply.

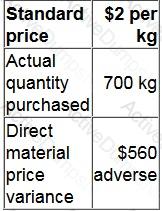

The following information is available about direct material T for the last period.

A JIT purchasing system is in operation.

Calculate the actual price paid per kg of material T.

Give your answer to 2 decimal places.

A company manufactures two products and has two production constraints.

When the graphical approach to linear programming is used, the axes of the graph will show:

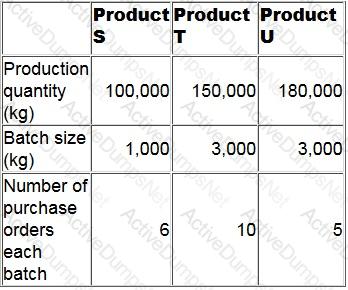

An agricultural company uses activity based costing to charge overheads to its three products. One of the main activities is purchasing, budgeted details of which are as follows:

Additional budgeted data:

What is the budgeted purchasing overhead cost per kg of Product S?

Give your answer to 2 decimal places.

Which THREE of the following would be contained within a master budget?

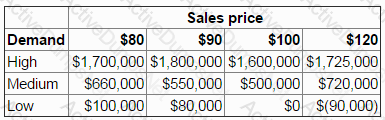

MBM is considering introducing a new product and has to decide if the sales price should be $80, $90, $100 or $120.

There is a 30% chance that demand could be high, a 50% chance that demand will be at a medium level and a 20% chance that demand will be low.

A payoff table below shows the profits based on the sales price and the level of demand.

MBM has decided, using an expected value approach, that the sales price should be set at $80 as this gives the highest expected profit of $860,000.

A market research company has since approached MBM offering to provide perfect information on the demand level.

What is the maximum amount that should be paid for the perfect information?

Give your answer as a whole number (in '000s).