CIMA CS3 Strategic Case Study Exam 2021 Exam Practice Test

Strategic Case Study Exam 2021 Questions and Answers

Hello

I have attached a news article

Arrfield does not set the price for aviation fuel sold at our airports, but we do receive a percentage of the revenues earned by the fuel companies.

I need your help to prepare for a Board meeting to discuss this matter Please write a paper covering the following

* Firstly, explain the impact that the criticisms voiced by the environmental campaigners will have on the frequent PESTEL analysis that Arrfield's Board conducts.

[sub-task (a) = 34%

* Secondly, evaluate the commercial logic of Arrfield's strategy of basing charges for non-aeronautical services (such as fuel sales and retail activities) on percentages of the revenues generated by the companies that operate at its airports

[sub-task (b) = 33%)

* Thirdly, recommend with reasons whether Arrfield should attempt to justify strategic decisions to its shareholders when the commercial logic of those decisions is not immediately obvious

[sub-task (c) = 33%}

Thanks

Romuald Marek

Chief Finance Officer

A month later, you receive the following email:

Reference Material:

From: Hesham El-Sayed. Independent Non-executive

Director

To: Romuald Marek. Chief Finance Officer

Subject: Collapse of fuel supplier

Hi Romuald

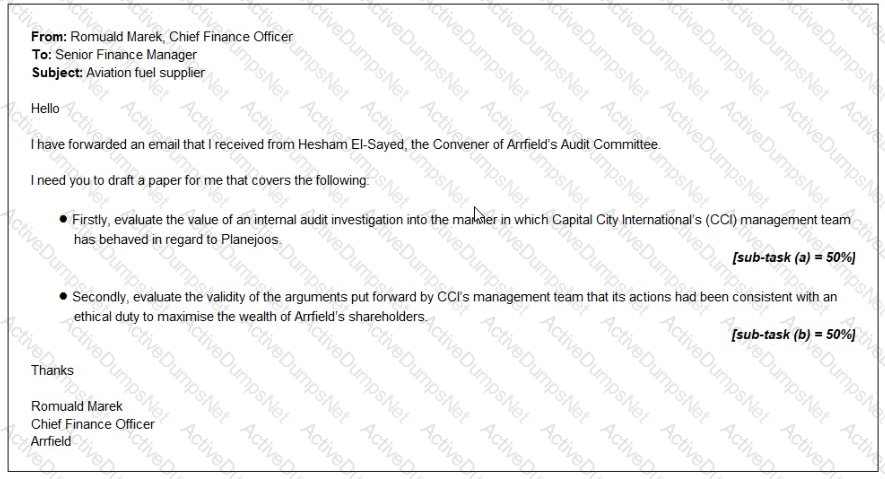

I am writing to give you some advance notice of an internal audit investigation that has been commissioned by the Audit Committee

Just over a year ago. Planejoos, a newly formed company, approached the management team at Airfield's Capital City International (CCI) airport and offered to take over refueling operations at Starport Planejoos offered a higher percentage of revenue than the existing supplier was paying CCI's management team agreed and appointed Planejoos rather than renew the existing supplier's contract.

CCI was unable to conduct the usual background and credit checks on Planejoos for two reasons. Firstly, Planejoos was a new company and so did not have an extensive credit history that could be checked Secondly CCI was under time pressure to reach a decision on whether to renew the existing supplier's contract or allow it to expire

CCI's management team claimed that it had acted quickly in order to benefit from the additional revenue that could be earned from dealing with Planejoos The management team was acting on the basis that it had an ethical duty to maximise the wealth of Airfield's shareholders and that maximising revenues from fuel sales through this agreement with Planejoos was consistent with that ethical duty.

Unfortunately, as a new company. Planejoos struggled to obtain trade credit and the high demand for fuel put the company's cash flows under extreme pressure Receipts from sales lagged behind payments for inventory Planejoos has now collapsed, leaving a large trade receivable that CCI will have to write off as uncollectable CCI had permitted this receivable to accumulate rather

than pressing for payment and so putting Planejoos under further pressure.

Fortunately, the previous fuel supplier was prepared to return to CCI.

Kind regards

The Director of Finance, William Seaton, has stopped you in the corridor:

“Your report was really helpful, but the Board is still considering the implications of that email from Jan Archibald at Fouce Oil. I need to make a more detailed report to the Board and I would like you to draft it for me.

I know that we have owned and operated oil wells in the past, but that has always been with the intention of finding a buyer who is prepared to pay a realistic price. We have chosen never to think about the implications of keeping wells.

I need a report from you that covers the following issues:

The key political risks of retaining our interest in these oil wells, with particular emphasis on high consequence, high

likelihood risks.

A suitable response to each of your political risks.

An overview of how changes in the global economy and the demand for oil could affect the decision to proceed.

The challenges associated with putting together a management team to take charge of the production side of this

proposed new strategy.

I realise that this is a lot to ask of you, but I need you to move quickly because of the interest from our biggest shareholder.”

It is now three days since the start of the oil spillage crisis.

You have received the following email from William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Crisis management issues

Hi,

A quick update on the latest developments.

We have brought Block Associates in to lead the operations on dealing with the oil spill. It has assigned one of its leading consultants to take charge of this for us. We have paid Block Associates an annual retainer for many years, but we have never actually had to call on its services because we have been able to contain any environmental problems using our own resources.

Using Block Associates is going to be expensive. It insists on being free to bring in whatever equipment and personnel are required to resolve matters and to charge that on the basis of cost plus 25%. Our annual retainer is simply the cost of ensuring that it will respond on this basis if required.

We have had some murmurings of discontent already because our own engineers and geologists have made significant progress in identifying the cause of the spillage and they believe that they are capable of bringing it to a successful conclusion. They have suggested that it would be both quicker and cheaper to leave them in charge, while retaining the option to bring in Block Associates at a later date if they fail.

Firstly, what factors should we take into account in deciding whether to leave our own experts in charge of this operation rather than using Block Associates?

Secondly, how should we manage our relationship with Block Associates if we decide that it should be used?

Thirdly, two things: The Board is concerned that Slide’s engineers and geologists have already become disillusioned by the decision to consider calling in Block Associates. We cannot afford to lose their commitment or to see them decide to leave Slide in the longer term. I need you to provide me with some ideas as to how we can motivate them to give their best performance for the duration of this crisis AND to inspire them to remain in Slide’s employment after the crisis has been resolved.

William

Two weeks have passed since the article about Wodd’s role in tax avoidance was published. Thankfully, the initial reaction was to condemn the celebrities who invest in tax avoidance and little was said about Wodd’s role in facilitating tax-efficient investments.

You have received the following email from Sarah Johns, Marketing Director:

From: Sarah Johns, Marketing Director

To: Senior Finance Manager

Subject: Forestry certification

Hi,

I am told that you would be a good person to talk to concerning the practical implications of a new venture that has been proposed.

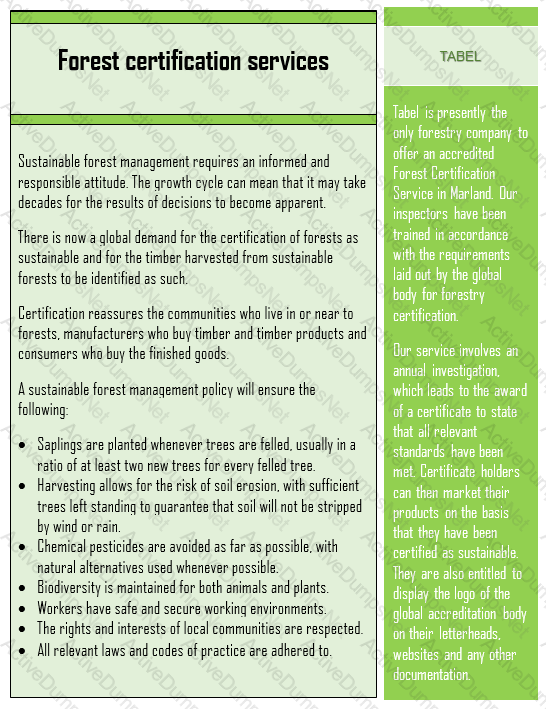

I have attached a sales brochure that I downloaded from Tabel’s website. Tabel is a competing forestry company that has similar interests to our own. It has recently launched the certification scheme that it has described in its brochure. It has no competition for this certification in Marland because no other company has sought the qualifications required to offer an accredited Forest Certification Service.

Wodd has the necessary skills to offer a credible Forest Certification Service. Our forestry managers already aim to exceed all of the requirements set out by the global body. We also have a well-resourced internal audit department. I believe that we could transfer either forestry managers or internal auditors to a new external certification department. The transferred staff would complete the training required by the global body and would sit the associated examinations. We could then compete with Tabel’s service.

I need your advice on the following:

Could you explain how you imagine that a typical certification investigation would work and the skills that it would require? That will help us to decide whether to approach forestry managers or internal auditors and will also enable us to describe the work that they would be doing if they agreed to be transferred.

What are the challenges associated with motivating and evaluating the investigators in the certification service and how might we address these?

Sarah

Reference Material:

You are sitting in your office when you hear Marcus Svenson, the Finance Director, speaking on the telephone. You can hear only Marcus’ side of the conversation:

"Hello, I would like to speak to Sally Walker please. It is Marcus Svenson here. (pause)

Hi Sally, you contacted me six months ago to discuss a job opportunity that you thought I’d be suitable for. I said that I didn’t wish to pursue it at that time because I was committed to Wodd. Things have changed since then and I would like to be considered for a finance directorship in another company. (pause)

Yes, I’m still with Wodd. (pause)

Yes, I realise that there was an unfortunate story in the business press about the problems that the weak USD is causing us, but there was very little that I could do to prevent that. (pause)

I am sorry to hear that. I had hoped to move on." (sound of telephone hanging up and door opening)

Marcus discovers that you are sitting at your desk and realises that you would have heard his side of the call.

"Please don’t tell anybody what you heard. Would you regard it as unethical to respect my privacy?

I suspect that the CEO knows that I am thinking of leaving. He commented on the need for Board members to be loyal to Wodd at the last Board meeting. But don’t you agree that the shareholders can better protect themselves against currency fluctuations than the directors?

The crazy thing is that I suspect that the Chairman will dismiss me next month. If that happens, I get a year’s salary as a severance package. That will really annoy the shareholders. How can I justify accepting the severance package if I am effectively being dismissed for failing to manage Wodd’s finances properly?

I need to explain at the next Board meeting why it would have been difficult to evaluate the risk of the USD weakening. According to an article I read, it has been picked up as a serious problem for us. How would you advise me to explain that?"

Reference Material: