CIMA BA3 Fundamentals of financial accounting Exam Practice Test

Fundamentals of financial accounting Questions and Answers

Which of the following are possible reason for a credit balance on the sales ledger account of a customer?

(a) A contra entry between the sales ledger and the purchase ledger has been carried out for an amount in excess of the sales ledger balance

(b) A customer has returned goods subsequent to making payment for them

(c) A credit note has been issued in error

(d) A bad debt written off has subsequently been paid

Which of the following would result in an increase in the cash balance for the period?

(a) A reduction in inventory

(b) A reduction in receivables

(c) A reduction in payables

(d) A gain on disposal of non-current assets

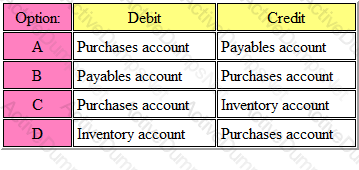

Refer to the Exhibit.

What is the correct ledger entry for purchase of goods on credit?

The answer is:

Which of the following transactions in the current year explains a reason for an increase in the gearing ratio of an entity from 35% last year to 45% this year?

Which of the following would meet the definition of a liability in accordance with the Conceptual Framework's definition?

A company has a debt/equity ratio of 50%. If the company's total equity is $750,000, what is the gearing ratio for the company?

Which one of the following best describes the stewardship function?

Which one of the following would not be considered one of the roles of a Financial Accountant?

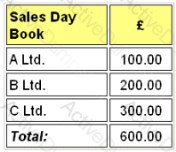

Refer to the Exhibit.

The sales day book for the last month, appeared as follows:

The entries which should be made in the ledger accounts are:

The answer is:

A non-current asset was purchased for £240000 at the beginning of Year 1, with an expected life of 7 years and a residual value of £50000. It was depreciated by 20% per annum using the reducing balance method.

At the beginning of Year 4 it was sold for £100000. The result of this was:

An entity decides to revalue its freehold property during the current period creating a revaluation surplus.

Where in the current period financial statements would the revaluation surplus appear?

External auditors report their findings to:

Which THREE of the below are possible reasons for an entity's capital amount to change?

Which one of the following best describes the purpose of an external audit of financial statements?

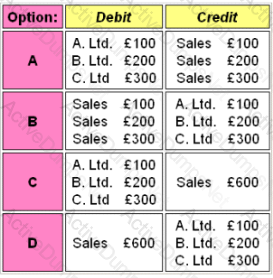

Refer to the Exhibit.

Accounting information is required for a wide range of users both internal and external. Each user has a different need for the information.

Which of the following is the correct combination of user and need?

A company purchases a piece of machinery for $180,000. It is estimated that the machinery will produce 450,000 units over its useful life of 10 years. The residual value at the end of 10 years is nil. After eight years, the machine has produced 340,000 units and is sold for $30,000.

The profit/loss arising on disposal of the asset is

In a cash flow statement, which one of the following would not be found under the section "cash flows from financing activities"?

An asset may best be defined as:

The IASB's Framework for the Preparation and Presentation of Financial Statements identifies four possible measurement bases for use in financial statements

Which of the following are those bases?

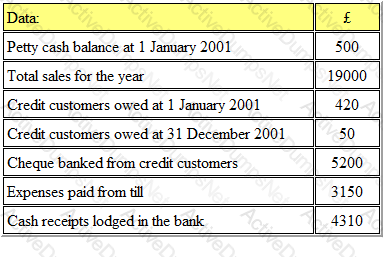

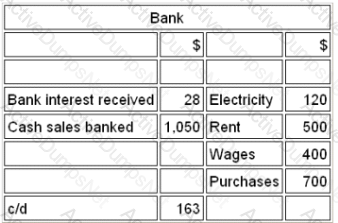

Refer to the exhibit.

The bookkeeper of Joshua Ltd has absconded with the petty cash. The following was available:

How much has the bookkeeper stolen during the year?

At the end of the year, the non-current asset register showed assets with a net book value of £170,300. The non-current asset accounts in the nominal ledger showed a net book value of £150,300.

The difference could be due to a disposed asset not having been removed from the non-current asset register, which had.

A decrease in the allowances for receivables would result in:

Refer to the Exhibit.

A company has the following chart of accounts:

The sales director of the northern region wants to know what the total sales of widgets are for the first quarter of the year.

Which code would he request for his report?

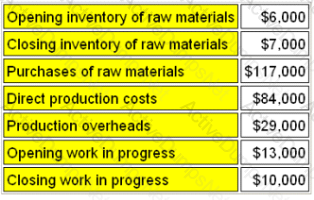

Refer to the Exhibit.

The following information is available for the period for AC Limited, a manufacturing company:

The factory cost of goods completed for the period was

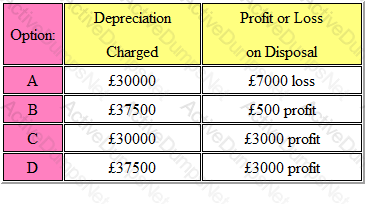

Refer to the Exhibit.

Your organization bought a machine for £50,000 at the beginning of year 1, which had an expected useful life of four years and an expected residual value of £10,000; the machine was depreciated on the straight-line basis.

At the beginning of year 4, the machine was sold for £13,000

The total amount of depreciation charged to the income statement over the life of the machine, and the amount of profit or loss on disposal was:

The answer is:

An accountant is taking on financial accounting responsibilities for company PQ. Which TWO of the following are NOT true of financial accounting?

Which one of the following is an error of original entry?

M Ltd owns property costing $80,000 ($50,000 for the land and $30,000 for the building).

The company's accounting policy is to depreciate buildings at the rate of 5% per annum on the straight-line basis.

After five years, what is the net book value of freehold land and building in the financial accounts of M Ltd?

Which one of the following is an error of commission?

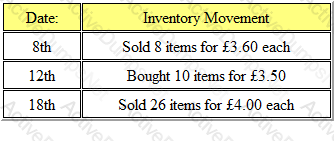

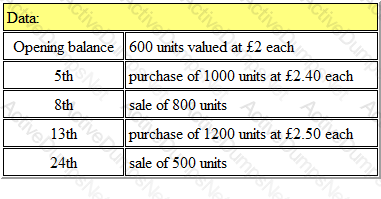

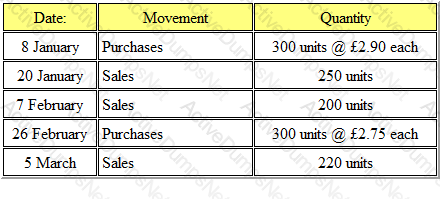

Refer to the Exhibit.

At the beginning of the month, an organization had opening inventory of 30 units of a product, valued at £3.00 each. During the month, it had inventory movements, occurring on the following dates:

Using the FIFO method of inventory valuation, the closing inventory at the end of the month was:

Give your answer to 2 decimal places.

A business needs to reconcile its cash book with the current bank statement on a regular basis

Which THREE of the following items could require an adjusting entry in the cash book?

ABC Limited had a gross profit margin of 55%, while a direct competitor, XYZ Limited, has a gross profit margin of 60%.

Which THREE of the following would be an acceptable explanation for this?

Refer to the Exhibit.

Your organization uses the Weighted Average Cost method of valuing inventory.

During a particular month, the following inventory details were recorded:

The value of the inventory at the end of the month was

Which of the following statements is NOT correct?

Different users have different needs from financial information. One of which is to assess how effectively management is performing and how much profit will be available to be distributed.

Which of the following users will have this need for information?

Which of the following would require an adjustment to be made to the cash book?

(a) Unpresented cheques

(b) Receipts not yet credited by the bank

(c) A dishonoured cheque

(d) Bank charges

The system of double entry book keeping relies upon accuracy of entries

Which of the following combinations represent credit balances?

Which THREE of the following are characteristics of management accounting?

Accounting records should be kept by all businesses for many reasons.

Which THREE of the following are reasons for keeping accounting records?

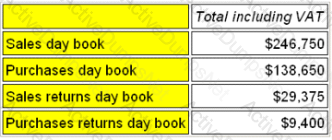

Refer to the Exhibit.

A company that is VAT-registered has the following transactions for the month of March.

All purchases were in respect of goods for resale and all items were subject to VAT at 17.5%.

Opening inventory was $16,200 and closing inventory was $18,400.

The movement on the VAT account for the period was:

On 31 December 20X6 GHI makes a bonus issue of 50,000 shares On this dale the nominal value of the shares is $1 and the market value is $3 GHI has a share premium account with a substantial credit balance. The share capital account is credited correctly in the nominal ledger. Which of the following statements is TRUE?

W and Partners has an opening capital balance at 1 January of £14,640 credit.

During the period there was an increase in assets of £6,820 and an increase in liabilities of £5,400.

The balance on the capital account at the end of the period is:

Which one of the following would not contribute to the prevention and detection of fraud?

A business may have thousands of transactions in any one accounting year. To trace the details of one of those transactions could be very difficult

Which of the following would be a way to make this easier?

Which of the following is the best definition of the objective of accounting?

Which of the following is not a book of prime entry?

A company's payables days has reduced from 60 days to 55 days.

Which of the following could be a possible explanation for this?

Accounting codes have proven to be very useful when recording business transactions.

Which THREE of the following does a coding system help to do?

The Subscriptions Receivable account of a club commenced the year with subscriptions in arrears of £250 and subscriptions in advance of £375.

During the year £62,250 was received in subscriptions, including £200 of the arrears, and £600 for next year's subscriptions. Subscriptions still owing at the end of the year amounted to £180.

The amount to be taken to the Income and Expenditure for the year is

The format of the financial statements and the disclosure notes are prescribed by accounting standards and Company Law.

Which THREE of the following are headings within the statement of financial position?

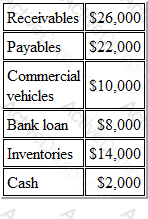

Refer to the exhibit.

Jordan has the following assets and liabilities at 1 January:

What is the capital balance at 1 January?

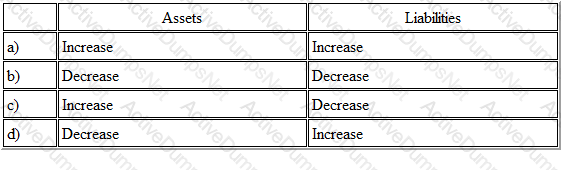

Refer to the Exhibit.

A business writes a cheque using its overdraft balance to purchase new display shelving for its showroom

Which of the following is the dual effect?

Which one of the following is unlikely to be identified by the ratio analysis of a company's financial statements?

Refer to the Exhibit.

A company operates a FIFO system of inventory valuation. Opening inventory at the beginning of the period was 200 units @ £2.80 each. During the period the following movements of inventory were recorded.

The value of the closing inventory at the end of the period and amount charged to the income statement were:

Refer to the Exhibit.

Which of the following would be shown in the trial balance for the bank ledger account?

In internal auditing, detection of fraud is an important objective. The auditors will best be able to detect frauds if they are knowledgeable in the most common methods of fraud.

Which THREE of the following are common methods of fraud?

A business has come to you for advice. There are about to start trading and want to ensure that they keep appropriate accounting records that will grow with their business, save time and produce useful information. They have already established books of prime entry.

Which of the following would you also suggest they use?

The petty cash imprest is restored to £500 at the end of each week. The following amounts are paid out of petty cash during week 23:

(a) Stationery - £70.50 (including VAT at 17.5%)

(b) Travelling costs - £127.50

(c) Office refreshments - £64.50

(d) Sundry payables - £120.00 plus VAT at 17.5%

The amount required to restore the imprest to £500.00 is:

Give your answer to 2 decimal places.