CIMA BA2 Fundamentals of management accounting Exam Practice Test

Fundamentals of management accounting Questions and Answers

C Ltd produces a chemical in a single process. Information for this process last month is as follows:

(a) Opening work in progress - 10000 kg valued at £10000 for direct material and £7500 for conversion costs.

(b) Materials input - 25000 kg at £1.10 per kg.

(c) Conversion costs - £17000

(d) Output during the month - 23000 kg.

(e) There were 7500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(f) Normal loss for the month was 10% of input and all losses have a scrap value of 80p per kg.

What was the average cost per kg of finished output during the month?

Which one of the following is NOT one of the five stated fundamental principles of CIMA's code of ethics?

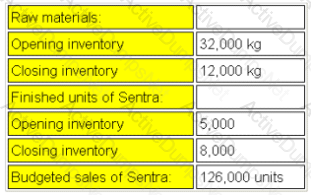

Refer to the exhibit.

The budget for product Sentra for the month of August is given below:

- Each unit of Sentra requires 4kg of raw materials.

- The raw materials purchases budget for the month of August is:

The master budget is:

A company’s cash budgetary plans show that there will be surplus cash for three months of the forthcoming year.

Which THREE of the following would be appropriate management actions in this situation?

In an integrated cost and financial accounting system, the accounting entries for the payment of net wages to indirect production workers would be:

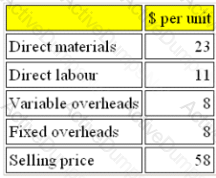

Refer to the exhibit.

SL manufactures a single product, the cost and selling price of which are given below:

Fixed overheads per unit are based on a budgeted production volume of 25,000 units.

Budgeted sales are assumed to be 25,000 units.

If all costs increase by 5% but selling price remains the same, by how much must sales change from the budgeted volume to achieve the same budgeted profit?

CVP Limited manufactures a single product with a selling price of $25.60. Fixed costs are $122,880 per month and the product has a profit/volume ratio of 40%.

In a month when actual sales were $358,400, CVP's margin of safety in units was

An increase in the selling price per unit, will cause the point at which the line plotted on a profit/volume (PV) graph intersects the horizontal axis to:

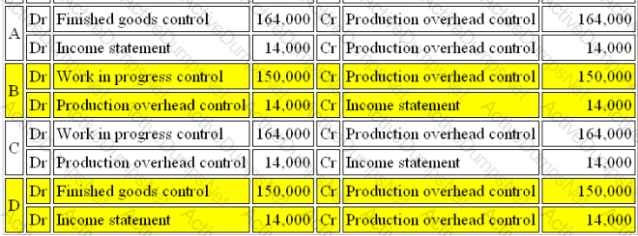

Refer to the exhibit.

WS operates an integrated accounting system. Transactions relating to production overheads for the month of May were as follows:

Indirect Material costs were $15,000

Indirect Labour Costs were $45,000

Production overheads of $58,000 were incurred during the period.

Depreciation of factory machinery amounted to $32,000.

Overheads costs absorbed by production using a standard absorption rate was $164,000 for the period.

What are the correct entries to record the absorption of production overheads for the period?

The correct set of entries to record the absorption of production overheads for the period is:

If the fixed costs are increased, the point at which the line plotted on a profit/volume (PV) graph cuts the horizontal axis will:

The accounting treatment for overheads over absorbed is to:

C Ltd produces a chemical in a single process. Information for this process last month is as follows:

(a) Opening work in progress - 10000 kg valued at £10000 for direct material and £7500 for conversion costs.

(b) Materials input - 25000 kg at £1.10 per kg.

(c) Conversion costs - £17000

(d) Output during the month - 23000 kg.

(e) There were 7500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(f) Normal loss for the month was 10% of input and all losses have a scrap value of 80p per kg.

What was the value of normal loss during the month?

A company uses an integrated accounting system and absorbs production overhead using a predetermined rate of $6 per machine hour.

Last period a total of 25,500 machine hours were worked and the actual production overhead incurred was $158,000.

The accounting entries for the absorption of production overhead for the period would be:

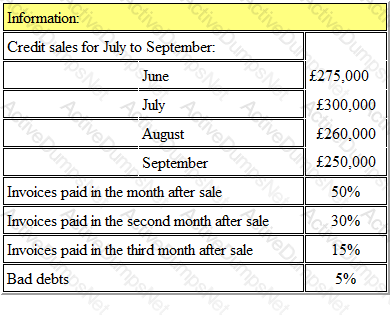

Refer to the Exhibit.

The following details have been extracted from the receivables collection records of SBC:

The amount budgeted to be received in September from credit sales is, to the nearest £000:

The net present value (NPV) of an investment is as follows.

NPV at 14% = $6,320

NPV at 18% = ($4,600) negative

The internal rate of return (IRR) of the investment is closest to

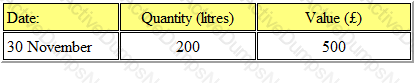

Refer to the Exhibit.

Fabex Ltd manufactures a household detergent called "Clear". The standard data for one of the chemicals used in production (chemical XTC) is as follows:

(a) 50 litres used per 100 litres of 'Clear' produced

(b) Budgeted monthly production is 1000 litres of 'Clear'.

The closing inventory of chemical XTC for November valued at standard price was as follows:

Actual results for the period during December were as follows:

(a) 500 litres of chemical XTC was purchased for £1300.

(b) 550 litres of chemical XTC was used.

(c) 900 litres of 'Clear' was produced.

It is company policy to extract the material price variance at the time of purchase.

What is the total direct material price variance (to the nearest whole number)?

Each unit of product GM requires 4 labour hours to be produced. 25% of the units will be completed during overtime hours.

Sales of 24,000 units are planned and finished goods inventory is budgeted to rise by 2,000 units.

If the wage rate is £6 per hour and the overtime premium is 50%, what is the budgeted labour cost?

An increase in the variable cost per unit, will cause the point at which the line plotted on a profit/volume (PV) graph intersects the horizontal axis to:

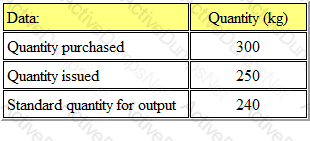

Refer to the exhibit.

Xell Ltd uses a standard costing system and therefore values all inventory at standard cost. During period 3 the price paid for material 'A' was £6 per kg less than the standard price.

The following information for material 'A' relates to period 3:

What was the material price variance for period 3?

A company has spent $5,000 on a report into the viability of using a subcontractor. The report highlighted the following:

A machine purchased six years ago for $30,000 would become surplus to requirements. It has a written-down value of $10,000 but would be resold for $12,000.

A machine operator would be made redundant and would receive a redundancy payment of $40,000.

The administration of the subcontractor arrangement would cost the company $25,000 each year.

Which THREE of the following are relevant for the decision? (Choose three.)

The year-to-date results at the end of month 9 included sales revenue of $3,600,000 and variable costs of $2,100,000.

During month 10, sales revenue was $450,000 and variable costs were $270,000.

What year-to-date contribution to sales ratio (C/S ratio) would be reported at the end of month 10?

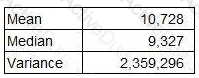

A company wishes to compare the variability of its monthly sales revenue in country A with that of country B. The two countries use different currencies.

The monthly sales revenue for the last 48 months in country A (which is measured in $) has been analysed as follows.

What is the coefficient of variation of this data?

Give your answer as a percentage to one decimal place.

Which of the following is NOT a valid purpose of budgeting?

Which of the following is NOT a characteristic of useful operational level information?

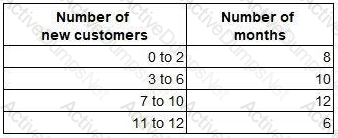

Every month for the last three years, a company has recorded the number of new customers for that month. The data have been summarised and grouped as follows:

What is the arithmetic mean of the number of new customers per month?

Which of the following is a relevant cost?

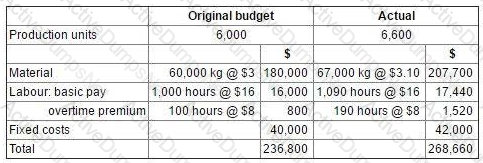

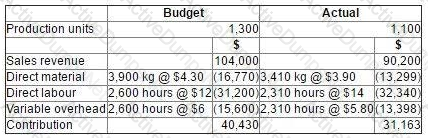

The budget and actual cost statements for the production department for the latest period were as follows.

Notes.

The 10% increase in production was required to meet unexpected additional sales demand.

The production manager is responsible for negotiating the price of materials with suppliers.

The normal working time is 900 hours per period. Any overtime worked above these 900 hours is paid at a premium of 50%.

In preparing the flexible budget for the latest period, which TWO of the following statements are correct? (Choose two.)

Which type of budget would be the most suitable for a cash budget?

Which of the following would NOT require taking into account the time value of money?

The concept of the time value of money:

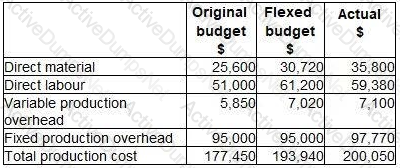

A company uses standard absorption costing. Budgeted and actual data for the latest period are as follows.

What was the production overhead absorption rate per unit?

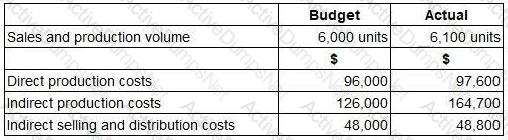

The following is an extract from a budgetary control report for the latest period:

The budget variance for prime cost is:

In order for the information in a management accounting report to be authoritative its contents must be:

A company operates an integrated standard cost accounting system. The standard price of raw material A is $20 per litre. At the start of period 1, the inventory of 500 litres of raw material A was valued at $20 per litre. During period 1, 100 litres of raw material A were purchased at an actual price of $21 per litre. During period 2, 550 litres of raw material A were issued to Job 789.

In respect of the above events, which TWO of the following statements are correct? (Choose two.)

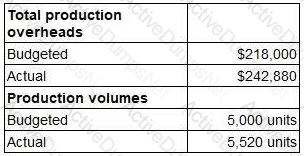

A company uses an integrated accounting system. The following data relate to the latest period.

At the end of the period, the entry in the production overhead control account in respect of under or over absorbed overheads will be:

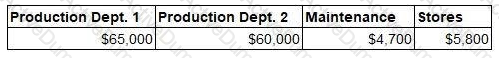

A company has two production departments and two service departments (Maintenance and Stores). The overhead costs of each of the departments are as follows.

The following equations represent the reapportionment of each of the service department overheads to the other.

M = 4,700 + 0.1S

S = 5,800 + 0.2M

Where M = total Maintenance overhead after reapportionment from Stores

S = total Stores overhead after reapportionment from Maintenance

60% of the total Maintenance overhead and 50% of the total Stores overhead are to be apportioned to Production Department 1.

The total production overhead for Production Department 1 after reapportionment of the service departments’ overhead costs is closest to:

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period.

The sales volume contribution variance for the period was:

Which of the following statements regarding variances is valid?

An organisation produces and sells a single product. The organisation’s management accountant has reported the following information for the most recent period.

Which TWO of the following statements are valid? (Choose two.)

Budgets are produced:

(a) For planning purposes

(b) For control purposes

(c) To be published with the annual accounts

(d) To comply with international accounting standards

A service company provides accountancy training courses. Which THREE of the following would be classified as variable costs of the company?

A new range of clothing is very unique and will not appeal everyone. You are aware that if you were to equally distribute all the units there is a chance that they would not all sell.

You decide that the best option would be to select specific stores in which to sell the items, making them rare and desirable. This way they will become highly sought after.

However, whilst this has the potential to be very profitable it also has the lowest probability.

By making this decision you are considered to be_______.

A cash budget is an example of a:

A company achieves a profit/volume ratio of 25%. Sales for the month of July were £127,280 and fixed costs were £24,872.

What was the profit for the month?

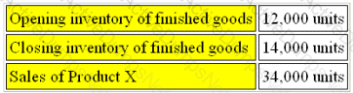

Refer to the exhibit.

Budgeted data for the manufacture of Product X is given below:

Each unit of Product X requires 6 labor hours. It is expected that idle time will account for 5% of labor hours. Products are quality checked and normal rejection rate is 10% of completed units.

The budgeted direct labor hours required for Product X is:

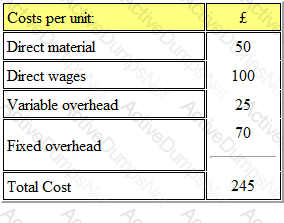

Refer to the exhibit.

A company currently manufactures a component which has the following costs per unit:

If the fixed overhead costs are unavoidable costs, what is the maximum price the company should be willing to pay to buy-in the component?

Give your answer to 2 decimal places.

Which of the following items would not be found in a cash budget?

A company uses an integrated accounting system and absorbs production overhead using a predetermined rate of $6 per machine hour.

Last period a total of 25,500 machine hours were worked and the actual production overhead incurred was $158,000.

The accounting entries for the production overhead under- or over-absorbed for the period would be:

Which ONE of the following would be classified as an internal environmental cost?

Which of the following statements are true of Risk? Select ALL that apply.

Which one of the global principles of management accounting should be tailored to the knowledge of the decision maker?

A flat letting company analyses its costs by individual property. Which of the following costs would be considered an indirect cost of the property?

Which of the following definitions best describes Zero based budgeting?

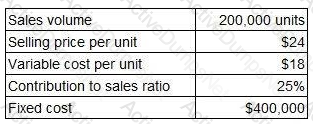

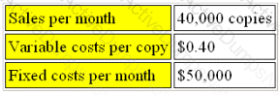

Refer to the exhibit.

ZAP publishes a monthly magazine aimed at the teenage market. It has drawn up a budget for next year as follows:

The magazine is currently sold at $2.00 per copy.

The margin of safety is

A company employs 28 production workers for 40 hours per week. The workers are paid $6 per hour during normal time and an overtime premium of 20%. It is anticipated that the employees will work at 95% efficiency.

Budgeted production for next week is 608 units and each unit requires 2 direct labour hours.

What is the direct labour cost budget for the week?

Fast Manufacturers PLC have reconsidered their new project and the initial investment required of £1,000,000 is now 25% less than the original conception. The project will remain will have a three year life span and

have no scrap value.

However, this new conception has operating costs of £150,000 in year 1, and increasing by 5% due to inflation the following years. The gross revenue will also be higher across the board. The new project conception is

forecasting a gross revenue of £525,000 in year 1 and again increasing with inflation 5% for years 2 and 3.

If the cost of capital has remained at 14%, should Fast Manufacturers PLC go ahead with the revised project?

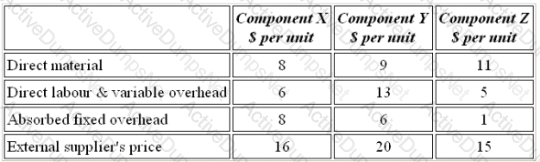

Refer to the exhibit.

A company manufactures three components on the same machine, on which there is spare capacity. An external supplier has offered to supply all of the company's requirements of the components. Data for the components are as follows:

Which components should be purchased from the external supplier?