AHIP AHM-520 Health Plan Finance and Risk Management Exam Practice Test

Health Plan Finance and Risk Management Questions and Answers

The Caribou health plan is a for-profit organization. The financial statements that Caribou prepares include balance sheets, income statements, and cash flow statements. To prepare its cash flow statement, Caribou begins with the net income figure as reported on its income statement and then reconciles this amount to operating cash flows through a series of adjustments. Changes in Caribou's cash flow occur as a result of the health plan's operating activities, investing activities, and financing activities.

Caribou is engaged in an operating activity when it

An actuary for the Noble Health Plan observed that the plan's actual morbidity was lower than its assumed morbidity and that the plan's actual administrative expenses were higher than its assumed administrative expenses. In this situation, Noble's actual underwriting margin was

In order to calculate a simple monthly capitation payment, the Argyle Health Plan used the following information:

- The average number of office visits each member makes in a year is two

- The FFS rate per office visit is $55

- The member copayment is $5 per office visit

- The reimbursement period is one month

Given this information, Argyle would correctly calculate that the per member per month (PMPM) capitation rate should be

With regard to capitation arrangements for hospitals, it can correctly be Back to Top stated that

A health plan that capitates a provider group typically provides or offers to provide stop-loss coverage to that provider group.

One true statement about cash-basis accounting is that

The Kayak Company self funds the health plan for its employees. This plan is an example of a type of self-funded plan known as a general asset plan. The fact that this is a completely self-funded plan indicates that

The following statements indicate the pricing policies of two health plans that operate in a particular market:

- The Accent Health Plan consistently underprices its product

- The Bolton Health Plan uses extremely strict underwriting practices for the small groups to which it markets its plan

From the following answer choices, select the response that correctly indicates the most likely market effects of the pricing policies used by Accent and Bolton.

The following statements are about pure risk and speculative risk—two kinds of risk that both businesses and individuals experience. Select the answer choice containing the correct statement.

The accounting department of the Enterprise health plan adheres to the following policies:

- Policy A—Report gains only after they actually occur

- Policy B—Report losses immediately

- Policy C—Record expenses only when they are certain

- Policy D—Record revenues only when they are certain

Of these Enterprise policies, the ones that are consistent with the accounting principle of conservatism are Policies

Mandated benefit laws are state or federal laws that require health plans to arrange for the financing and delivery of particular benefits. Within a market, the implementation of mandated benefit laws is likely to cause __________.

The following statements are about carve-out programs. Three of these statements are true, and one statement is false. Select the answer choice containing the FALSE statement.

Over time, health plans and their underwriters have gathered increasingly reliable information about the morbidity experience of small groups.

Generally, in comparison to large groups, small groups tend to

The Health Maintenance Organization (HMO) Model Act, developed by the National Association of Insurance Commissioners (NAIC), represents one approach to developing solvency standards. One drawback to this type of solvency regulation is that it

The following statements are about federal laws and regulations which affect health plans that offer products and services to the employer group market. Select the answer choice containing the correct statement.

Rasheed Azari, the risk manager for the Tower health plan, is attempting to work with providers in the organization in order to reduce the providers' exposure related to utilization review. Mr. Azari is considering advising the providers to take the following actions:

- 1-Allow Tower's utilization management decisions to override a physician's independent medical judgment

- 2-Support the development of a system that can quickly render a second opinion in case of disagreement surrounding clinical judgment

- 3-Inform a patient of any issues that are being disputed relative to a physician's recommended treatment plan and Tower's coverage decision

Of these possible actions, the ones that are likely to reduce physicians' exposures related to utilization review include actions

Mandated benefit laws are state or federal laws that require health plans to arrange for the financing and delivery of particular benefits. Ways that mandated benefits have the potential to influence health plans include:

1. Causing a lower degree of uniformity among health plans of competing health plans in a given market

2. Increasing the cost of the benefit plan to the extent that the plan must cover mandated benefits that would not have been included in the plan in the absence of the law or regulation that mandates the benefits

Dr. Jacob Winburne is compensated by the Honor Health Plan under an arrangement in which Honor establishes at the beginning of a financial period a fund from which claims approved for payment are paid. At the end of the given period, any funds remaining are paid out to providers. This information indicates that the arrangement between Dr. Winburne and Honor includes a provider incentive known as a:

Julio Benini is eligible to receive healthcare coverage through a health plan that is under contract to his employer. Mr. Benini is seeking coverage for the following individuals:

- Elena Benini, his wife

- Maria Benini, his 18-year-old unmarried daughter

- Johann Benini, his 80-year-old father who relies on Julio for support and maintenance

The health plan most likely would consider that the definition of a dependent, for purposes of healthcare coverage, applies to:

The Savanna health plan used a risk analysis technique which defines the key assumptions of Savanna's strategic financial plan in terms of mathematical formulas that can be correlated to each other or analyzed independently. This technique allowed Savanna to simulate probable future events on a computer and produce a distribution of possible outcomes. This risk analysis technique, which can be used to predict Savanna's distribution of expected claims, is known as

Cascade Hospital has negotiated with the McBee Health Plan a straight per-diem rate of $1,000 per day for medical admissions. One of McBee’s plan members was admitted to Cascade for 10 days. Total billed charges equaled $10,000, of which $2,000 were for noncovered items. This information indicates that, for this admission, the amount that McBee was obligated to reimburse Cascade was:

The Norton Health Plan used blended rating to develop a premium rate for the Roswell Company, a large employer group. Norton assigned Roswell a credibility factor of 0.7 (or 70%). Norton calculated Roswell’s manual rate to be $200 and its experience claims cost as $180. Norton’s retention charge is $3. This information indicates that Roswell’s blended rate is:

One way that the Medicare and Medicaid programs differ is that under Medicare, a smaller proportion of provider reimbursement goes to the primary care providers and a greater proportion of the reimbursement goes to hospitals and specialists.

The goal of the investment department at the Wayfarer Health Plan is to maximize investment return. The investment department executes investments on time and at a low cost. However, these transactions often result in low returns or risks that are deemed too high for Wayfarer. With regard to effectiveness and efficiency, it is correct to say that Wayfarer’s investment department is:

For a given healthcare product, the Magnolia Health Plan has a premium of $80 PMPM and a unit variable cost of $30 PMPM. Fixed costs for this product are $30,000 per month. Magnolia can correctly calculate the break-even point for this product to be:

A health plan may experience negative working capital whenever healthcare expenses generated by plan members exceed the premium income the health plan receives.

Ways in which a health plan can manage the volatility in claims payments, and therefore reduce the risk of negative working capital, include:

1. Accurately estimating incurred but not reported (IBNR) claims

2. Using capitation contracts for provider reimbursement

The theory of vicarious liability or ostensible agency can expose a health plan to the risk that it could be held liable for the acts of independent contractors. Factors that may give rise to the assumption that an agency relationship exists between a health plan and its independent contractors include:

The Jade Health Plan used a profitability index (PI) to rank the following capital proposals:

Proposal PI

A0.45

B1.05

This information indicates that, of these two projects, Jade would most likely select:

The following statements are about the option for health plan funding known as a self-funded plan. Select the answer choice containing the correct response:

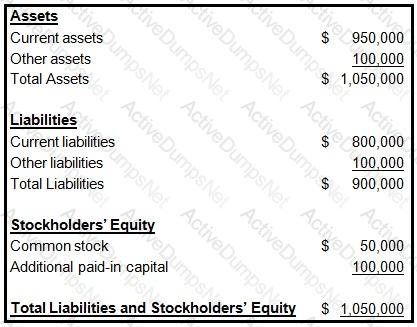

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

The Chamber Health Plan reimburses primary care physicians on a monthly basis by using a simple capitation method. Chamber assumes an annual utilization rate of three visits per year. The FFS rate per office visit is $75, and all plan members are required to make a $10 copayment for each office visit. This information indicates that the capitation rate that Chamber calculates per member per month (PMPM) is equal to:

The Danube Health Plan's planning activities include tactical planning, which is primarily concerned with