AFP CTP Certified Treasury Professional Exam Practice Test

Certified Treasury Professional Questions and Answers

Cash management services commonly used outside the United States include which of the following?

I. Interest-bearing deposit accounts

II. Controlled disbursement systems

III. Pooling of bank accounts

Compared to debt, which of the following statements is true about a company issuing equity?

The ACH system eliminates float because the:

When a subsidiary borrows money, the parent, sister subsidiary, or other entity is often used in order to:

All of the following statements are true about loan participations EXCEPT:

Which of the following is NOT characteristic of commercial paper with a term of less than 270 days?

A manufacturing company selling engines and other mechanical equipment, with invoices averaging $15,000, would use which of the following systems?

A major toy retailer operates 65 retail stores throughout the Midwest. Which of the following credit terms is MOST LIKELY to be offered to this company by its suppliers?

The credit management function is responsible for:

The purpose of cash letters is to:

A convenience store chain would typically use which of the following types of collection systems?

Which of the following investment instruments is a discount instrument?

Which of the following clears international checks?

To increase the money supply, the Federal Reserve would increase which of the following?

An increase in the availability float on a company's collections would cause a reduction in which of the following?

I. Earnings credit

II. Ledger balance

III. Service charges

IV. Collected balance

A cash manager invests in Treasury bills for which of the following reasons?

A company uses a dividend capture strategy to:

Which of the following is responsible for examining national banks?

The time between when the payor mails the check and the payee receives available funds is known as:

A prearranged ACH payment normally includes which of the following?

I. A fixed payment amount

II. A provision for immediate availability

III. A predetermined payment date

Which of the following companies would be MOST LIKELY to use a wholesale lockbox?

Which statement is typically true about cash dividends?

Which of the following instruments is sold at multiple price bid auctions?

The time between the payor's mailing of a check and the payee's receipt of usable funds is known as:

Which of the following are interest-bearing instruments?

I. Certificates of deposit

II. Treasury bills

III. Treasury notes

IV. Banker's acceptances

Which of the following can be used for monitoring accounts receivables?

I. Aging schedule

II. Credit terms

III. Days' sales outstanding

IV. Receivables balance pattern

Which of the following is an example of a company's internal data used for cash management?

The process by which a bank or insurance company guarantees the debt obligation of a borrower is referred to as credit:

Under which of the following circumstances is lengthening the disbursement mail float NOT a benefit to the disbursing company?

Which of the following are primary objectives of cash forecasting?

I. Managing liquidity

II. Optimizing float

III. Enhancing financial control

IV. Minimizing borrowing costs

Which of the following cash concentration transfers is MOST LIKELY to result in a bank ledger overdraft?

A retail chain with 500 locations throughout the United States would use which of the following systems?

Which of the following are basic security issues to be considered in evaluating a treasury management system?

I. Data recovery

II. Anti-virus protection

III. Database access controls

IV. Data integration

Buying a security with the intent of selling it prior to its maturity date to increase the return is an example of:

Which of the following can be considered key responsibilities of daily cash management?

I. Overseeing compensation for bank services

II. Management of short-term borrowing and investing

III. Projecting future cash shortages and surpluses

A currency is said to trade at a discount if it is worth:

A company is looking for a way to finance their inventory. What is the BEST funding match?

A company enters into a cash flow hedge to offset fluctuations in the value of foreign currency transactions occurring in two years. How should the company record the gains and/or losses on the cash flow hedge in the current year?

In an organization with personnel limitations, which of the following strategies should be considered to mitigate cash management system risk?

A national retailer’s cash management system includes a field deposit system using multiple banks. To limit the impact of a failure of one of these banks, a cash manager should:

A large U.S. company is planning to fund its Canadian subsidiary. Currently, the Canadian dollar is trading at CAD 1.25 per U.S. dollar, and the U.S. dollar is expected to depreciate in the near term. To manage this FX exposure, what technique should the company implement?

A U.S.-based electronics company that buys components from one of its foreign subsidiaries at a price above market is likely to:

If the Federal Reserve Board increased the discount rate, you would expect:

A regional physicians’ group is looking for an alternative to liability insurance to help protect against potential future liability claims. Which method would BEST serve its need to protect against catastrophic losses?

Which of the following is a source of short-term financing?

The combination of difference in condition (DIC) insurance and umbrella insurance:

Today’s modern cash management systems would include which of the following?

What does a company with a restrictive current asset investment strategy typically have?

Which of the following payment types is at the greatest risk for fraud?

As an internal control tool, what does the matching of an invoice to the original purchase confirm?

Disbursement float includes which of the following three float time intervals?

A publicly traded company is looking to fund its next project with the issuance of stock. The company’s stock is primarily held by a small group of investors. The company is concerned that issuing stock may upset these investors because it would dilute their holdings. Which of the following strategies would help address the investors’ concern?

Which of the following statements is typically true about a net settlement system?

A company has large, ongoing short-term financing requirements with a maximum horizon of 250 days. It has a good credit rating and would like to use the least expensive source of short-term debt to finance its needs. The Treasurer might recommend which of the following?

Which of the following is a KEY operational advantage of short-term debt?

An airline wants to lock in the price of the jet fuel it needs to purchase to satisfy the peak in-season demand for travel. The airline wants to manage its exposure to fluctuations in fuel prices. What type of exposure is this?

A treasury employee of Company XYZ is privy to financial reporting information yet to be released to the public. He knows that year-end earnings exceed last year’s and would be viewed as positive to the investment community. He casually mentions to a relative that now would be a good time to buy the stock of Company XYZ. Which section of the treasury code of ethics would typically be violated by such a disclosure?

A put option gives the holder the right to:

When evaluating a FSP during the RFP process, a company should place a high value on a FSPs financial strength when the provider:

An internal auditor discovers that employees can enter and approve their own wire transfers. This practice violates what internal control?

Which of the following industries is MOST LIKELY to use a sophisticated cash concentration system with multiple banks as part of its cash management system?

A company determines that no combination of risk control or financing techniques will produce an adequate, risk-adjusted rate of return on manufacturing a new product. It decides to discontinue the product line. This is an example of:

Banks often control information flow, records and assets, therefore it is critical that banks have:

The measurement of the significance of any loss exposure depends on:

A U.S. based multinational company is filing its U.S. tax return and notes that its U.K. subsidiary had pre-tax income equal to $1 million. The U.K. subsidiary paid an effective tax rate on this income of 40%. If the U.S. tax rate is 34%, what will be the amount of the foreign tax credit on the U.S. tax return related to the U.K. income?

When using the Internet to access auction markets, companies may use certificate authorities to reduce their exposure to which of the following types of risk?

As a result of the Sarbanes-Oxley Act, what new entity was established to sanction firms and individuals for audit violations?

A company is interested in lowering its overall banking costs, managing netting, pooling, re-invoicing, and centralizing FX exposure at headquarters. Which of the following options will accomplish this?

One of the PRIMARY ways the Fed addresses systemic risk is by:

Which function involves evaluating alternative projects in relation to one another and in relation to the company's cost structure?

A main characteristic of a company with regional offices using a centralized treasury function is:

One of the KEY risks associated with a company’s use of financial institutions is the possibility that:

Which of the following BEST describes an advantage of a company going public?

Account analysis statements should be examined for which of the following reasons?

I. To verify volumes processed

II. To determine daily cash shortages

III. To verify the accuracy of bank service charges

IV. To ensure that company-initiated transactions have occurred

In which of the following instances does the clientele effect come into play?

Future treasury operations will be affected MOST significantly by consolidation of which of the following?

When a project has an initial cash outflow with cash inflows in subsequent years, what decision model is most applicable to use to evaluate the adequacy of the project?

With respect to the Sarbanes-Oxley Act, a company may avoid additional reporting requirements by:

When a short-term loan is paid with a lump sum payment and the payment includes both interest and principal, the loan is often referred to as a:

In which of the following international cash management methods is title for goods transferred for intercompany sales?

Which of the following would be expected to happen on the ex-dividend date?

Which of the following is NOT a short-term cash forecasting technique?

Which one of the following ties a user’s private key to a user’s public key?

For a defined benefit plan,

What is the PRIMARY issue that management needs to consider when determining capital structure?

A large mature company with limited growth opportunities (positive NPV projects) achieved abnormally high profits this year. After paying mandatory principal, interest, and taxes, the company has $200 million in surplus cash on hand. Assuming its investor base is most concerned with capital appreciation, which of the following is the BEST option for the company?

One reason for using a sale and lease-back arrangement in lease financing is to:

Which of the following is NOT a drawback to using ROI as a performance measure?

In developing an operating budget, the first and MOST critical step is?

XYZ Company is considering selling treasury stock but is concerned about the amount of capital it will raise given the current high volatility of the stock market. What is the BEST strategy a firm can employ to reduce its uncertainty?

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

A put option on a company's stock has an exercise price of $20. On the delivery date, the stock is trading at $24 per share. What should the investor who has paid $2 for the option do?

A French company conducts business strictly within the euro zone (the EMU). Which type of risk is of LEAST concern?

Assume the cost of an ACH transaction is $0.80, the charges for a wire transfer are $30.00, the monthly account maintenance fee is $10.00, and the company earns interest at an annual rate of 1.825% on overnight investments. What is the break-even point where the interest earned on overnight investments offsets the incremental wire costs?

Company XYZ is not sure which direction interest rates are headed. Which of the following would be MOST suitable?

Company A is a large public company with annual revenue of $1.2 billion and high fixed costs. Its stock is listed on the New York Stock Exchange. Company B is a mid-sized company with annual revenue of $100 million and low fixed costs. Its stock is listed on the NASDAQ. Which of the following statements is MOST LIKELY to be true when comparing Company A and Company B?

The Federal Reserve can increase the money supply by:

A company sells products to customers on credit, generating accounts receivable. The company uses the accrual accounting method. Once the company collects good funds from its customers, what is the impact on the financial statements of the company?

Which of the following is subject to translation exposure?

The fixed costs to manufacture widgets are estimated to be $54,000. The benefit (sales) of a widget is estimated to be $6.78 per unit, and the variable costs are estimated at $4.48 per unit. What is the estimated break-even point in units for the manufacture of widgets (rounded to the nearest unit)?

A company is evaluating a project. What is the appropriate discount rate that it should use if its marginal tax rate is 34%, its capital structure is 40% common equity, and 60% debt. Its cost of equity is 10%, and its average cost of debt is 4%?

The accounting requirement that a product’s selling costs be recorded in the same period as the product’s revenue is recorded, regardless of when the cash is paid, is an example of the:

A company with constant earnings and excess cash is considering a significant stock repurchase plan. Which of the following is MOST LIKELY to occur?

A foreign company could raise capital in the United States using an:

What is the MOST appropriate rate used as the discount rate in calculating NPV?

What kind of budget forecasts the cost for investing activities?

Which agency implements monetary policy through purchases and sales of treasury securities?

A real estate development company has excess cash that it would like to invest in one of its properties:

Property A has shown an ROI of 40%, a residual income of $25,675, and an EVA of $32,678.

Property B has shown an ROI of 45%, a residual income of $27,635, and an EVA of $29,523.

Property C has shown an ROI of 55%, a residual income of $22,658, and an EVA of $30,678.

Property D has shown an ROI of 52%, a residual income of $19,675, and an EVA of $31,523.

In which property should the company invest?

Which of the following is NOT one of the three goals of a disbursement system?

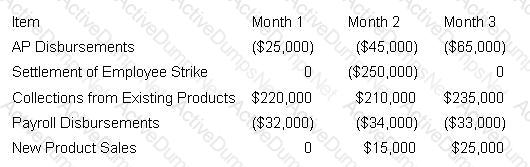

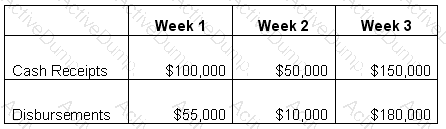

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

A comprehensive payables service can do all of the following EXCEPT:

Company A has operated a Pension Plan since 1985. Despite a recent surge in asset values, the plan remains significantly underfunded. With the passage of the Pension Protection Act of 2006, Company A will be need to:

All of the following are basic considerations for balance compensation by a company EXCEPT:

A treasurer’s role in budgeting is primarily to do which of the following?

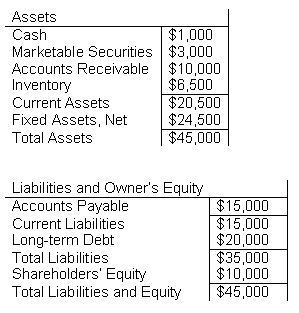

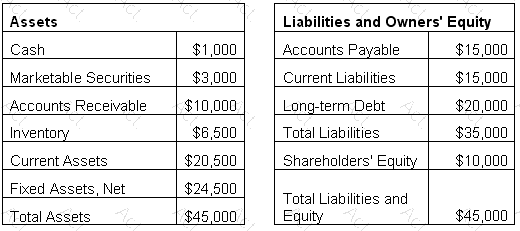

The following information about a company is at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%. The company's current ratio is:

If a company’s pension plan offered its executives the right to contribute a greater percentage of their salary to the plan than the percentage offered to other employees, it would be at risk of violating the ERISA nondiscrimination rule related to what?

Included in the CAMELS rating system for financial institutions are all of the following EXCEPT:

Which of the following statements are true about the use of different discount rates for different types of projects?

I. Low-risk, short-term projects may be evaluated by using a short-term opportunity cost.

II. High-risk projects may be evaluated by using a discount rate that is greater than the company's normal opportunity cost.

III. A short-term investment (or borrowing) rate may be used as the company's short-term discount rate.

IV. The use of a lower discount rate for riskier projects forces riskier projects to earn higher rates of return.

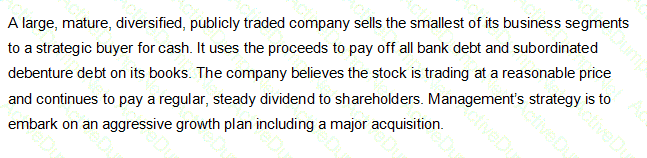

Based on the above information, before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

Advantages of writing checks locally on a centralized disbursing bank include all of the following EXCEPT which statement?

Check MICR line information includes which of the following?

I. Bank of deposit identification number

II. Payee bank identification number

III. Federal Reserve bank code

IV. Payor's account number

A company can dispute any check alterations within how many days after the bank statement has been sent?

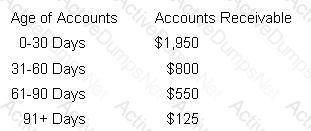

A company has average monthly sales of $2,700, of which 5 percent is on a cash basis, with the remaining sold on open account. The company's accounts receivable aging schedule at the end of March is as follows:

What is the company's DSO?

Which agency appoints the chairman and members of the Public Company Accounting Oversight Board?

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

The amount of the discount required to renegotiate credit terms in EDI depends on which two of the following?

I. Present value impact of the timing change

II. Credit risks involved

III. Revolving credit agreements

IV. Transaction costs savings

Which two of the following are optimal uses for short-term excess cash?

I. Pay down credit lines.

II. Make overnight investments.

III. Repurchase stock.

IV. Make capital expenditures.

T-bill discount rate = 5.85%

T-bill face value = $100,000

Initial term = 90 days

What is the bond equivalent yield on this T-bill?

T-bill discount rate = 5.85%

T-bill face value = $100,000

Initial term = 90 days

If the U.S. Treasury was considering issuing a 91-day T-bill at the same time as this T-bill, what discount rate would cause both instruments to have the same purchase price?

According to the Capital Asset Pricing Model, which of the following would increase the required rate of return, given a beta of 1?

A company has $75 million in adjustable-rate debt, $25 million in fixed-rate debt, and $50 million in accounts receivable. If the company is concerned that interest rates will rise, which of the following would be the BEST interest rate derivative?

A commercial paper issuer who repays investors earlier in the day than it receives funds from new investors often creates which of the following?

All of the following staff would be involved in the evaluation of an outsourced accounts payable solution EXCEPT:

Which of the following are examples of covenants in loan agreements?

I. Financial ratios

II. Corporate resolutions

III. Borrower limitations

IV. Borrower obligations

A bank's reserve requirement on demand deposits is 10%, and its earnings credit rate is 6%. If a company uses bank services amounting to $2,600 and has an excess of $550 in earnings credit, what is the average collected balance in the account based on a 30-day month?

Which of the following is normally MORE significant for a corporation?

All of the following would encourage a company operating nationwide to develop multiple banking relationships EXCEPT:

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

The before-tax cost of long-term debt is 10% and the cost of equity is 12%.

The marginal tax rate is 35%. The company's weighted average cost of capital is:

A telecommunications company has decided to sell its call center hosting division. This is an example of what type of financial decision?

An auto manufacturer experienced a decline in sales, an increase in inventory, and an increase in labor costs over the past two months. With all else being equal, what is the MOST LIKELY impact to the company's balance sheet?

Which method of financing would a company use to establish a wholly owned subsidiary to perform credit operations and obtain accounts receivable financing for the sale of products?

Which of the following is an example of using cash forecasting for liquidity management?

A trader of ABC Bank executed and audited his own trades. Assigning these two functions to the same person introduced which one of the following risks to the bank?

ABC Company offers trade terms of 2/10 NET 30. For several reasons, ABC has decided to eliminate the requirement for a letter of credit from one of its customers. If ABC puts the customer on open book credit, what is the MOST LIKELY outcome?

Contingency plans often focus on the business supply chain, ensuring that customer service is maintained. The financial supply chain, which is equally critical to the plan, should address:

If the spot foreign exchange rate and the forward foreign exchange rate are the same between two countries, which of the following is implied?

An olive oil producer in Macedonia is arranging for shipment of its product to an international distributor. To support this activity, the company arranges for export financing because:

Financial ratios may provide an inaccurate forecast of a company's performance because they are:

Multi-divisional or multi-subsidiary companies have opportunities to optimize their working capital position and overall liquidity by doing which of the following?

What type of tax does a multinational auto manufacturer commonly pay in foreign countries at each stage of a vehicle’s production?

A manufacturing company has no liquidity and needs to purchase additional inventory in 60 days. Which of the following would have helped the company plan for this situation?

Evaluating the liquidity needs of an organization is a function of:

Which of the following is NOT a component of the operating cycle?

ABC company has a significant number of customers who are mainly consumers making monthly installment payments. Which one of the following types of lockbox would be the MOST appropriate for ABC to use?

Companies in the U.S. with a nationwide over-the-counter/field bank collection and concentration system often deal with:

Compared to a letter of credit, a documentary collection is:

A lockbox provider offers which of the following advantages over a company processing center?

I. It increases the company's operational control.

II. It produces processing economies of scale.

III. It allows for external audit controls.

IV. It reduces collection float.

Which section of the statement of cash flows includes items that represent the cash inflows and outflows related to the daily functions of a company?

A company is considering issuing debt in a market environment in which there is a larger than normal spread between high- and low-risk investments. Among several factors, what are the concerns regarding investor behavior that the treasurer will MOST need to consider?

Financial statement preparation guidelines are provided by:

To acquire an asset without putting debt on the balance sheet, a company should consider which of the following arrangements?

What is the MOST appropriate definition of working capital?

In predicting collections from credit sales, a cash manager can obtain prior period information from which of the following sources?

I. Customer payment histories

II. The company's concentration bank

III. The accounts receivable department

IV. The accounts payable department

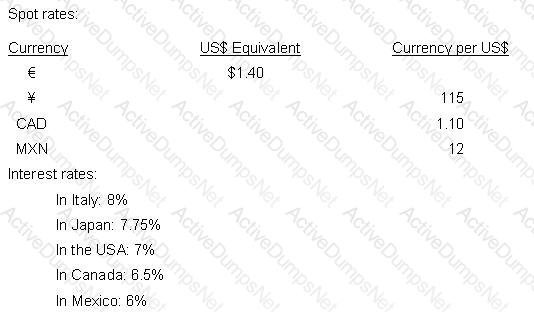

Which currency will sell at the greatest discount in the forward market against the U.S. dollar?

When a company creates future receivables and/or payables that are denominated in a currency other than its home or functional currency it is faced with:

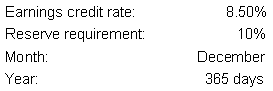

On the basis of the information above, what level of net collected balances is necessary to compensate a bank for $1.00 worth of services?

A utility company is evaluating whether or not it should build a new plant. The process of reviewing the quantitative and qualitative factors are an example of which finance function?

When a foreign subsidiary pays a dividend to its parent company the transfer of funds may be subject to:

A company that has facilities in different states and wants to control funding and facilitate check cashing would use which of the following?

A farmer who plans to sell his/her corn crop in three months would benefit MOST from which of the following?

If the Federal Reserve wanted to stimulate a sluggish economy, it could do so by:

Which of the following would increase if the Fed were to announce a reduction in reserve requirements?

A U.S. company is selling product for US$10,000 to a Canadian company with payment in Canadian dollars. The exchange rate has been booked at C$1.45/US $1 for payment upon delivery in 15 days. The Canadian dollar is forecasted to weaken within this period. This is an example of A.

The MOST important tool the Federal Reserve Board has for influencing the amount of reserves in the banking system is:

Since the inception of ABC Company's pension plan, 1,500 employees qualified and were paid pensions of $500 million after retirement, of which 700 employees were those who earned $110,000 or more and received $200 million in pension benefits. When the company filed for bankruptcy in 2010, the IRS claimed back taxes from the company stating that the pension plan was not qualified under ERISA. On what basis was the IRS MOST LIKELY making its claim?

An L/C in favor of a U.S. exporter is issued by a bank in an emerging-market country, and it is confirmed by the exporter’s bank. What risk is reduced for the U.S. exporter?

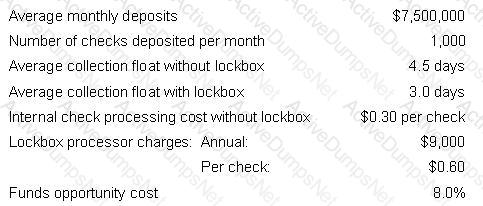

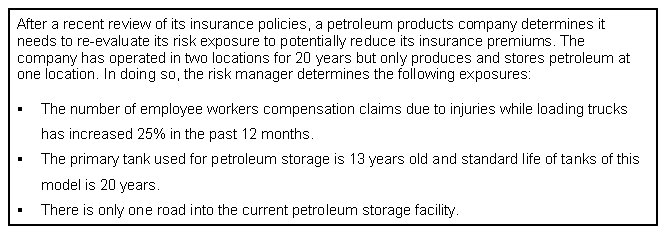

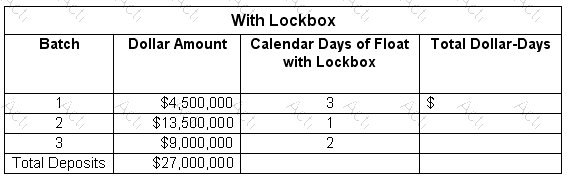

A company that is considering using a central lockbox for collections has conducted an initial study and determined the following:

What will be the annual net dollar benefit to the company if it uses a lockbox?

Which of the following institutions would be regulated by the Office of the Comptroller of the Currency (OCC)?

Which of the following techniques would MOST accurately predict a company's daily cash position?

A manager has prepared an analysis of five investment alternatives. Prior to selecting which alternative to invest funds in, the manager calculated the anticipated return for all options. The manager is only going to invest in one alternative. The four investments that are not chosen are:

Company ABC, with a current debt rating of BBB- from Standard & Poor’s, is negotiating a new revolving credit agreement with its lenders. The company anticipates closing on a small acquisition within a year of executing this new agreement and would like maximum flexibility to determine its capital structure. The company is MOST concerned about the lenders’ inclusion of A.

A small for-profit, start-up company is designing a retirement plan with the goal of minimizing costs and operating income volatility while providing a qualified retirement savings vehicle. Which of the following would be the BEST choice?

Sign Company and Paint Company have a twenty-year business relationship, and they work together when sending and receiving payments. Sign Company also does a large amount of business with Brush Company, a subsidiary of Paint Company. Brush Company’s Treasurer recently received a memo from the Treasurer of Paint Company reminding it that when dealing with vendors, extensive information is required when receiving or making ACH payments. What ACH payment format are Sign Company and Paint Company MOST LIKELY to use?

A large retailer is preparing to accept credit cards and anticipates monthly credit card sales of $1,000,000. If the terms with the acquiring bank include bundled allocated fees of 6% and the retailer wishes to delay fee payment as long as possible, what should the retailer do?

A portfolio manager wishes to make a short-term investment. His investment policy requires that short-term investments be low risk and secured, have a fixed interest rate and be highly liquid/redeemable prior to maturity. Which of the following should the manager choose?

The treasury manager of an auto-parts manufacturer has noticed that checks were sent to a foreign individual not on the approved vendor list. The payables manager has explained the payments but did not provide an invoice. The treasury manager did no further research and is later disciplined for:

A treasury manager at a multinational manufacturing corporation assigned a team of analysts to re-engineer the company’s FX exposure management program. Which of the following alternatives would BEST accomplish this objective?

JKL Company has been successful in shortening the time associated with its mail float, processing float and availability float. JKL Company will experience which of the following as a result of these improvements?

A-Plus Company has made arrangements for a new insurance broker to provide products to its employees. Historically, A-Plus Company’s employees made insurance payments via payroll deduction, but the new broker will be collecting payments from employees directly. What will the broker MOST LIKELY use to minimize collection float?

A company is looking to improve its collection rate of returned checks. If the company implements re-presented check entry (RCK) with its bank, it might see a reduction in what type of returned items?

Which of the following types of risk would an investor who does NOT receive payments on a security under the original terms be subject to?

When company profits are high, what is the MOST LIKELY way management will prefer to finance growth?

Two months after a government overthrow, the new Minister of Industry and Culture took over the country’s largest steel company and compensated the owners at 50% of book value. What is the government’s action called?

On June 1, a manufacturing company experienced a system failure that lasted more than 24 hours. The company did not have any contingency plans in place and as a result the cash manager was unable to process the following payments: $25,000 to the p-card issuer, $125,000 for weekly payroll, $500,000 for a bond interest payment, $260,000 for the weekly vendor payments and $50,000 for the monthly utilities. The receivables were deposited at the bank; however, the cash manager does not have a way to confirm the amounts. The suppliers are threatening to stop shipments due to the delay in payment and the loss of supplier shipments threatens the company’s just-in-time production. What did the manufacturing company trigger as a result of the system failure?

Making payments through electronic payments networks can be a part of a treasury management system’s functionality, but it is subject to numerous constraints. Which of the following is a true statement of those constraints?

Which of the following is a purpose of the Check 21 Act?

What is the reserve-requirements provision of the Federal Reserve Act of 1913 known as?

Amalgamated Binding Consolidators takes 20 days to convert its raw materials to finished goods, 5 days to sell it, and 15 days to collect its credit sales. What is the company’s days receivable period?

A company in the market to purchase a treasury management system (TMS) has issued a request for proposal to evaluate various vendors. One of the evaluation factors focuses on the long-term viability of the vendor. The company may have to choose between an untested new vendor with a superior product and an established vendor with an incomplete product suite. This dimension of the RFP is measuring what type of risk?

When a company announces a significant and unexpected dividend increase, it signals to the market that management expects:

Which of the following actions would the CFO of a Canadian multinational conglomerate MOST LIKELY take to repatriate profits from its international subsidiaries?

EDI infrastructure includes which of the following four PRIMARY components?

ABC Ltd. uses a third party lockbox provider to collect and clear its paper receivables. A customer disputes the price charged for a binding machine and issues a check to ABC Ltd. for 50% of the balance due, noting “paid in full” on the face of the check. The third party provider does not bring the check to ABC's attention prior to depositing it. Which regulation allows ABC to attempt to collect the remaining balance?

Given the above information,

if the risk manager adds a tank at its second facility, what loss control technique is being used?

What is the premium (price) for an oil contract, if the following conditions are present?

LIBOR rate of 5%

Out of the money cost of $3

Strike price is $4

In the money price of $1

Speculative premium of $2

Which of the following is generally NOT a benefit of financial risk management?

A nationwide discount retailer is re-evaluating financing methods since the most-popular and most-expensive electronics “must-have” item for this year is set to ship from factories in China. Which of the following credit facilities would be MOST effective for the retailer to use?

What do MOST companies try to maintain due to the signaling effect and clientele effect?

Company XYZ is in its first year of operations. The company culture is conservative, and it has $500 million to invest in short-term investments. The company has a growth rate of 25% and is looking to issue an IPO in the near future. The investment manager is in the process of creating a short-term investment policy which must be approved by the board of directors. An item that should be included in the policy is:

Which of the following would be true for a company with high operating leverage?

An analyst at XYZ Company was assigned with determining if the company should start to use a lockbox provider for its retail payments. The analyst determined that the company’s annual sales of $324,000,000 were recorded evenly throughout the year. The Company receives 30,000 checks annually. Total dollar-days float without the lockbox is $76,500,000 and the annual opportunity cost is 5.5%; assume 30-day month. The industry’s average opportunity cost is 6.0%. Using the information in the table, what would be the net effect of using the lockbox?

Which of the following would be considered insurance risk management services?

Simplifying upgrades and system restoration, access from multiple remote locations, and interfacing with multiple applications are all reasons to:

Which of the following is true of return on investment (ROI)?

A company is filing for bankruptcy protection and is concerned about the welfare of its sizeable retiree population. Under ERISA, it is obligated to perform which of the following actions regarding its defined benefit plan?

An investor is willing to participate in the initial bond issue of a trading company. The investor wants to be assured of his return although at the same time the company requires flexibility to adjust its balance sheet to future developments. What would the investor seek to have included in the indenture?

James Corp has a 7.98% WACC and an assumed tax rate of 30%. James Corp employed €70,000,000 of capital (long-term debt and equity) in a project that generated an operating profit of €9,500,000, after depreciation expense of €300,000. EVA in this case would be:

A disbursement check was intercepted in the mail, fraudulently altered, and subsequently cashed for $1,000 more than it had been written. The fraud was not detected until two months later, when the vendor phoned about late payment. Which of the following could have detected the fraud sooner?

An investor is interested in acquiring ownership in a firm while ensuring predictable timing and amount of cash flow. Which instrument should the investor choose?

Company A and Company X are small companies doing business with only one bank. Company A has monthly sales of approximately $1.1 million and Company X has sales of $750,000. Typically, Company A holds daily available cash balances in the range of $175,000 to $250,000 and Company X holds $90,000 to $125,000. Which of the following can be said of the cash management practices of both companies?

For days’ sales outstanding to be a meaningful method for evaluating the effectiveness of a company's receivable collections, it is usually compared to the:

Which of the following is an example of a typical passive investment strategy?

The actions taken by a company regarding crisis management, alternative operating procedures, and communications are referred to as:

A company that has an unusual spike in earnings in any given year is MOST LIKELY to declare which type of dividend?

What is the Weighted Average Cost of Capital for XYZ Company, assuming the following:

The pre-tax cost of long term debt is 8%

The cost of equity is 11%

The marginal tax rate is 33%

Total liabilities = $75,000

Long term debt = $50,000

Owners equity = $75,000

The corporate security officer for a large Fortune 30 firm has been tasked with evaluating the use of eBAM to help streamline bank account management for the company. Which of the following would be a PRIMARY reason that the company would be eager to adopt an eBAM management tool?

A company is preparing for a U.S. IPO transaction. A full-service investment bank has been selected, via an RFP, as the investment advisor and the underwriter. The lead banker is a personal friend of the CEO and is supporting both activities. The investment bank recommended $29 as the offer price. The stock closed at $31 after its first day of trading. Why would the SEC be concerned?

A corporation has a $500 million revolving line of credit whose interest rate is based on LIBOR. The board authorized the treasurer to initiate a swap transaction which has the company paying a fixed rate of interest rather than a floating rate. The treasurer entered into a swap with a notional value equal to the prior year's average outstanding balance of the revolver. The swap is also initiated for the same period as the revolver's remaining time to maturity. The counterparty for the swap transaction is, however, not a bank participating in the syndicate which had issued the revolver. The corporation's accounting team is now trying to determine the proper income recognition principals to apply to gains or losses on the swap. This is an example of what kind of hedge?

Which of the following is a PRIMARY responsibility of a company's risk management function?

What European financial regulation requires financial institutions to charge for research and transaction processing separately?

A review of a company's risk management strategy would include all of the following EXCEPT:

Since inception, an automobile manufacturer receives all of its parts from the leading industry supplier. What type of risk will the company reduce if it uses an additional distributor?

Recent improvements in the effectiveness of corporate governance are mostly due to the:

A company is expanding its investment portfolio to include external managers. All managers place trades through a company account so that detailed investment reports can be generated. What is the BEST method to adopt for accurate tracking and reporting of investment activity and to reduce the potential for fraud?

The main objective of a company's international cash management function is to:

Management is concerned with the level of volatility in the company's fixed income portfolio. Which of the following measures will provide management with the MOST comprehensive view of portfolio volatility?

Exhibit:

What is the price to earnings ratio for Company ABC?

Which of the following ASC X12 transactions is used to confirm the receipt and compliance of transmitted sets?

A company has experienced significant growth through acquisition. The treasury group would like to improve operations by bringing together the various financial services from previously separate businesses. The treasury group has identified the company's needs and service requirements for a customized solution. What should be the next step in this process?

Company A purchases materials on cash-before-delivery terms, while Company B uses paid-on-production terms. Both companies are diligent with the protection of assets, but Company B has concerns with respect to transfer of title of the materials. Company B is MOST LIKELY what type of business?

All treasury policies should be approved by:

A multinational firm headquartered in Germany expects the U.S. dollar to depreciate relative to the euro in the next few weeks. To counteract this expectation, the firm will lead payments from its only subsidiary, located in New York City. What situation could the firm encounter by employing this practice?

The owner of XYZ Company just completed an initial public offering. Which of the following is the MOST LIKELY outcome?

Which scenario provides the BEST example of an agency problem?

Which of the following occurs when the U.S. dollar strengthens?

All of the following are methods of financing accounts receivable EXCEPT:

A company is evaluating its long-range plan and determined free cash flow is tight in years one and two, while more favorable in years three through five. Its financial institution has offered an attractive interest rate on a term loan with a maturity option for both two and five years. What is a good financing option for this company?

Concerning the financial management function of a company, which organization sits at the center of the financial supply chain?

An electronics manufacturer wishes to purchase a key component from a foreign supplier. If the manufacturer has limited access to that supplier's currency, it would benefit from which of the following forms of trade payment?

ABC Company is an energy-holding company which owns a number of regulated power utilities that have monopolies in different regions. The majority of the holding company’s income is realized from investment portfolios. The company has done well and is going to report its overall performance to the public. What performance evaluation processes should management use to measure portfolio performance?

A decrease in the accounts receivable from one period to the next is considered to be:

An intern was hired by the Vice President of Accounts Payables to process the electronic payments that come through the bank. The intern is responsible for manually entering payee information into the system at each step of the process. The VP directed the intern to enter the information as fast as possible without mistakes to optimize the number of transactions that could be processed. Instead of manually entering information the VP should have utilized:

XYZ Company has incurred a financially devastating event because of a hurricane at its offshore manufacturing plant. Due to the impact on liquidity, the company may not be able to survive. What should the Treasurer have done in order to assess the risk associated with this type of event?

A company converts the expense processing for its sales team from reimbursement by check to providing the team with travel and entertainment cards. Immediately, the company’s expenses for the sales force increase by 10%, with no concurrent increase in sales volumes. What aspect should the company have covered in their policies for card use to prevent the increased expenses?

Bank A is to pay Bank B $6,000,000 for 10 transactions that occurred throughout the day. Bank B is to pay Bank C $8,000,000 for 13 transactions that occurred throughout the day. Bank B is to pay Bank A $5,000,000 for 17 transactions that occurred throughout the same day. These banks operate using a gross settlement system. How many transactions will occur between these banks to settle the payments?

RAL Industries is a manufacturing company that currently has locations in the United States and Latin America and has just completed an acquisition of a company located in Europe. As a result of the acquisition, they have a large number of financial service providers. In an effort to reduce the number of providers and services used globally, RAL has decided to develop a formal selection process to consolidate its many global banking services. In order to reduce the amount of time the selection process takes, determine which services providers can offer, and the number of providers involved in the process, what should RAL Industries issue?

The CFO asks the Treasurer to create a new collections and concentration policy for their company. Following implementation of the policy, the company finds that reporting of receivables values is taking 10% longer, with no improvement in the company’s cash flow or liquidity. What step in developing the policy could have been executed better?

XYZ Company is a fairly new and high growth company funded by venture capital. Which of the following performance measures is it MOST LIKELY to use?

XYZ Holdco has multiple credit facilities with a bank under a borrowing agreement that includes certain covenants. A fire has destroyed the manufacturing plant owned by ABC, one of the XYZ subsidiaries that is part of the credit facilities. All loans, including the ABC loan, are up to date and being repaid as required. However, after the fire, the bank notified XYZ that it was in default. Which one of the following covenants is MOST LIKELY a term of the borrowing agreement?

During a company’s cash flow analysis review it discovers that for every 10 new customers it gains, there is an increase of 2% in its float costs associated with the payment methods it offers. If the company pursues faster collection methods for payments, resulting in greater availability of surplus cash with a correlating decrease in the need to issue commercial paper, what risk will the company mitigate?

A U.S. company decides to enter a new geographic market facing some dominant competitors, but projects sales growth of 40% in its first year due to its superior product line. The company decides to only offer electronic payment methods for settlement of its receivables. A year later, the company’s sales volume only increases by 10%, but their average days’ sales outstanding of 32 days is the best in the industry. What should the company have considered in its collection policy objectives?

A customer buys a laptop for $850 and a CD for $13. Only items with sale price of $15 and greater are subject to value added tax (VAT). Assuming VAT of 8.5%, how much tax does the customer incur at the point of sale?

Based on the following information, what is the required collected balance to cover all monthly service charges?

Deposit Float$10,000

Reserve Requirement5%

Earnings Credit Rate15%

Monthly Service Charges$6,000

Days in month30

Which of the following is a component of a company’s operating budget?

The Treasurer at Worldwide Industries is concerned that its retail lockbox provider, Bank A, is not PCI DSS-compliant. Bank A processes 500,000 checks per month for Worldwide Industries. Worldwide Industries uses a third-party provider, Pay Point, for their credit card payments and funds are wired daily to Worldwide’s depository account at Bank A. What should the Treasurer do?

The regional offices of ABC Company implemented a system that would allow the employees to pass information between regions in a secure fashion. This system requires that all offices have the same key in order to read messages sent electronically. Which e-commence security type is MOST LIKELY being used?

An individual has just inherited several million dollars and has decided to purchase the stock of a telecommunications company to diversify his portfolio. Before purchasing shares, he would like to do some company-specific research to determine which company to select. Examples of the information the individual wishes to obtain are financial statements and disclosures, company organizational structure, code of conduct, pending litigation, and profiles of the board of directors. Who would be the BEST person to contact to obtain all this information?

Due to a loss of proprietary information held for clients, ABC Company has been named in a billion dollar lawsuit. It was determined that the loss of information was due to a breach in its computer system firewalls by outside parties. When the lawsuit became public, the company experienced a steep drop in its stock price. This scenario is an example of what kind of risk?

A publicly held U.S. company has reported at the beginning of the year that it expects to increase shareholder value by 5%. The current expectations are for interest rates to remain steady with a decline in fourth quarter. Treasury policy requires that investments be 90 days or less and investment grade. How should the company invest excess cash to support this goal?

XYZ Company has a well established commercial paper (CP) program that they use to fund operations. The company is expanding by purchasing a new factory. The CFO is worried about the time and expense needed to issue long-term debt and decides to use the funds they raise in the CP market to pay for the purchase of the factory. This strategy will be successful if:

Which of the following capital budgeting methods ignores the time value of money?

Company A has decided to purchase $3,000,000 of real estate from Company B. Company A will make the payment in 3 parts. The electronic payments will be sent from Bank A to Bank B. On Day 1 Company A will send a $400,000 check as a deposit, which is deductible from the balance. The check is expected to clear in 4 days. On Day 2, two payments are initiated, one wire transfer for $2,000,000 and an ACH for $600,000 to complete the balance. On Day 2 what percentage of the payment to Company B is NOT final?

ABC Company’s Treasury department outsourced its overnight investment duties to XYZ Money Management. XYZ placed the funds received from ABC into corporate commercial paper, which has recently gone into default after numerous ratings downgrades. The investment policy of ABC Company states that all investments must be in investment grade commercial paper; however, the agreement gives XYZ the ability to make exceptions with the approval of the Treasurer of ABC Company. The Treasurer was never notified of the ratings downgrades. What role or responsibility, if any, was violated with regards to the investment policy?

Why would a company establish a short-term credit facility?

USA Tires, LLC is a U.S. company that manufactures a high performance tire. It has $500 million in annual domestic sales. Customer A is located 50 miles from the USA Tires warehouse. Customer A orders 1,000 high performance tires per month at a price of $50 per tire. It has credit terms of 30 days. Customer B is located 40 miles from the USA Tires warehouse. Customer B orders 1,000 high performance tires per month at a price of $60 per tire. Customer B has credit terms of 20 days. Which legislation is being violated in the scenario?

While revising the investment policy, the CFO performs a sensitivity analysis for the company’s cash flow from investments, and identifies that increasing the maximum dollar value for bond purchases will improve returns by 10% on average, all other variables being equal. What issue will the CFO now need to address in the investment policy?

A U.S. company’s pension plan is managed by an investment management firm, headquartered outside the United States. The investment management firm outsources the accounting for the plan to an organization on the Office of Foreign Assets Control (OFAC) sanctions lists and the firm does not advise the U.S. company of this fact. A financial loss in the pension plan is later realized due to the mismanagement of funds. When establishing its contract with the firm to protect itself from losses in the pension plan, the company should have:

ABC Company, a publicly held U.S. multinational, owns several manufacturing plants in Latin America as well as several ships to transport its products globally. 60% of its sales are from its euro-based subsidiaries. The company uses various derivative instruments to mitigate exposure to fluctuations in fuel prices and FX rates. The hedging deals are long-term and placed with many counterparties. ABC Company is also a net borrower and has a syndicated credit facility in place. Which of the following actions to mitigate counterparty risk would MOST benefit the company?

A cash manager is determining the threshold over which cash concentrations will be done by wire. An ACH transaction costs $0.50. A wire costs $12.00. Funds are available 2 days quicker by wire and the opportunity cost of funds is 5%. What threshold should the cash manager use?

Company GRA has retail locations in remote areas of Montana. All banking options within the area, deemed a safe distance for making cash deposits, fail the counterparty risk assessment. Deposits would include both cash and checks. In order to achieve immediate availability of funds, what deposit method should be utilized?

Company ABC experienced a loss in the past when an employee in the treasury department was able to transfer $1.5 million to a personal account offshore. The company is working with a security agent to prevent this from happening in the future. ABC also accepts a large number of checks as payment. The agent has suggested upgrades to ABC’s payment process. What step should be taken to help mitigate this type of risk in the future?

Which of the following is an example of off-balance-sheet financing?

Based on the following information, how much money will XYZ Company owe the bank for monthly service charges after the earnings credit is applied?

Average Ledger Balance $500,000

Deposit Float$10,000

Reserve Requirement10%

Earnings Credit Rate5%

Monthly Service Charges$5,000

Days in month30

A daily short-term forecast and variance analysis for LMN, Inc. is updated with relevant trends and actual data every Monday. Upon review, the Treasurer assessed that sales were higher than forecasted, inventory was up and yields being earned on excess cash were lower. The MOST important reason for this cash forecast process is:

A treasury manager has $5 million that is not needed for 6 months. The treasury manager has decided to invest the funds in a liquid instrument, using the current portion of a 5-year AA rated corporate bond that is subject to U.S. Securities and Exchange Commission (SEC) regulations. In what market would the treasury manager purchase this investment?

The Treasurer of PJB Company is in charge of implementing new treasury management software. Without issuing any RFPs, the Treasurer hires a consulting company to install the software and program it to suit the company’s needs. The Treasurer is responsible for approving the consultant’s invoices for payment. Through conversation, the CFO discovered that the Treasurer’s relative is one of the partners at the consulting company. The Treasurer was immediately terminated. What did the Treasurer MOST LIKELY violate?

The Treasurer at ABC Company currently uses an in-house company-processing lockbox center. The Treasurer has asked for an analysis to determine the major advantage of using a traditional check/mail-based lockbox system. ABC receives 287,000 payments per month and hired seven additional staff members to process the payments in-house. Additionally, $389,000 was invested in the equipment used to process the payments and NSF checks have decreased 7% since using the in-house center. The equipment’s current market value is equal to its book value. What major advantage should the analysis indicate?

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

"Fees" in Country Y, which would be considered bribes in the United States, are ingrained in the commercial culture. A U.S. company doing business in Country Y:

Financial risk management requires monitoring changes in which of the following?

I. Interest rates

II. Foreign exchange rates

III. Commodity prices

IV. Cost of insurance

All of the following are reasons to use a confirmed irrevocable letter of credit EXCEPT concern about:

The relationship between debt and equity in a company's capital structure is called:

A new retail chain has decided to offer 3 payment methods: cash, cards and checks. It was determined that card payments would be the biggest sales driver and projects have been scheduled accordingly. To be in line with this strategy, which of the following should be the priority?

Assuming a marginal tax rate of 36%, the taxable equivalent yield for an investment with a tax-exempt yield of 3% would bE.

An assistant treasurer discovers that the CFO has been allowing other executives to exercise stock options during blackout periods. What will prevent the assistant treasurer from losing his/her job if he/she reports this discovery?

A company has a beginning cash balance of $50,000. Its weekly cash flow forecast shows the following information for the next three weeks.

Which of the following statements is true?

ABC Company is considering investing in new production technology. ABC has projected that the investment would add $5,000,000 in additional operating profit and that the resulting balance sheet would show $7,000,000 in long-term debt and $11,000,000 in total equity. ABC has a 34% tax rate and a 10% WACC. Which of the following is the investment's EVA?

Major Manufacturing Inc. (MMI) is a manufacturer of customized restaurant equipment. MMI's supplier relations policy is to take advantage of trade discounts, when available. All suppliers offer payment terms of 1/10, net 30. MMI invoices customers at the end of its 30-day manufacturing cycle. Which of the following is the correct chronological sequence of the events listed?

1. Customer invoice is sent.

2. Supplier payment is sent.

3. Customer payment is received.

4. Order is shipped.

5. Customer order is received.

6. Supplier order is placed.

Which report is MOST LIKELY to be a current-day information report?

I. Banker’s acceptances

II. Commercial paper

III. U.S. Treasury bills

IV. Federal agency securities

Which of the following is the MOST usual ranking, from lowest to highest risk, of the investments listed above?

The role of the depository bank in the check-clearing process is typically which of the following?

A company has made an investment of $30,000, which matures in 180 days and pays $800 in interest. Which of the following is the effective annual yield?

A merchant, wanting to accept credit cards as payment method, will negotiate its fees with which of the following participants?

LST Company is a publicly traded company with $120 million in sales. Historically, LST does not extend credit to customers beyond net 45 terms. To help promote sale of a new product introduced into the market this year, LST offered financing terms to customers purchasing the new product. As a result, sales increased by 15% from the prior year and accounts receivable increased by 5%. At the end of their fiscal year LST had a $15 million sale to a new customer that was recorded as a note receivable. LST recognizes revenue when goods leave the facility. During the financial audit the auditors discovered that the customer did not receive the product until three days after the year-end. Under GAAP accounting, the auditors would MOST LIKELY render a(n):

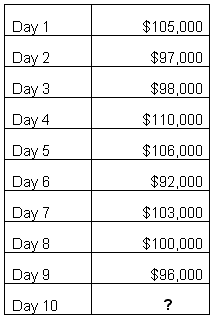

This question is based on the following data describing a company's actual deposits.

If a five-day moving average is used, what was the deposit forecast for day six?

Merchant XYZ has total credit card sales of $20,000 for one day with an average ticket of $200. The merchant’s interchange reimbursement fees are 2% and transactions fees are $0.05. This merchant receives net settlement. Which of the following is the value of the deposit for that day?

XYZ Corporation is presently a short-term borrower and uses a revolving line of credit with an interest rate of 7%. The Treasurer would like to reduce interest expense and increase liquidity without renegotiating the line of credit. Which of the following projects should the Treasurer support in order to achieve this objective as quickly as possible?

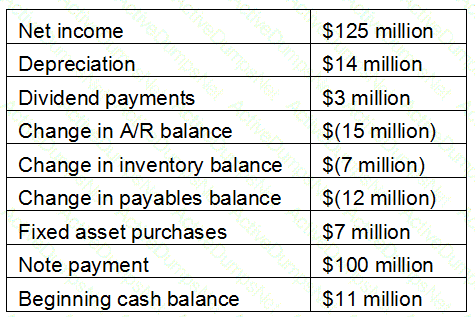

The treasury analyst at RST Corporation has been asked to forecast cash levels for the company’s year-end balance sheet. The analyst has been given the following information:

What should the analyst project as the upcoming year-end cash balance?

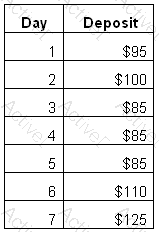

The treasury analyst for XYZ Corporation, a small retailer, is trying to forecast daily cash receipts being swept from the store depository accounts. The analyst has been given the data in the table regarding receipts from the last few days. The analyst chooses to use a seven-day simple moving average forecast methodology.

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

A diversified industrial company operates multiple remote manufacturing facilities that manage local supplier relationships. The company draws on a single line of credit for all of its working capital needs. Which of the following types of disbursement systems would BEST meet this company's needs?

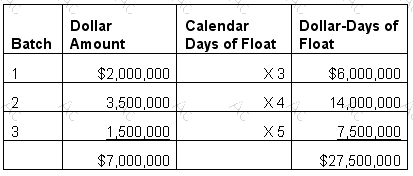

There are 31 calendar days in the month, and the opportunity cost of funds is 9%.

What is the annual cost of float for the batches listed?

A large multinational company recently implemented new processes to automate its treasury operations. If these changes were the direct result of comparing the company's practices with those of other companies, the activities could be considered an example of which of the following?

I. Liquidating

II. Re-engineering

III. Benchmarking

IV. Forecasting

Which of the following types of payments would NOT be included in cash flow forecasting?

Which of the following ways of financing accounts receivable requires a company to relinquish control of the type of customer to which it sells?

Which of the following factors will allow a company to decrease the amount of collected balances required to compensate its bank for services?

Which statement is true about private placements compared to public offerings?

An option can be exercised in the market at its:

Upon entering into an interest rate swap with a notional principal of $10,000,000, what is the initial amount of money the counterparties must exchange at the beginning of the swap?

Which of the following MOST often contributes to the misinterpretation of DSO?

If a company uses accrual accounting, deferred taxes are reported on which financial statement?

The earnings allowance rate applied to collected balances is usually determined by which of the following rates?