ACI 3I0-012 ACI Dealing Certificate Exam Practice Test

ACI Dealing Certificate Questions and Answers

With reference to dealing periods, what does the term “short dates” refer to?

If 6-month EUR/AUD is quoted at 29/32, which of the following statements is correct?

A sold JUN 3-month STIR-future should be reported in the gap report as of 22 May:

How many USD would you have to invest at 3.5% to be repaid USD125 million (principal plus interest) in 30 days?

When a stop-loss/profit order is taken, the rate specified in the order:

Which of the following definitions of a nostro account is correct?

Payment and settlement instructions should be passed:

You have made a price by a Japanese bank in (SD 2,000,000.00 against JPY. They made you

98.95-03 and you took the offer. USD/JPY is now quoted 98.78-81 and you square your position.

What is your profit or loss?

What usually happens to the collateral in a tri-party repo?

Which of the following statements is true?

The mid-rate for USD/CHF is 1.3950 and the mid-rate for AUD/USD is 0.7060. What is the midrate for CHF/AUD?

Which of the following statements reflects the Model Code on gambling or betting amongst market participants?

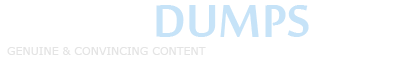

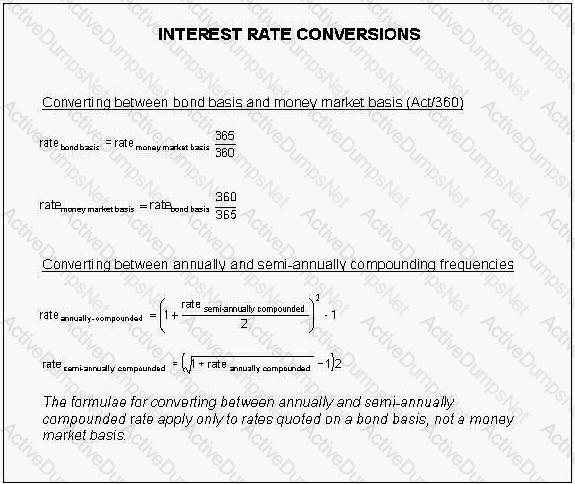

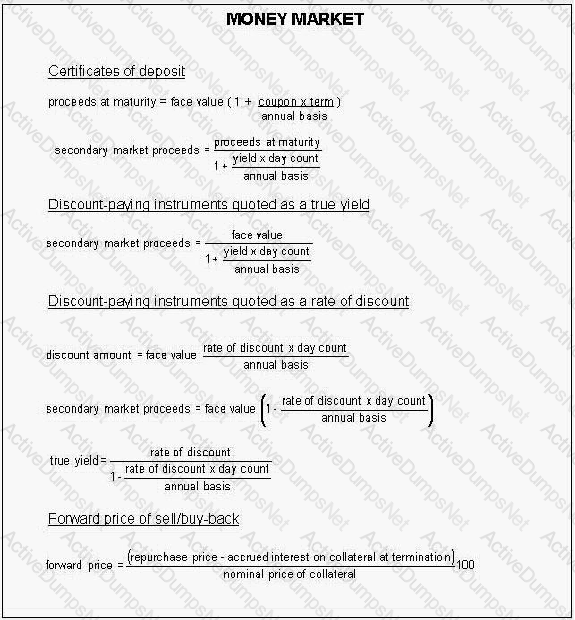

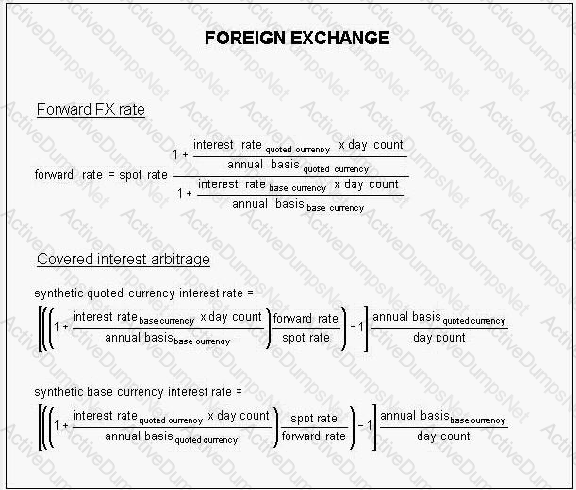

Click on the Exhibit Button to view the Formula Sheet, If GBP/USD is 1.5350-53 and USD/JPY is 106.50-53, what is GBP/JPY?

If there is a need for assistance to help resolve a dispute over differences between a broker and a bank, the Model Code suggests turning to:

When performing a gap analysis, into which of the following time buckets should a 5-year floating-rate note with a 6-month LIBOR coupon be slotted?

Which of the following statements is false? The repo legal agreement between the two parties concerned should:

A Eurodollar futures price of 99.685 implies:

What is the purpose of an initial margin on a futures exchange?

What is interest rate immunization in the context of bank gap management?

What recommendation does the Model Code make to banks accepting a stop-loss order?

Selling a FRA has the same interest rate exposure as:

Today, you sold 10 December EURODOLLAR futures contracts at 99.50. The closing price is fixed by the exchange at 99.375. What variation margin will be due?

What is the ISO code for silver?

Automated trading systems for interbank spot FX display the best prices entered into the systems by users and:

Experience has shown that recourse to taped telephone conversations proves invaluable to the speedy resolution of disputes. Therefore, the Model Code recommends:

An important reason for trading a futures contract rather than an FRA is:

A forward-forward lender has an exposure to the risk of:

For which of the following might an MT370 be used?

If you are trading spot on an ATS (Automated Trading System) and see a price for EUR/USD of

1.3050-53. If you hit the button marked “YOURS”, what have you done?

What does the Model Code recommend regarding “entertainment and gifts”?

What is the Overnight Index for GBP?

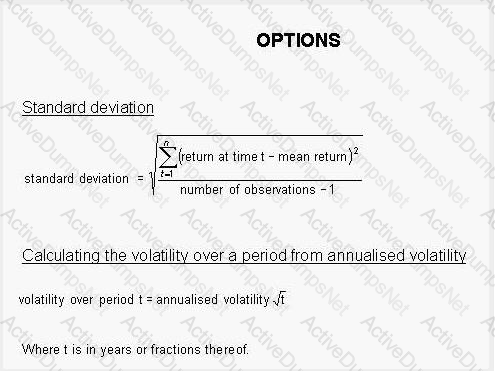

The gamma of an option is:

Which of the following is true?

The term “under reference” refers to:

One or your brokers asks you to buy and sell EUP/USD at the same price net of brokerage in order to allow him to clear a transaction.

Dealers should not conduct dealing activities outside the bank unless:

When dealing with customers, financial market professionals are advised by the Model Code to clarify that all transactions are entered into solely at each partys risk by explicitly agreeing in writing that:

A dealer needs to buy USD against SGD. Of the following rates quoted to him, which is the best rate for him?

A disgruntled customer claims that he should not have to settle an FRA with you because it is really just a wager. What type of risk are you exposed to?

An at-the-money call option:

You are quoted the following market rates:

spot EUR/USD. 1.2250

3M (91-day) EUR 2.55%

3M (91-day) USD. 2.00%

What is 3-month EUR/USD?

The extension of forward FX contracts at their historic rates is only allowed when:

A 3-month (91-day) deposit of EUR25 million is made at 3.25%. At maturity, it is rolled over three times at 3.55% for 90 days, 4.15% for 91 days and 4.19% for 89 days. At the end of 12 months, how much is repaid (principal plus interest)?

You buy a 181-day 2.75% CD with a face value of USD 1,500,000 at par when it is issued. You sell it in the secondary market after 150 days at 2.60%. What is your holding period yield?

Where internet trading facilities are established by a bank for a client, the conditions and controls should be stated in a rulebook produced by:

How is an outright forward FX transaction quoted?

Market participants should, where activity justifies it, aim to reduce settlement and related credit risk on currency transactions by:

The Chairman and members of the ACls Committee for Professionalism are ready to assist in resolving disputes through the ACIs Expert Determination Service in situations where:

Under what conditions can an FX broker act as a position taker?

A customer based in the UK exports automotive parts to the US. His main competitor is in France. What type of exposure to currency risk is posed by movements in EUR/USD?

What do you call a combination of a long (short) call option and short (long) put option with same face value, same expiration date, same style, where the strike price is equal to the forward price?

A customer sells a 3-month Euro Swiss Franc (EUROSWISS) futures contract. Which of the following risks could he be trying to hedge?

Which of the following statements about the Net Stable Funding Ratio is correct?

The two-week repo rate for the 5.25% Bund 2011 is quoted to you at 3.33-38%. You agree to reverse in bonds worth EUR 266,125,000.00, but insist on an initial margin of 2%. You would earn repo interest of:

Which of the following functions does a to-party repo agent not perform?

You are quoted the following market rates:

Spot EUR/USD 1.3010

6M (181-day) EUR 0.30%

6M (181-day) USD 0.50%

What is 6-month EUR/USD?

What is an outright forward FX transaction?

The Interest Rate Parity Theorem states that:

What is the name of a swap in which the counterparties sell currencies to each other with a concomitant agreement to reverse the exchange of currencies at a fixed date in the future at the same price, and where the interest rates for the two currencies are reflected in the two exchanges but paid separately?

What should a dealer say to express his commitment to putting an additional bid or offer at a current bid or offer price already quoted by his broker?

When should confirmations be sent out?

What is a hedge?

Forward points represent:

What are de minimis claims?

What is the correct interpretation of a EUR 2,000,000.00 overnight VaR figure with a 97% confidence level?

You have quoted spot USD/CHF at 0.9423-26. Your customer says “I take 5”. What does he mean?

You are quoted the following market rates:

Spot GBP/USD 1.5525

9M (272-day) GBP 0.81%

9M (272-day) USD 0.55%

What are the 9-month GBP/USD forward points?

You are quoted the following market rates:

spot USD/SEK 6.3850

1M (30-day) USD 0.40%

1M (30-day) SEK 1.15%

What is 1-month USD/SEK?

Which of the following statements is correct?

Which party usually takes an initial margin in a classic repo?

Which of the following is not a negotiable instrument?

Which one of the following statements is true?

Which of the following is always a secured instrument?

Hybex Electrics is a highly rated company with a considerable amount of fixed rate liabilities and would like to increase the percentage of floating rate debt. Which of the following is the best course of action?

An ‘at-the-money’ option has:

Which of the following is typical of liquid assets held by banks under prudential requirements?

The exercise price in an option contract is:

What are the primary reasons for taking an initial margin in a classic repo?

Lending for 3 months and borrowing for 6 months creates a 3x6 forward-forward deposit. The cost of that deposit is called:

An option is:

What should be done if a broker fails to conclude a transaction at the quoted price and the dealer has to accept a lesser quote to neutralize his risk?

What is the correct interpretation of a EUR 5,000,000.00 one-week VaR figure with a 99% confidence level?

What is Funds Transfer Pricing in the ALM process?

What is settlement risk in FX?

You want to hedge your deposit against falling interest rates. Which of the alternatives below are appropriate for this purpose?

A forward/forward FX swap:

Which of the following statements regarding economic capital is correct?

Which of the following statements is true? The repo legal agreement between the two parties concerned should:

Which of the following both provide credit enhancement to a true-sale securitization?

Where there are shared management responsibilities or where an investment or shareholding exists in a broker by a counterparty:

You have borrowed at 3-month LIBOR+50. LIBOR for the loan will be re-fixed in exactly one month. The market is quoting:

1x3 USD FRA 0.42-45%

1x4 USD FRA 0.54-58%

1x5 USD FRA 0.57-62%

To hedge the next LIBOR fixing, you should:

You are quoted the following rates:

Spot EUR/NOK7.5250-60

O/N EUR/NOK swap 3.10/3.20

T/N EUR/NOK swap 3.12/3.22

S/N EUR/NOK swap 9.35/9.55

At what rate can you sell EUR against NOK for value tomorrow?

The 180-day CAD/CHF rate is bid 62 and the 90-day CAD/CHF rate is bid 29. What is the bid rate for 120 days, assuming straight-line interpolation?

When quoting the exchange rate between the USD and AUDI which is conventionally the base currency?

Where dealing for personal account is allowed, what safeguards to prevent abuse or insider dealing are stated by the Model Code?

When a broker needs to switch a name this should be done:

At the end of the day, you are short CHF 3,500,000.00 against SEK at 6.9275. You are asked to revalue your position at 6.9190. What is the resulting profit or loss?

Which of the following statements best describes the conditions under which a prime broker may accept a trade given up?

What does the Model Code recommend in respect of prices and orders made on electronic trading platforms?

A negative yield curve is one in which:

The Liquidity Coverage Ratio imposed by Basel III requires a bank:

Which of the following statements reflects the position of the Model Code on gambling or betting amongst market participants?

In trade confirmation, which one of the following statements about “matching” is correct?

What is the Repurchase Price of a classic repo?

Under Basel III rules the meaning of RSF is:

In order to be introduced in a controlled manner, which areas should be involved before a new product or business strategy is launched?

What does the Model Code say concerning repos and stock-lending?

An FRA is:

The Model Code’s correct recommendation regarding electronic trading states:

A USD deposit traded in London between two German banks is cleared:

3-month USD/CHF is quoted at 12/10. Interest rates in Switzerland are reduced but USD rates (which are higher) are unchanged. What would you expect the 3-month forward USD/CHF rate to be?