ACAMS CAMS-FCI Advanced CAMS-Financial Crimes Investigations Exam Practice Test

Advanced CAMS-Financial Crimes Investigations Questions and Answers

A compliance analyst is reviewing the account activity of a customer that they suspect may be indicative of money laundering activity. Which is difficult to determine solely from the customer's account activity and KYC file?

A bank’s transaction surveillance system triggers an alert for a deposit of 250.000 USO into a client's account. According to the bank's KYC information, the client works for a financial advisory firm, and earns approximately 100,000 USD per year. Which actions should be taken? (Select Three.)

File the suspicious transaction immediately to the financial intelligence unit.

A financial institution (Fl) receives an urgent request for information from the financial intelligence unit (Fl country. According to FATF recommendations, which is the best action for the FI to take?

Online payments from a customer's account to three foreign entities trigger an investigation. The investigator knows the funds originated from family real estate after an investment company approached the customer online. Funds were remitted for pre-lPO shares. Which should now occur in the investigation?

A government entity established a trust to provide social welfare programs. The entity wants cash payments made to persons without supporting documentation. These persons would oversee the allocation of funds to beneficiaries without complying with internal disbursement of government funds controls. Which is the main premise for filing a SAR/STR?

Law enforcement (LE) suspects human trafficking to occur during a major sporting event. LE officers asked several financial institutions (FIs) to monitor financial transactions occurring before, during, and after the event.

An investigator identified a pattern linked to a business. The business' account received multiple even dollar deposits between midnight and 4:00 AM. They occurred each day for several days prior to the date of the sporting event. Also, large cash deposits, typically between 2,000 USD and 3,000 USD. made by a person to the business' account occurred in many branches in the days after the sports event.

There was little information about the company. The company did not have any history of employee payroll expenses or paying taxes. Expenses from the business account included air travel and hotel expenses. Searches about the person making cash deposits showed little. An online social media platform webpage with the individual's name showed ads for dates" and "companionship."

The Fl receives a keep open' letter from LE for the identified account and agrees to keep the account open. What is the Fl required to do?

A client at a financial institution deposits large amounts of money into an account, and almost immediately, the funds are then distributed to numerous individuals' accounts. The transaction activity described in the scenario is a pattern of:

In the past 6 months, a small financial institution (Fl) has received regular remittances that are increasing in value from a country with high piracy activity. The Fl's AML officer (AMLO) has also noted that piracy in this country has increased in the same time frame. Which recommendation should the AMLO make?

An unusual spike in activity has occurred for a customer who is a supplier of aviation parts to a military force. The customer's current line of business is consistent with the banks records, and no adverse media hits have occurred. Which is the best reason for an investigator to continue an investigation?

Which might suggest misuse of crowdfunding resources by a terrorist?

An investigator is reviewing an alert for unusual activity. System scanning detected a text string within a company customer's account transactions that indicates the account may have been used for a drug or drug paraphernalia purchase. Based on the KYC profile, the investigator determines the customer's company name and business type are marketed as a gardening supplies company. The investigator reviews the account activity and notes an online purchase transaction that leads the investigator to a website that sells various strains of marijuana. Additional account review detects cash deposits into the account at the branch teller lines, so the investigator reaches out to the teller staff regarding the transactions. The teller staff member reports that the business customers have frequently deposited cash in lower amounts. The teller, without prompting, adds that one of the transactors would occasionally smell of a distinct scent of marijuana smoke.

Which information should be included in the SAR/STR?

While each is potentially important, which allows an investigations analyst to better write a SAR/STR narrative that is useful to law enforcement? (Select Two.)

An investigator at a bank triggered a review in relation to potential misuse of legal persons and a complex network of corporate entities owned by customer A. For the investigator to provide a holistic view of the underlying risk, which action should be the initial focus of the investigation?

What action does the USA PATRIOT Act allow the US government to take regarding financial institutions (FIs) that are based outside of the US?

The intended benefits of section 314(b) of the USA PATRIOT Act include: (Select Three.)

An investigator receives an alert documenting a series of transactions. A limited liability corporation (LLC) wired 59.000.000 USD to an overseas account associated with a state-run oil company. A second account associated with the state-run oil company wired 600,000,000 USD to the LLC. The LLC then wired money to other accounts, a money brokerage firm, and real estate purchases.

The investigator initiated an enhanced KYC investigation on the LLC. The financial institution opened the LLC account a couple weeks prior to the series of transactions. The names associated with the LLC had changed multiple times since the account opened. A search of those names revealed relations with multiple LLCs. Public records about the LLCs did not show any identifiable business activities.

Open-source research identified mixed reports about the brokerage firm. The firm indicated it purchased mutual funds for its clients and dispensed returns to clients. Media reports claimed the firm laundered money by holding money for a fee before returning it to investors.

What is the total suspicious transaction amount that the investigator should report?

SAR/STR NARRATIVE

A SAR/STR has been submitted on five transactions conducted on the correspondent banking relationship with ABC Bank.

Client Information:

Remitter information: DEF Oil Resource Ltd. is the oldest member of the DEF Group. It was founded in 1977 as a general trading business with a primary focus on exports from Africa and North America. The group has business activities that span the entire energy value chain. Their core field of endeavor is centered within the oil and gas industry and its associated sub-sectors.

Beneficiary Information:

As per the response received from ABC Bank, it was determined that the beneficiaries are related to DEF Oil Resource Ltd. These were created by DEF Oil Resource Ltd. to purchase property in a foreign country on behalf of their senior management as part of a bonus scheme. The purpose behind this payment was for the purchase of property in another country.

Payment Reference:

ABCXXXXX31PZFG2H

ABCXXXXXX51PQGEH

ABCXXXXXX214QWVG

ABCXXXXXX41PSXA2

ABCXXXXXX815QWS3

Concerns:

• We are unsure about the country of incorporation of the beneficiaries.

• We are concerned about the transactional activity since the payment made towards entities (conducted on behalf of individuals) appears to be possible tax evasion.

• There appears to be an attempt to conceal the identity of individuals (senior management), which again raises concerns about the source of funds.

• Referring to the response received from ABC Bank, we are unclear about the ultimate beneficiary of funds.

• The remitter is involved in a high-risk business, (i.e., oil and crude products trading), and the beneficiary is involved in real estate business which again poses a higher risk.

When drafting the SAR/STR narrative, the investigator notes several payment references. What additional information should the investigator include in the narrative?

A financial institution (Fl) banks a money transmitter business (MTB) located in Miami. The MTB regularly initiates wire transfers with the ultimate beneficiary in Cuba and legally sells travel packages to Cuba. The wire transfers for money remittances comply with the country's economic sanctions policies. A Fl investigator on the sanctions team reviews each wire transfer to ensure compliance with sanctions and to monitor transfer details.

An airline located in Cuba, unrelated to the business, legally sells airline tickets in Cuba to Cuban citizens wanting to travel outside of Cuba. The airline tickets are purchased using Cuban currency (CUC).

The MTB wants 100,000 USD worth of CUC. Purchasing CUC from a Cuban bank includes a 4% fee. The MTB contacts the airline to ask if the airline will trade its CUC for USD at a lower exchange fee than the Cuban bank. The airline agrees to a 1% fee. The MTB initiates a wire transfer to the airline which appears as normal activity in the monitoring system because of the business' travel package sales.

The investigator recommends that a SAR/STR be filed. What documentation should be referenced in the SAR/STR filing? (Select Three.)

Which test should be included in a bank's Office of Foreign Assets Control sanctions screening audit program?

A KYC specialist from the first line of defense at a bank initiates an internal escalation based on a letter of credit received by the bank.

MEMO

To: Jane Doe. Compliance Manager, Bank B From: Jack Brown, KYC Specialist, Bank B RE: Concerning letter of credit

A letter of credit (LC) was received from a correspondent bank. Bank A. in Country A. in Asia with strict capital controls, providing guarantee of payment to Bank B's client for the export of 10 luxury cars located in Country B. located in Europe. Bank A's customer is a general in the army where Bank A is headquartered.

The information contained in the LC is as follows:

• Advising amount per unit 30.000.00 EU •10 units of BMW

• Model IX3

• Year of registration: 2020

Upon checks on Bank B's client, the exporter mentioned that the transactions were particularly important, and a fast process would be much appreciated in order to avoid reputational damage to the firm and the banks involved in the trade finance process. The exporter has a longstanding relationship with Bank B and was clearly a good income generator. The exporter indicated that, as a general, the importer was trustworthy.

The relationship manager Feedback from the RM: The RM contacted the exporter for a client courtesy visit, but it was rearranged four times as the exporter kept cancelling the appointments. When the exporter was finally pinned down for an interview, employees were reluctant to provide clear answers about the basis of the transaction. The employees were evasive when asked about the wider business and trade activity in the country. Findings from the investigation from various internal and external sources of information: • There were no negative news or sanctions hits on the exporter company, directors, and shareholders. • The registered address of the exporting business was a residential address. • The price of the cats was checked and confirmed to be significantly below the market price of approximately 70,000 EU, based on manufacturer's new price guide. • The key controllers behind the exporting company, that is the directors and During the investigation, the investigator determines that a nephew of the general (Bank A's customer) is a customer at Bank B. Which step should the investigator take next?

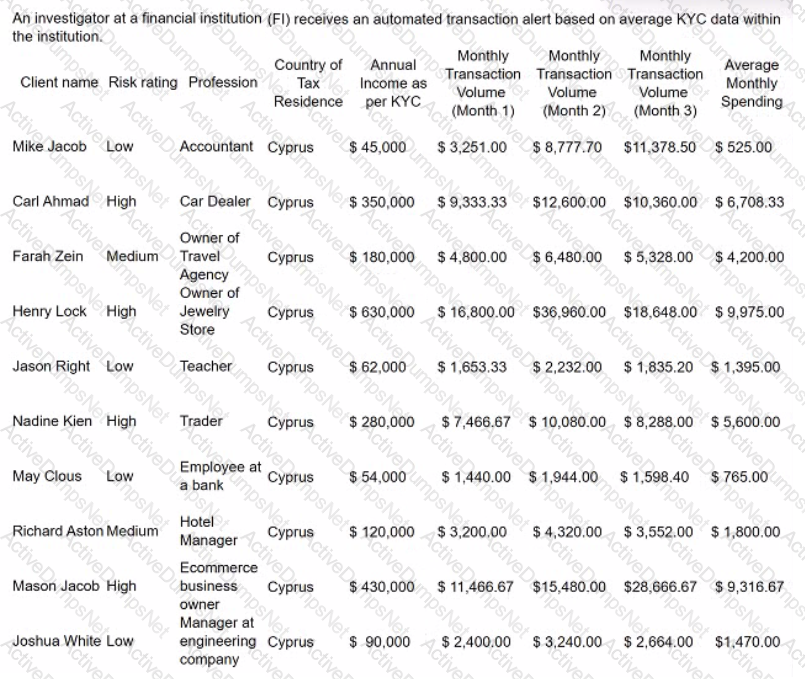

In a review of the account activity associated with Nadine Kien, an investigator observes a large number of small- to medium-size deposits from numerous individuals from several different global regions. The money is then transferred to a numbered company. Which is the next best course of action for the investigator?

Which scenarios are common to money laundering through online marketplaces and trade-based money laundering? (Select Two.)

Which action is part of the enhanced due diligence process?

CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client I.D. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai. India Cell Phone: *■*•"— Alt Phone: Email: *•*•*«•*•

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020

Sub-sector: Software-Cryptocurrency Exchange

Expected Annual Transaction Amount: 125.000 USD

Payment Nature: Transfer received from client’s fund

Received from: Clients

Received for: Sale of digital assets

The client identified themselves as "Cryptocurrency Exchange" Client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

Investigators determine the ultimate beneficial owner of ABC Tech Corp is a high-net-worth client. The client owns a real estate agency left to her when her spouse died. The spouse provided seed capital for ABC Tech Corp through a direct 1,000.000 Great British Pound (GBP) deposit.

What additional information would trigger filing a SAR/STR?

During transaction monitoring. Bank A learns that one of their customers. Med Supplies 123. is attempting to make a payment via wire totaling 382,500 USD to PPE Business LLC located in Mexico to purchase a large order of personal protective equipment. specifically surgical masks and face shields. Upon further verification. Bank A decides to escalate and refers the case to investigators.

Bank A notes that, days prior to the above transaction, the same customer went to a Bank A location to wire 1,215,280 USD to Breath Well LTD located in Singapore. Breath Well was acting as an intermediary to purchase both 3-ply surgical masks and face shields from China. Bank A decided not to complete the transaction due to concerns with the involved supplier in China. Moreover, the customer is attempting to send a third wire in the amount of 350,000 USD for the purchase of these items, this time using a different vendor in China. The investigator must determine next steps in the investigation and what actions, if any. should be taken against relevant parties.

During the investigation, Bank A receives a USA PATRIOT Act Section 314(a) request related to Med Supplies 123. Which steps should the investigator take when fulfilling the request? (Select Three.)

A U.S. financial institution (Fl) receives a grand jury subpoena for a corporate client's account. The Fl should:

A country that does not have strong predicate offenses and is lax in prosecuting AML cases could suffer which social/economic consequence?

A national financial intelligence unit (FIU) is undertaking the country risk assessment for the financing of the proliferation of weapons of mass destruction (WMD). The evaluation involves determining the exposure that financial institutions (FIs) have to operations that evade sanctions. Which should be performed by the FIU to assess proliferation financing risk? (Select Two.)

In which case should an investigator avoid escalating a suspicious event to the chief compliance officer and pursue other channels?

Due to an ever-diversifying business model and multi-jurisdictional footprint, a casino has decided to outsource the source of funds and wealth checks to a third-party provider. Why is it important for the casino to maintain control of the output from the provider?