AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination Exam Practice Test

Chartered Wealth Manager (CWM) Certification Level II Examination Questions and Answers

Section A (1 Mark)

The subscription paid into PPF account enjoys the tax benefit under

Section C (4 Mark)

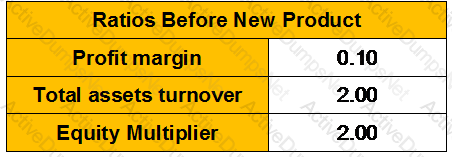

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

Section C (4 Mark)

Read the senario and answer to the question.

Harish wants a monthly investment to achieve the goal of his children's higher education. For accumulation of fund you recommend Harish to invest in an investment vehicle which invests in the ratio of 20:80 in Debt and Equity. If Harish starts investing from 1st Dec 2010, what approximate amount should he set aside every month for each child to achieve the goal? Harish maintains separate investment accounts for Chirag and Vishesh and invests till they individually turn 21 years of age.

Section B (2 Mark)

Which of the following factors affect the price of a stock option?

Section A (1 Mark)

________ bias means that investors are too slow in updating their beliefs in response to evidence.

Section A (1 Mark)

A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 on one of the factors and a beta of 0 on any other factor.

Section A (1 Mark)

According to the __________________ if irrational traders cause deviations from fundamental value, rational traders will often be powerless to do anything about it.

Section B (2 Mark)

A financial institution plans to issue a group of bonds backed by a pool of automobile loans. However, they fear that the default rate on the automobile loans will rise well above 4 percent of the portfolio – the projected default rate. The financial institution wants to lower the interest payments if the loan default rate rises too high. Which type of credit derivative contract would you most recommend for this situation?

Section C (4 Mark)

Pizer Drugs, a large drugstore chain, had sales per share of Rs122 in 1993, on which it reported earnings per share of Rs2.45 and paid a dividend per share of Rs1.12. The company is expected to grow 6% in the long term, and has a beta of 0.90. The current Risk Free Rate is 7%.

Estimate the appropriate Price for Pizer Drug and what would the profit margin need to be to justify the price per share if the stock is currently trading for Rs34 per share, assuming the growth rate is estimated correctly,

Section C (4 Mark)

You purchased a call option for Rs3.45 seventeen days ago. The call has a strike price of Rs45 and the stock is now trading for Rs51. If you exercise the call today, what will be your holding period return? If you do not exercise the call today and it expires, what will be your holding period return?

Section A (1 Mark)

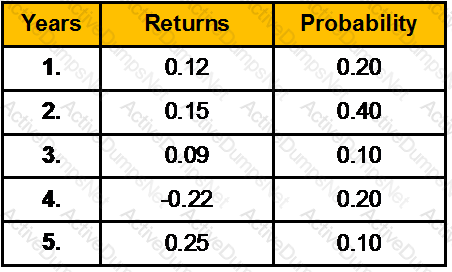

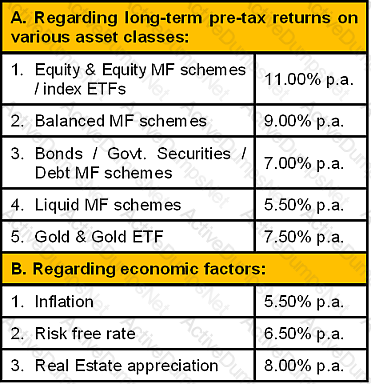

During the past five years, the returns of a stock were as follows:

Calculate the expected rate of return

Section B (2 Mark)

Manav wishes to calculate that if he wants to withdraw Rs. 2,000/- every Quarter at start of the month for 6 years, then how much amount is required to be in his account today. He wants to start this withdrawal immediately and ROI is 9 % per annum compounded quarterly.

Section C (4 Mark)

Read the senario and answer to the question.

Vinay wants to have 80% of the desired retirement corpus from his monthly savings from now itself. If he expects to earn 12% p.a. on these savings, how much amount should the couple save at the end of each month to achieve this target?

Section B (2 Mark)

A hired a bicycle from B. The written contract contained a clause which read “Nothing in this agreement shall render the owner liable for any personal injuries to the rider of the machine hired”. Owing to a defect in the brakes of the cycle, A met with an accident and got injured. Can A recover Damages?

Section A (1 Mark)

Which one of the following definitions of hedge fund strategies is not correct?

Section A (1 Mark)

A relatively new type of credit derivative is a CDO which stands for ________________.

Section C (4 Mark)

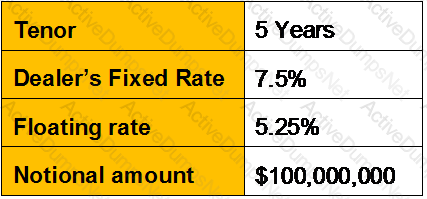

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

Section C (4 Mark)

Mr. Chopra runs a Garment Factory, he is very concerned about his retirement and wants you to help him out in planning for it. His Current annual expenses are Rs. 12,00,000 which would be rising at an annual rate of 8% pre- retirement and 2% post retirement. His current age is 50 years and he wants to work till the age of 65. The expected life expectancy in his family is 75 years. Calculate the monthly contribution he must make till his retirement if the pre- retirement returns are 12% p.a. compounded monthly and post-retirement returns are 8% p.a compounded annually.

Section A (1 Mark)

Which of the following statements regarding debit and credit card liability is correct?

Section C (4 Mark)

Two friends Neeraj and Kapil, both belonging to the 33.66% tax bracket, have invested Rs. 10 lakhs in a debt-based scheme. The scheme is a regular run of the mill, assembly line product — nothing extraordinary about it.

The scheme has earned a distributable profit of 12%.

Kapil’s financial condition is not good and due to the business losses his assets are to be auctioned.

Neeraj is working in MNC and getting an annual package of Rs. 18 lakhs. This includes Rs. 270000 as dearness allowance (2/3 forms the part of retirement benefit). He is also earning an agricultural income of Rs. 54000.His expenses are Rs. 80000 per month.

Neeraj has also taken a housing loan in joint name of his wife Anita and himself. Property is also in the joint name and their contribution is equal. Annual outflow towards housing loan in terms of repayment of principal and interest is Rs. 300000. Out of this Rs. 198800 is toward interest.

Neeraj has also invested an equal amount in a portfolio consisting of securities A and B. Standard deviation of A is 12.43%; Standard deviation of B is 16.54%; Correlation coefficient is 0.82

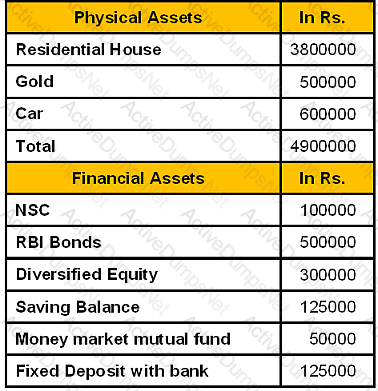

Assets held by Neeraj

Section C (4 Mark)

Azhar deposits Rs. 12,500 in an account that pays a ROI of 20% p.a compounded annually on 5th. Of March 2010. Calculate the date on which the balance in his account would be Rs.35,338/-

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Technical Services are:

Section B (2 Mark)

If an investor strongly believes that the stock market is going to have a sharp decline shortly, he or she could maximize profit by

Section C (4 Mark)

Mr. Peter sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45 and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs. 3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3800

• If Nifty closes at 4500

Section A (1 Mark)

The tendency, after an event has occured, to think that we knew what was going to happen beforehand. We overestimate the likeliness that we would have been able to predict the outcome of a past series of events. Which of the following is most likely consistent with this bias?

Section A (1 Mark)

Essential requirement for the person who can attest the will is that he

Section A (1 Mark)

The premium on all other riders put together should not exceed _____ of the premium on the base policy

Section B (2 Mark)

Eric, who has lived in the Netherlands for the whole of his life, arrives in the UK on 1 June 2011 and remains in the UK until 31 December 2011, when he returns permanently to the Netherlands. His UK residence status for 2011-12 is:

Section B (2 Mark)

An appraiser estimates that a property will produce NOI of Rs 25,000, the Yo is 11 percent, and the growth rate is 2.0 percent. What is the total property value (unrounded)?

Section B (2 Mark)

When the income of an individual includes Rs. 20000 as the income of his minor child in terms of section 64(1A), taxable income in this respect will be:

Section C (4 Mark)

Mr. XYZ buys a Nifty Call with a Strike price Rs. 4100 at a premium of Rs. 170.45 and he sells a Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

What would be the Net Payoff of the Strategy?

• if Nifty closes at 4200

• if Nifty closes at 5447

Section A (1 Mark)

____________represents people’s propensity to claim an irrational degree of credit for their successes.

Section C (4 Mark)

J&M had a return on equity of 31.5% in 1993, and paid out 37% of its earnings as dividends. The stock had a beta of 1.25. (The treasury bill rate is 6%.) The extraordinary growth is expected to last for ten years, after which the growth rate is expected to drop to 6% and the return on equity to 15% (the beta will move to 1).

Assuming the return on equity and dividend payout ratio continue at current levels for the high growth period, estimate the P/BV ratio for J&M.

Section B (2 Mark)

Reproduction cost has been estimated as Rs 350,000 for a property with a 70-year economic life. The current effective age of the property is 15 years. The value of the land is estimated to be Rs 55,000. What is the estimated market value of the property using the cost approach, assuming no external or functional obsolescence?

Section C (4 Mark)

Amit an industrialist wants to buy a flat in a housing society presently costing Rs. 35,00,000/- after 6 years. The cost of the house is expected to increase by 15% p.a for the first 3 years and by 10% in the remaining years. Amit wants to start a SIP with monthly contributions in Birla Front Line Equity Mutual Fund to pay for the down payment of the house which would be 25% of the house value at that time. You as a CWM expect that the fund would give ROI of 14% p.a. compounded monthly in the next 10 years. Please advise Amit the monthly SIP amount starting at the beginning of every month for the next 6 years to fulfill his goal of buying the Flat he desires.

Section B (2 Mark)

Which of the following statements is most correct?

Section A (1 Mark)

What amount needs to be invested today at 10 % per annum, so that it pays Rs. 1 lac per annum for 5 years, starting from 6th year to 10thyear. First payment starts at BEGIN of 6thyear.?

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Interest Rate in Mauritius is charged at:

Section A (1 Mark)

----------- shifts the weights of securities in the portfolio to take advantage of areas that are expected to do relatively better than other areas.

Section C (4 Mark)

Read the senario and answer to the question.

Mahesh’s company has made plans for the next year. It is estimated that the company will employ total assets of Rs. 1000 lakh: 50% of the assets being financed by borrowed capital at an interest cost of 8% per year. The direct costs are estimated at Rs. 500 lakh. All other operating expenses are estimated at Rs. 76 lakh. The good will be sold to customer at 140% of the direct costs. Income tax rate is assumed to be 30%. Calculate net profit margin and return on owners’ equity.

Section B (2 Mark)

The arbitrage pricing theory (APT) and the CAPM both assume all except which of the following?

Section A (1 Mark)

In a short call, profit is

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $ 83560 in SGD and he is a Singapore citizen

• £ 73150p.a (only employment) and he is a UK citizen

Section B (2 Mark)

Mehak Rana took a loan of Rs 20 Lakh in September 2010 which is payable in 10 years (monthly installments).The rate of interest is 10% p.a.

What would be the remaining principal amount after September 2012?

Section A (1 Mark)

Determine the status of X and Y who are the legal heirs of Z

Section B (2 Mark)

The current market price of a share of JVJ stock is Rs60. If a put option on this stock has a strike price of Rs55, the put

Section C (4 Mark)

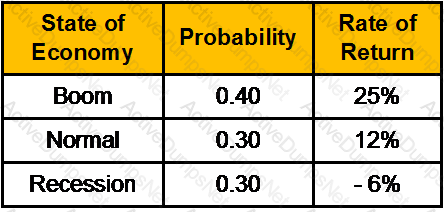

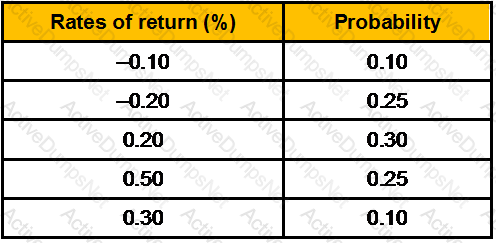

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

Section B (2 Mark)

To maximize this benefit a bank must:

Section B (2 Mark)

Mr. Patel expects the stock of A to sell for Rs. 70/- a year from now and to pay Rs. 4/- dividend. If the stock’s correlation with the Market is –0.3, and the standard deviation of A is 40% and standard deviation of the Market is 20% and the risk free rate of return is 5% and the market risk premium is 5%, what would be the price of stock A be now ?

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $125000 in US dollars and he is a US citizen (single individual)

• $109000 in SGD and he is a citizen of Singapore

Section C (4 Mark)

Read the senario and answer to the question.

If Saxena’s debentures have a balance maturity period of 15 years &the coupons are payable annually, what should be the market valuation of these debentures, if risk free interest rate is taken as the required IRR?

Section A (1 Mark)

One of the tax exemption under avoidance of Double Taxation is U/S Sec 10(6)(ii) for exemption on income received by the diplomats, ambassador, etc

Section B (2 Mark)

If JVM Industries pays dividend of Rs.6 per share which is growing at a 8 percent rate per year and is expected to grow at the same rate in future. Its required rate of return is 16%. Determine its share price.

Section B (2 Mark)

Retiring early will ____________ the accumulation phase while ____________ the retirement phase

Section A (1 Mark)

Vineet invests Rs. 5000/- per month at the beginning of the month for 10 years in Recurring Deposit account that pays 8.5% p.a interest compounded quarterly. What will be the accumulated amount in his account.

Section C (4 Mark)

Read the senario and answer to the question.

What is the Basic Liquidity Ratio for the couple? Is it sufficient considering Vinay’s circumstances?

Section A (1 Mark)

Commodity exchanges enable producers and consumer to hedge their _______ given the uncertainty of the future.

Section A (1 Mark)

_________________makes us throw more good money after money already gone bad.

Section C (4 Mark)

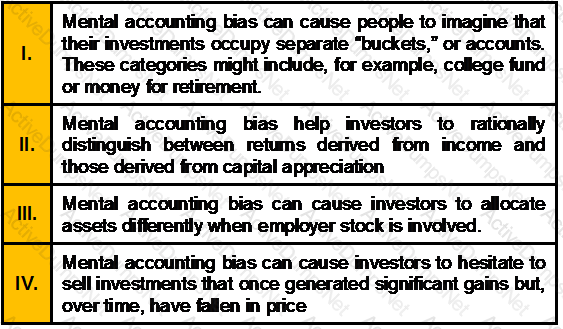

Which of the following statements is/are correct?

Section C (4 Mark)

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have to analyze three risky firms and must decide which (if any) to purchase. Your information is

What is the maximum price? Which (if any) should buy?

Section A (1 Mark)

These instruments rest on pools of credit derivatives that mainly insure against defaults on corporate bonds. The creators of these instruments do not have to buy and pool actual bonds but can create these instruments and generate revenues from selling and trading in them.

Section B (2 Mark)

You have Rs. 5 Lacs available to invest. The risk free rate as well as the borrowing rate is 8%. The return on the risky portfolio is 16%. If you wish to earn 22% return, you should:

Section A (1 Mark)

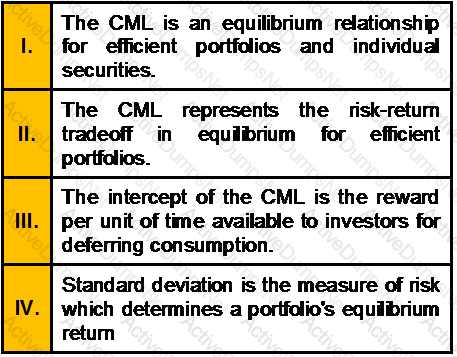

Select the INCORRECT statement regarding the CML

Section A (1 Mark)

Wages for the purpose of gratuity payment as per the Act means

Section C (4 Mark)

Read the senario and answer to the question.

Nimita wants to know if she were to meet with an accident and get permanent disability in the third year of her Term Insurance policy, what amount of the premium due in the fourth year would be payable by her if the premium being paid towards the policy is Rs. 15,000 with sum assured of Rs. 50 lakh?

Section A (1 Mark)

Which of the followings are the important features of Real estate Investment?

Section C (4 Mark)

What is the portfolios standard deviation if you put 25% of your money into stock A which has a standard deviation of 15% and rest into stocks B which has a standard deviation of 10%. The correlation coefficient between the returns of the stocks is .75.

Section A (1 Mark)

Statman (1977) argues that ________ is consistent with some investors' irrational preference for stocks with high cash dividends and with a tendency to hold losing positions too long.

Section A (1 Mark)

Which of the following is not normally one of the reasons for a change in an investor's circumstances?

Section C (4 Mark)

In the year to 31 March 2012, a UK resident company receives overseas income of £9,000 (net) from which 10% tax has been deducted at source. The company's only other income is a UK trading profit of £80,000. There are no associated companies. What is the UK corporation tax liability for the year?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the tax liability of Mr. Neeraj for the A.Y.08–09 assuming that he has avail full deduction under section 80C

Section A (1 Mark)

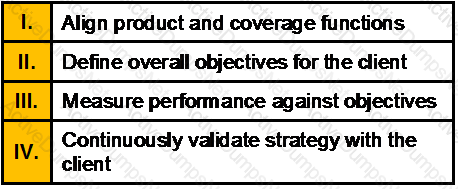

Which ONE of the following in not the requirement for managing customer?

Section A (1 Mark)

A trough is ________.

Section B (2 Mark)

Calculate Gross Annual Value where Gross Municipal Value is Rs.120, Fair Rent is Rs.105. Actual rent receivable is Rs.100& Standard Rent is Rs.125

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Companies are:

Section B (2 Mark)

What is the size of the final unequal payment of a loan that has 89.34 payments and the equal payment size is Rs215.64? The interest rate is 3% per compounding period.

Section B (2 Mark)

Regular collateralized debt obligations (CDO) have been surpassed by:

Section C (4 Mark)

At end of this year ICICI Ltd. will pay a dividend on its stock of Rs. 5 per share. The dividend is expected to remain same for next year. During third year dividend is expected to be Rs.6 from there on, the dividend is expected to grow at 5% per year indefinitely. Stocks with similar risk are currently priced to provide a 10% expected return. What is the intrinsic value of ICICI Ltd.

Section C (4 Mark)

Find out the effective quarterly rate for 18% per annum compounded half yearly.

Section A (1 Mark)

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

Section A (1 Mark)

The borrower's attitude toward his or her credit obligations is called:

Section A (1 Mark)

Where the return of income is filed after the due date specified u/s 139(1):

Section A (1 Mark)

An aggressive asset allocation would contain larger proportions of __________ than a conservative allocation.

Section A (1 Mark)

Real Estate market in India is __________

Section C (4 Mark)

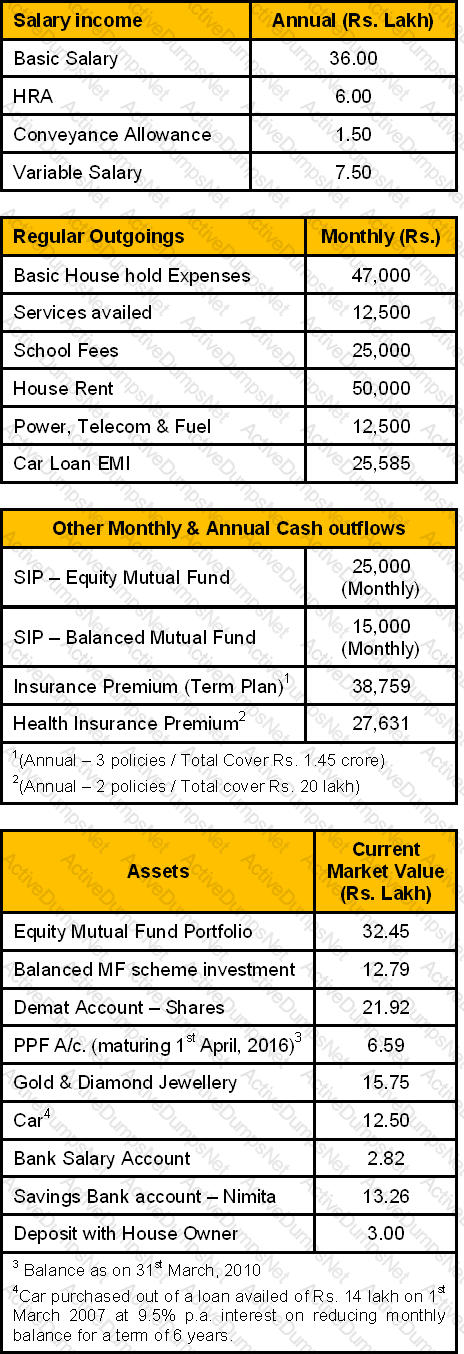

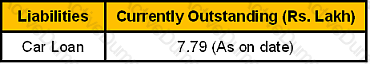

Ms. Nimita Shah, aged 34 years as on 2nd April 2010, is Vice President in a Mumbai-based firm. She has twin daughters Revati and Savitri of age 12 years and she is the sole guardian of her children pursuant to her recent divorce. She is currently residing in a rented house. Both her daughter are studying in the 6th Standard. She has approached you, a CWM®, for preparing her Wealth plan. She has shared the following financial information with you:

You, in consultation with Nimita have crystallized the following financial goals for her family and the preliminary roadmap to achieve them:

1.Send both daughters to a Boarding school – immediately – Outlay Rs. 1.80 lakh (present cost) per child p.a. – for 6 years – To be met on year to year basis by investing a suitable corpus.

2.Buy a house–in the next three years – Outlay of Rs. 80 lakh – Take a loan for 15 year term.

3.Invest suitably for the Higher Education of both children – Higher Education starts after 6 years – present cost Rs. 4.5 lakh p.a. for each child for a team of 5 year.

4.To invest monthly for Revati and Savtri’s wedding when they complete 24 years of age. The estimated present cost of one such marriage is Rs. 15 Lakh

5.Retirement Corpus for self – Corpus to be accumulated in 21 years – Corpus to sustain an annuity of Rs. 1.25 lakh p.m. (current cost) inflation linked for a post – retirement life of 25 years.

6.A world tour with both of her kids – After 11 years – outlay of Rs. 8 lakh at current prices.

7.A suitable Estate Planning to cover all her physical and financial assets.

Assumptions:

Section A (1 Mark)

Which of the following statement is correct?

Section A (1 Mark)

Which of the following statements about Real Estate Investment Trusts is/are true?

Section A (1 Mark)

In Private Equity, the stage where the start-up company may starts generating profits in a quarter or so or be just at the point of breaking even is called_________________

Section B (2 Mark)

Pranoy is entitled to a basic salary of Rs. 5,000 p.m. and dearness allowance of Rs. 1,000 per month, 40% of which forms the part of the retirement benefits. He is also entitled to HRA of Rs. 2,000 p.m. He actually pays Rs. 2,000 p.m. as rent for a house in Delhi. Compute the taxable HRA.

Section C (4 Mark)

Belstate reported net income of Rs221 million in 1993 on revenues of Rs8298 million. It paid out 31% of its earnings as dividends, a payout ratio that is expected to remain level from 1994 to 1998, during which period earnings growth is expected to be 13.5%. After 1998, earnings growth is expected to decline to 6%, and the dividend payout ratio is expected to increase to 60%. The beta is 1.15 and this figure is expected to remain unchanged. The treasury bill rate is 7%.

Estimate the price/sales ratio for Walgreens, assuming its profit margin remains unchanged at 1993 levels.

Section A (1 Mark)

Income from which trust is added to the beneficiary’s taxable income?

Section B (2 Mark)

Rahul decides to deposit Rs. 5,000/- every month into an account yielding 12 % per annum compounded monthly for 20 years. What will be the accumulated value in this account after 20 years and how much amount can be withdrawn from this account every month for a further period of 20 years of ROI is 8 % per annum compounded monthly?

Section A (1 Mark)

Dividend received by a shareholder from an Indian company the whole of whose income is agricultural income shall be treated as:

Section B (2 Mark)

Calculate the expected rate of return for M/S X Ltd. from the following information:

Section B (2 Mark)

Which of the following statement is/are correct?

Section A (1 Mark)

All of the following are examples of excise taxes except:

Section B (2 Mark)

A hedge fund manager purchases 10 convertible bonds with a par value of $1,000, a coupon of 7.5%, and a market price of $900. The conversion ratio for the bonds is 20. The conversion ratio is based on the current price of the underlying stock, $45, and the current price of the convertible bond. The delta, or hedge ratio, for the bonds is 0.4.

Therefore, to hedge the equity exposure in the convertible bond, the hedge fund manager must short the following shares of underlying stock:

Section C (4 Mark)

Dinex Ltd, a leader in the development and manufacture of electronic devices, reported earnings per share of Rs 2.02 in 2003, and paid no dividends. These earnings are expected to grow 14% a year for five years (2004 to 2008) and 7% a year after that. The firm reported depreciation of Rs 2 million in 2003 and capital spending of Rs 4.20 million, and had 7 million shares outstanding. The working capital is expected to remain at 50% of revenues, which were Rs 106 million in 2003, and are expected to grow 6% a year from 2004 to 2008 and 4% a year after that. The firm is expected to finance 10% of its capital expenditures and working capital needs with debt. Dinex Ltd had a beta of 1.20 in 2003, and this beta is expected to drop to 1.10 after 2008. The current risk free rate is 7%.

Estimate the value per share today, based upon the FCFE model.

Section A (1 Mark)

Amit has monthly net income of Rs10500. He has a house payment of Rs 4500 per month, a car loan with payments of Rs 2500 per month, a Visa card with payments of Rs 500 per month, and a credit card with a local department store with payments of Rs 1000 per month.

What is Amit's debt payments-to-income ratio?

Section A (1 Mark)

Mr. Kashyap took a business premise on lease with the provision that he himself had to pay the insurance premium for fire and other perils on the premises and not the owner of the premises. This would be an instance of_______________ on the part of owner of the premises.

Section A (1 Mark)

In US which of the following does not count as an itemized deduction on income tax?

Section B (2 Mark)

Which of the following statements is TRUE concerning zero coupon bonds?

Section A (1 Mark)

_____________ is defined as fairness in spending in US.

Section B (2 Mark)

You borrowed Rs8500, with the understanding that you are to make monthly payments over 36 months. Interest is charged at 7% compounded monthly. If you were to increase your payments by Rs20 per month, how much less time would it take you to pay back the loan?

Section A (1 Mark)

An investor will take as large a position as possible when an equilibrium price relationship is violated. This is an example of _________.

Section A (1 Mark)

The investors who buy the debt of troubled companies including subordinated debt, junk bonds, bank loans, and obligations to suppliers are called__________

Section A (1 Mark)

A testamentary trust is affected after the

Section C (4 Mark)

The Meryl Corporation's common stock is currently selling at Rs100 per share, which represents a P/E ratio of 10. If the firm has 100 shares of common stock outstanding, a return on equity of 20 percent, and a debt ratio of 60 percent, what is its return on total assets (ROA)?

Section A (1 Mark)

Riskier stocks have

Section B (2 Mark)

As Per Article 12 Double Taxation Avoidance Agreement with US, _____per cent of the gross amount of the royalties or fees for included services as defined in this Article, where the payer of the royalties or fees is the Government of that Contracting State, a political sub-division or a public sector company.

Section A (1 Mark)

Which of the following is an element of an organization’s internal-environment?

Section C (4 Mark)

Read the senario and answer to the question.

For the purpose of World Tour Nimita has an option to use her investments in PPF A/c. She would contribute maximum permissible amount on the 1st working day of April every year till its due maturity as well as in all years of the extension of account for a 5-year term after its due maturity. She wants to use half of the PPF account proceeds for the proposed world tour. You estimate the adequacy of such amount, the same is _____________.

Section B (2 Mark)

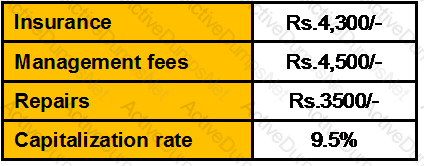

Lalit wants to sell a property for Rs.20 lakhs. He is earning rent from tenant Rs.2,15,000. He is spending following amounts annually on that property

The value of the property would be:

Section A (1 Mark)

Which part of the wealth management planning deals with efficient and optimum use of credit for the business.?

Section A (1 Mark)

The potential loss for a writer of a naked call option on a stock is

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Saxena is planning to visit USA for the very first time in his carrier to promote software of his company and is expected to stay long. He wants to plan his journey in such a manner so that he can get maximum tax benefits in the FY 2007–08 from the residential status point of view. What is the latest date when he can afford to leave India & earn status of an NRI to get maximum tax benefits in assessment year 2008–09?

Section A (1 Mark)

As per presumptive income scheme under section 44AE, the presumed income shall be:

Section A (1 Mark)

Investments that are difficult to convert to cash are said to have _________

Section B (2 Mark)

In 2011-12, Steven has business profits of £34,125, net bank interest of £1,240 and net dividends of £9,000. He claims the personal allowance of £7,475. What is the income tax payable for the year after subtracting tax deducted at source?

Section A (1 Mark)

The risk that occurs when the index used for determination of interest earned on the CDO trust collateral is different from the index used to calculate the interest to be paid on the CDO trust is known as______________.

Section A (1 Mark)

Which among the following is not an advantage of setting up a trust?

Section C (4 Mark)

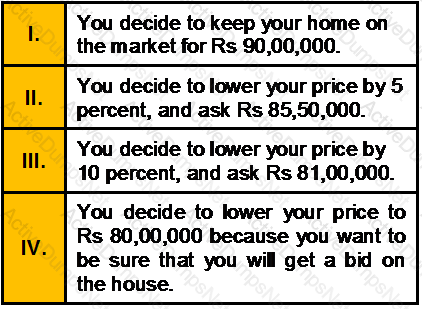

Suppose you have decided to sell your house and downsize by acquiring a townhouse that you have been eyeing for several years. You do not feel extreme urgency in selling your house; but the associated taxes are eating into your monthly cash flow, and you want to unload the property as soon as possible. Your real estate agent, whom you have known for many years, prices your home at Rs 90,00,000—you are shocked.

You paid Rs 250,000 for the home only 15 years ago, and the Rs 900,000 figure is almost too thrilling to believe. You place the house on the market and wait a few months, but you don’t receive any nibbles. One day, your real estate agent calls, suggesting that the two of you meet right away. When he arrives, he tells you that Pharma Growth, a company that moved into town eight years ago in conjunction with its much-publicized initial public offering (IPO), has just declared bankruptcy.

Now, 7,500 people are out of work. Your agent has been in meetings all week with his colleagues, and together they estimate that local real estate prices have taken a hit of about 10 percent across the board. Your agent tells you that you must decide the price at which you want to list your home, based on this new information. You tell him that you will think it over and get back to him shortly.

Assume your house is at the mean in terms of quality and salability.

What is your likeliest course of action if you exhibit Anchoring and Adjustment bias?

Section C (4 Mark)

Zenith Finance is a big financial firm which owns several mutual funds. The funds are managed individually by portfolio managers but it has an investment committee that oversees all of the funds. This committee is responsible for evaluating the performance of the funds relative to the appropriate benchmark and relative to stated investment objectives of each individual fund. During a recent investment committee meeting, the poor performance of its Equity Funds were discussed. In particular, the inability of the portfolio managers to outperform their benchmarks was highlighted. The net conclusion of the committee was to review the performance of the manager responsible for each fund and dismiss those managers whose performance had lagged substantially behind the appropriate benchmark.

The fund with the worst relative performance is the Zenith Large Cap Fund which invests in large cap stocks. A review of the operations of the fund found the following:

• The turnover of the fund was almost double that of other similar style mutual funds

• The fund’s portfolio manager solicited input from her entire staff prior to making any decision to sell an existing holding

• The beta of the Zenith Large Cap Fund’s portfolio was 65% higher than the beta of other similar style mutual funds

• The portfolio manager refuses to increase the Capital Goods sector weighting because of past losses the fund incurred in the sector

• The portfolio manager sold all the fund’s Oil Marketing Companies stocks as the price per barrel of oil rose above $105. He expects oil prices to fall back to the $80 to $85 per barrel

• No stock is considered for purchase in the Large Cap Fund unless the portfolio manager has 10 years of financial information on that company.

A committee member made the following 2 comments:

Comment 1: “One reason for the poor performance of Large Cap Mutual Fund is that the portfolio lacks recognizable companies. I believe that good companies make good investments

Comment 2: “The portfolio manager of the Large Cap Fund refuses to acknowledge his mistakes. He seems to sell stocks that appreciate, but she holds stocks that have declined in value

The two behavioral biases exhibited respectively in the above 2 comments from the committee are:

Section A (1 Mark)

An example of a highly cyclical industry is ________.

Section B (2 Mark)

How much interest is paid in total on a 3-year loan for Rs27 400? The interest rate is 8.6% compounded monthly and the payments are monthly?

Section A (1 Mark)

In US which of the following is classified as passive income?

Section B (2 Mark)

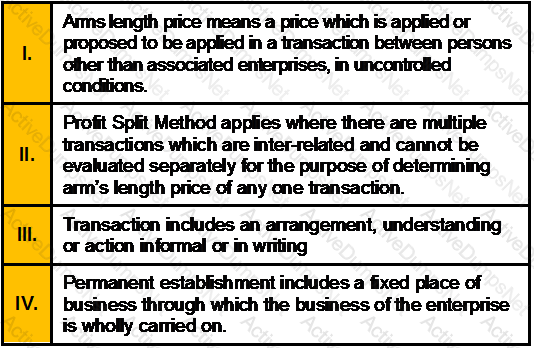

Which of the following statements with respect to Transfer Pricing is/are correct?

Section A (1 Mark)

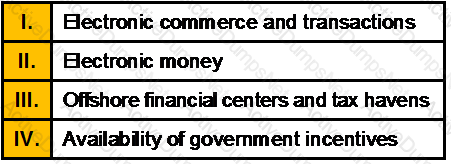

Fiscal termites are factors that threaten the integrity of tax systems, and most of which relate to the internationalization of tax. These are:

Section C (4 Mark)

An investor purchased on margin Alpha Computer for Rs. 30/- a share. The stock's price subsequently rose to Rs. 50/- a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on the investor's funds (excluding commissions)? What would have been the return if the investor had not bought the stock on margin?

Section B (2 Mark)

Narayan expects to receive Rs 25000 in net receipts each year for five year and to sell the property for Rs 350,000 at the end of the five-year period, if Narayan expects a 15% return, what would be the value of the property?

Section B (2 Mark)

A bank plans to offer new subordinated notes in the open market next month but knows that its credit rating is being reviewed by a credit rating agency. The bank wants to avoid paying sharply higher credit costs. Which type of credit derivative contract would you most recommend for this situation?

Section C (4 Mark)

Azhar aged 30 is a disciplined investor. He has started depositing Rs. 25,000 every year in an account that pays a return of 9% every year. He plans to increase his contribution by Rs. 5000 every year till his age 50. Calculate the amount he would be having in his account at this age.

Section B (2 Mark)

In 2011-12, George has property income of £8,000 and net bank interest of £4,000. He claims the personal allowance of £7,475. What is the income tax borne for the year?

Section A (1 Mark)

The trust which is empty at creation during life and tranfers the property into the trust at death is called ____________

Section B (2 Mark)

Customer relationship management applications dealing with the analysis of customer data to provide information for improving business performance best describes by which of the following?

Section B (2 Mark)

Mrs. Sharma, a 40-year-old widow, has an 8-year-old son. Her current savings are not adequate to provide for her son’s post graduate studies, however she will be able to save for it by the time he finishes graduation i.e. when he is 20 years old. Mortality tables indicate that her life expectancy is another 30 years.

Which one of the following is true?

Section C (4 Mark)

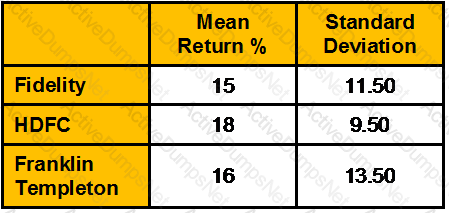

Data on following mutual funds is given below:

Risk free return is 8%. Calculate Sharpe measure.

Section A (1 Mark)

A ____________________ tax system places a relatively large tax burden on lower-income people and a relatively small tax burden on upper-income people.

Section B (2 Mark)

Ms. Shalini Bhargav plans to purchase a property having a projected annual income for three year is Rs 20,000 with 12 percent expected return and expect to sell it at the end of three years for Rs 2,70,000. Compute the present value of the property.

Section C (4 Mark)

Read the senario and answer to the question.

Whether Mrs. Deepika as a resident individual can invest in units of Mutual Funds, Venture Funds, and Promissory notes without opening the bank account in foreign country?

Section B (2 Mark)

Contribution under a defined benefit plan

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the retirement corpus required by Raman to generate his post-retirement expenses.

Section A (1 Mark)

Assessing client’s level of risk tolerance is done while

Section A (1 Mark)

A(n)_______________ is a credit-rating agency that keeps records of borrowers' loan payment histories.

Section C (4 Mark)

Read the senario and answer to the question.

Sajan sold 350 shares of a company at Rs. 300 each on 1st March 2010. He purchased 50 shares on 1st May 1979 for Rs. 20 each. The fair market value was Rs. 40 each as on 1st April 1981. Again on 7 August 1998, he was allotted 50 bonus shares. The fair market value was Rs. 115 each as on 7th August 1998. He purchased additional 250 shares on 1st April 2009 for Rs. 150 each. Calculate the capital gains on shares sold.

(CII – 1981-82 : 100; 1998-99 : 351; 2008-2009 ; 582; 2009-10; 632)

Section B (2 Mark)

A bank is concerned about excess volatility in its cash flows from some recent business loans it has made. Many of these loans have a fixed rate of interest and the bank's economics department has forecast a sharp increase in interest rates. The bank wants more stable cash flows. Which type of credit derivative contract would you most recommend for this situation?

Section C (4 Mark)

Read the senario and answer to the question.

The present household expenses of Mr Bhatia is Rs. 3,00,000 p.a. but if he were to retire today he would require only Rs. 2,25,000 p.a. Calculate his required retirement corpus if interest rate is 12% p.a. and inflation rate is 7%.

Section A (1 Mark)

Merton’s theory is ___________

Section B (2 Mark)

A perspective on decision making based on the assumption that people typically show risk aversion; hence, when making decisions they view whatever losses may be involved as more painful than equivalent gains are desirable. We have an irrational tendency to be less willing to gamble with profits than with losses.

Section A (1 Mark)

Securities with betas less than 1 should have:

Section A (1 Mark)

With the______________, the buyer gets no protection from encumbrances. This deed type has very specialized uses.

Section B (2 Mark)

The expected market return is 16 percent. The risk-free rate of return is 7 percent, and BC Co. has a beta of 1.1. Their required rate of return is

Section B (2 Mark)

A bank is about to make a Rs50 million project loan to develop a new oil field and is worried that the petroleum engineer's estimates of the yield on the field are incorrect. The bank wants to protect itself in case the developer cannot repay the loan. Which type of credit derivative contract would you most recommend for this situation?

Section B (2 Mark)

The favorable difference received by buyer/holder on the exercise/expiry date, between the final settlement price as and the strike price, will be recognized as ___________

Section A (1 Mark)

“Early accumulation” life stage is normally during ______

Section B (2 Mark)

Ramesh has invested Rs 3,000/- in Reliance Growth Fund two years ago and its worth is now 4,000/-. Ram has received dividend Rs.300 at the end of two years. Calculate Compounded annual growth rate (CAGR) of Ram’s investment.

Section A (1 Mark)

__________refers to responding to a positive action with another positive action, rewarding kind actions.

Section A (1 Mark)

The profits of a controlled foreign company which are apportioned to a UK company are charged to corporation tax at the UK company's average rate of tax.

Section B (2 Mark)

An asset may be purchased for Rs 10,00,000. It is expected to generate Rs 10,000 annual income for 10 years after which it is expected to sell for Rs. 1,20,000. What is the rate of return expected from this investment?

Section A (1 Mark)

A call option on a stock is said to be in the money if

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the Net Worth of Mr. Adhikari as on 31/03/2009.

Section A (1 Mark)

Which of the following statements is/are correct with respect to naïve diversification?

Section A (1 Mark)

During “Building the foundation” life stage, we learn about _______

Section A (1 Mark)

Which of the following is true regarding the resistance level?

Section C (4 Mark)

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio’s required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D. What would be the portfolio’s required rate of return following this change?

Section B (2 Mark)

In the maturity stage of the industry life cycle

Section C (4 Mark)

Mr. Mahesh Chabaria, aged 52 years, currently owns an transport firm. His family consists of his wife Nitika, also aged 52 years, son Manish aged 29 and daughter Nidhi aged 27. Nitika is a housewife and both the children are happily married and well settled. The couple anticipates their life expectancy to be 80 years each.

Income and Expenses:

The gross annual income of Mahesh for the previous year 2007-08 is expected to be Rs. 1000000. The couples’ household expenses are estimated to be Rs. 32000 per month. Taking into account incidental expenses of another Rs. 5000 the net expenses of the family are estimated to be Rs. 37000 per month for the previous year 2007-08. Mahesh has a net saving of Rs. 1800000 which he would like to invest for his post retirement purposes.

Assets Allocation:

Mahesh has hardly 8 years left for retirement and thus he is not very aggressive in his investments. Returns of his portfolio based on asset allocation during the accumulation and distribution phase are calculated as below:

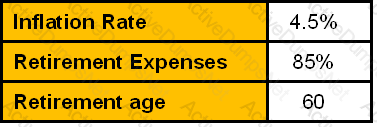

Assumptions:

Section B (2 Mark)

Resident but not ordinary resident (RNOR) is ____________ on Indian Income and ___________ on Foreign Income.

Section A (1 Mark)

Loss of a closely held company cannot be carried and set off unless on the last day of the previous year in which the loss was incurred and as on the last day of the previous year in which such loss is set off, at least:

Section B (2 Mark)

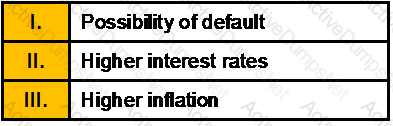

Risk to bondholders comes from

Section C (4 Mark)

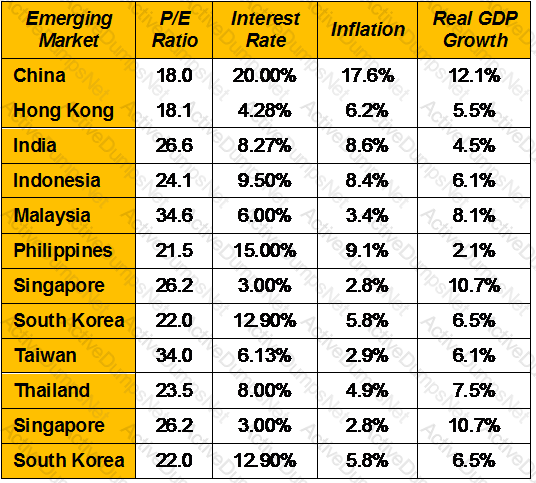

The following were P/E ratios for some Asian markets in February 1994, with relevant information on interest rates and economic growth:

Assuming the dividend payout ratio in each of these countries is 60%, estimate the P/E ratio in South Korea and Thailand, based upon stable growth. (Use a risk premium of 7.5% over the risk-free rate in each country.)

Section B (2 Mark)

A Resident is defined as not Ordinarily Resident provided such individual has been: a non- resident in 9 out of 10 Financial Years preceding the current year or his stay in India totals to _________days or less in ___________financial years preceding the current year.

Section A (1 Mark)

Financial Independence usually occurs between _______

Section B (2 Mark)

Behavioral finance argues that ____________.

Section A (1 Mark)

If the deceased has two widows, four sons and two daughters then what is the share of each widow

Section A (1 Mark)

The________________ deals with the double-edged enigma of why individuals like dividends (in developed country where dividends are taxable) and why this method of income distribution persists in light of quite burdensome double taxation.

Section A (1 Mark)

Fiscal policy is difficult to implement quickly because

Section B (2 Mark)

An investor is bearish about Tata Motors and sells ten one-month ABC Ltd. Futures contracts at Rs.6,06,000. On the last Thursday of the month, Tata Motors closes at Rs.600. He makes a _________. (assume one lot = 100)

Section A (1 Mark)

A covered call position is equivalent to a

Section B (2 Mark)

If Second National Bank has more rate-sensitive liabilities then rate-sensitive assets, it can reduce interest rate risk with a swap that requires Second National to

Section C (4 Mark)

Suppose ABC Ltd. is trading at Rs. 4457 in June. An investor Mr. A buys a Rs 4500 call for Rs. 100 while shorting the stock at Rs. 4457. The net credit to the investor is Rs. 4357

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 4145

• If ABC Ltd closes at 4983

Section A (1 Mark)

The length of the insurance industry’s business cycle is shortened because of

Section A (1 Mark)

The cumulative number of futures contracts that are not offset at any point in time is called:

Section A (1 Mark)

A principal weakness of the Dow Theory is:

Section B (2 Mark)

Equity stock of X ltd. is currently selling at Rs. 35/- per share. The dividend expected next year is Rs. 2/- per share and the investor’s required return in this stock is 15 % per annum. If the constant Growth Model applies to X ltd. then calculate the Growth Rate.

Section B (2 Mark)

Ram is working in Rashid Enterprises, a proprietorship firm.During his working hours Ram was injured seriously. Due to this injury Ram was hospitalized for six months. Ram is the only bread winner of his family. Ms. Rashid, the proprietor of Rashid Enterprises is liable to pay damages to Ram. Under which of the following policy Rashid can protect himself from this liability?

Section A (1 Mark)

Wealth Enhancement is _____________

Section A (1 Mark)

Acquiring the Right Customers, based on known characteristics, which drives growth and increased profit margin, is a benefit of __________